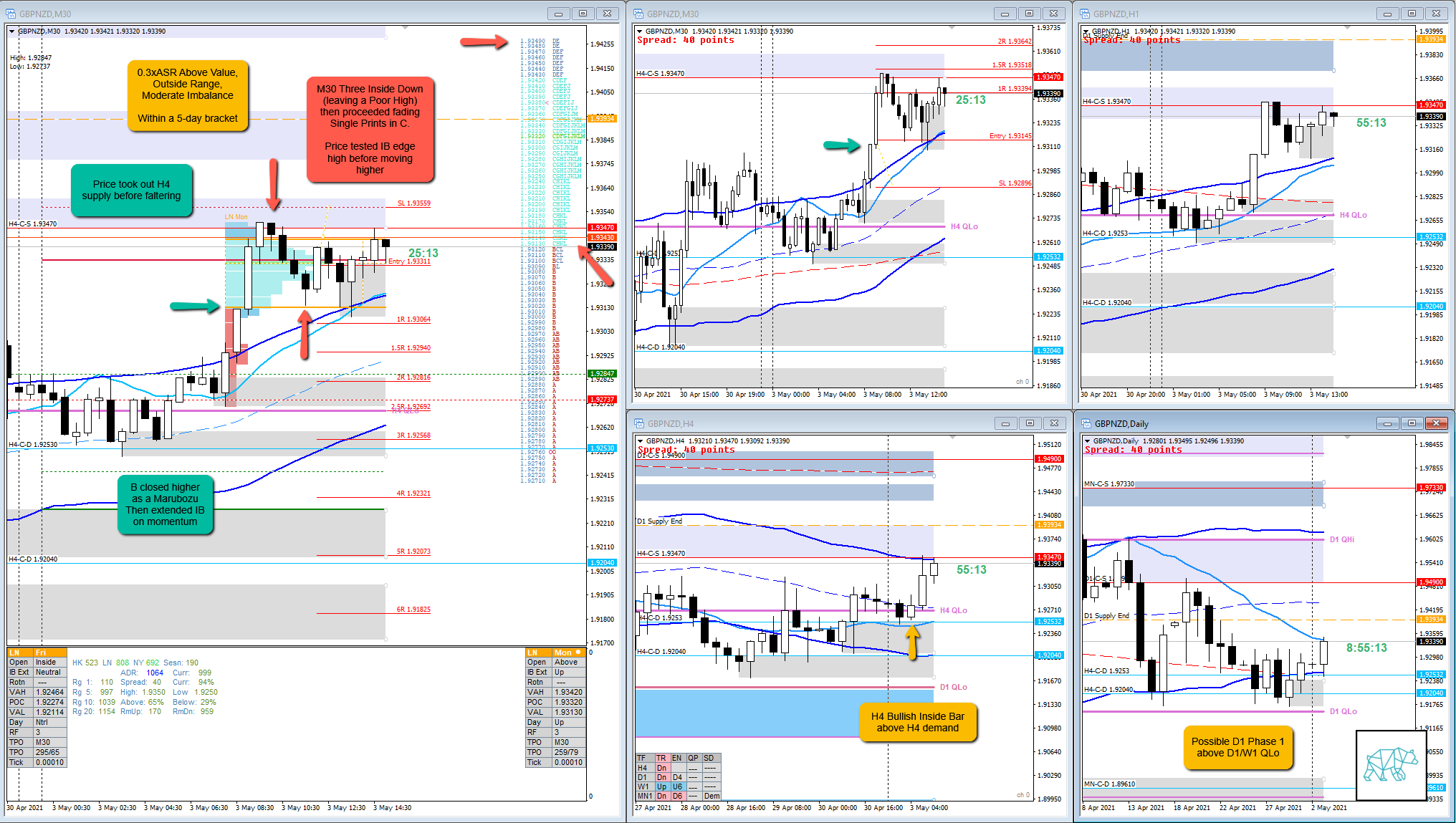

03 May 20210503 Trade Review GBPNZD

Play: Return to Value to Single Print Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

I have already reviewed these trades but I like to go back and review them again. Hence this new format I am introducing into my process.

How was the Entry?

There was an open above value, outside range. There was an earlier IB extension up in C TPO with D making HHs into H4 C‑sup after IBR had traversed about 0.5xASR indicating possible momentum. E formed a Poor High and F closed as a M30 Three Inside Down. There was a 4 TPO structure buildup around the high of the distribution curve. Then G started taking out Single Prints in C. At the first TPO I went in short. Entry was good.

Odds enhancer: IB extension up, above value, outside range, bracket, balancing market, trend is down, H4 supply popped, M30 Three Inside Down, Poor High, Single Print Fade, Marubozu, momentum trade, H4 Bullish Inside Bar, H4 demand, Possible D1 Phase 1, above D1/W1 QLo, TPO structure, 0.5xASR IBR,

How was the SL placement and sizing?

SL placement was great. Due to the nature of the setup entry and SL placement isn’t as important. Still the SL placement was above the PA formation.

How was the profit target?

Profit target at IB edge was only 0.8R although a higher probability trade.

How was the Exit?

Exit could have been better as I did not wait for a retracement to IB edge high to cut the trade. I had placed my take profit at the edge but the Poor High and my experience it getting taken out quite often made me want to take the trade off when nearing M15 VWAP in UT.

What would a price action-based exit have done for the trade?

It wasn’t so much a price-action formation but rather a pop of IB edge that could have yielded 0.8R. A manual cut off would have probably yielded 0.6R.

What would a time-based exit have done for the trade?

N.A. due to the nature of the trade

What could I have done better?

I could have let the trade reach IB edge High before taking the trade off.

Observations

Price ‘popped’ IB edge high to complete the Single Print Fade.

Missed Opportunity

There was a Return to Value play in C TPO that I could have taken on IB extension up. This would have yielded nearly 1.5R.

Premarket prep on the day

Daily Report Card on the day