Play: Failed Auction anf Extended Frankie Fakeout

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Market Narrative

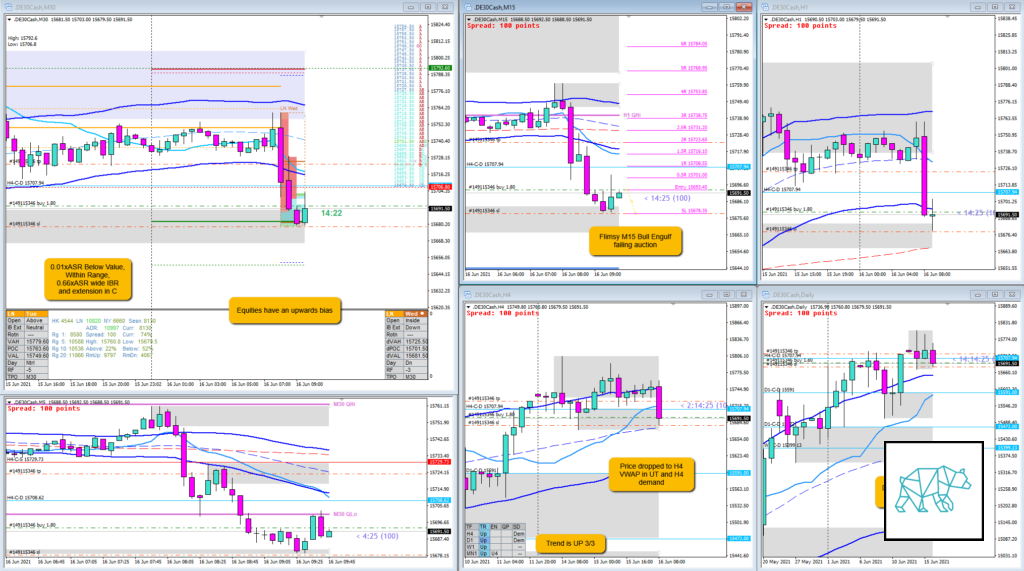

Price opened slightly below VAL then traversed down 0.66xASR lower. Extended in C within LTF, H4 demand, before forming a flimsy M15 Bull Engulf within IB.

How was the Entry?

I took an educated guess based on the wide IBR and upward bias for equities that the M15 Bull Engulf could transition into a M30 Bull Engulf failing Auction.

How was the SL placement and sizing?

I scaled the SL to match the entry just below the body of the M15 formation.

How was the profit target?

Due to possible responsive activity I had the profit target tapered but 1.5R should have been okay.

How was the Exit?

My indicator wasn’t set right making me think price had opened within value which in fact it had not. This made me lose confidence and I took off the trade at 0.5R. Luckily as price went against the trade soon after even though M30 closed as a Bull Engulf within IB.

What would a price action-based exit have done for the trade?

-1R

What would a time-based exit have done for the trade?

N.A.

What did I do well?

I did well to try and take an early entry.

What could I have done better?

Well, I didn’t know my indicator was set wrong but that is taken care of now.

Observations

Price extended slightly further below but then reversed for an extended Franky Fakeout.

Missed Opportunity

TAGS: Extended Frankie Fakeout, Trend is UP 3/3, Below Value, Within Range, Wide IBR,

Premarket prep on the day

Daily Report Card on the day