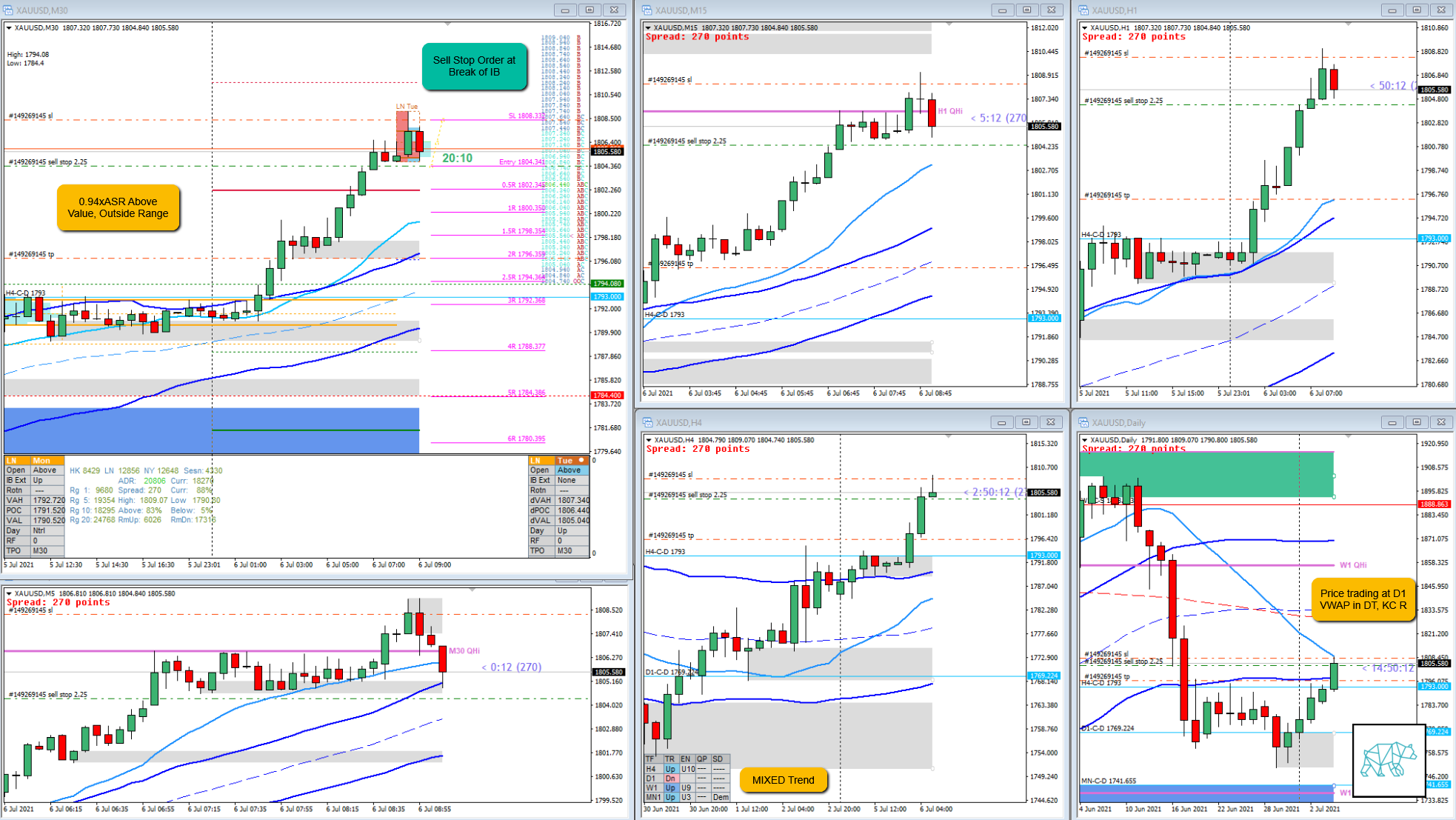

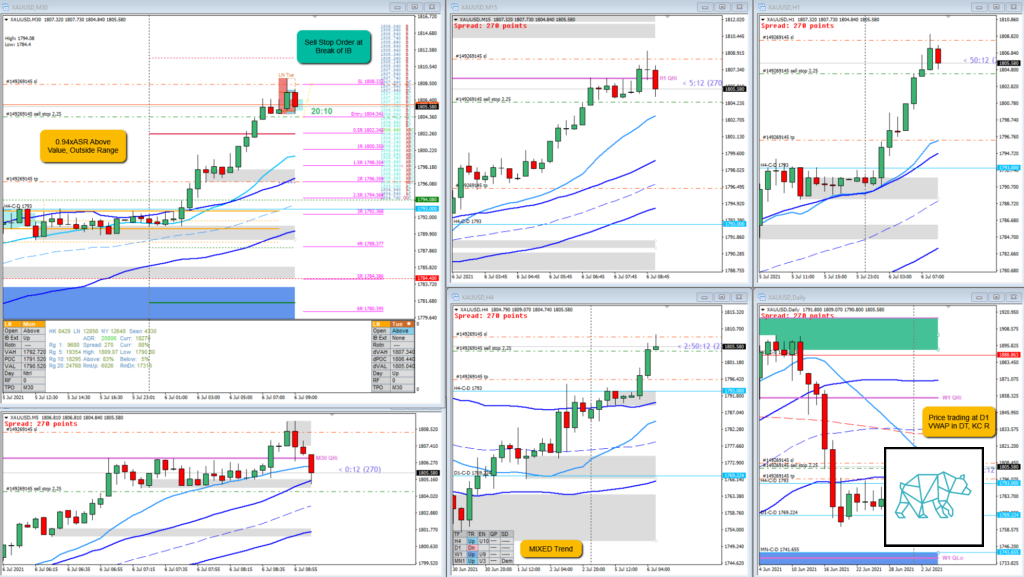

07 Jul 20210706 Trade Review GOLD

Play: Mean Reversion Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GOLD #XAUUSD

Market Narrative

0.94xASR Above Value, Outside Range. Mixed Trend.

How was the Entry?

Sell Stop Order at the break of IB. I was considering going in on the M15 Doji with longer selling wick expecting a mean reversion but this could have been a possible base as well so waited for a break of IB. This was okay.

How was the SL placement and sizing?

SL was too wide. I had overly rounded up the standard SL adding the spread which would have netted about 34–36 pips to 40 pips. I’ll tighten this up going forth. Although I could just add it to all my shorts and longs to be on the safe side to keep things easy.

How was the profit target?

1.5–2R at LTF demand, more at value edge.

How was the Exit?

Price had reached 0.5R and halted around M15 VWAP in UT. I decided to wait for a transition to M30 closing bullish within IB failing the auction. And this was my exit at ‑0.4R.

What would a price action-based exit have done for the trade?

-0.4R

What would a time-based exit have done for the trade?

-1R

What did I do well?

I did well to take the trade and let the trade play out and based on OODA loops and a confirmation of an exit I took the exit.

What could I have done better?

Well, I think I did well… I was considering to take the 0.5R when I saw price not reaching far below M15 VWAP but this could have had legs to go further and decided it would be grasshoppering out of the trade if I had taken that 0.5R.

Observations

When there is no push within the first 2 hours for the mean reversion there could be a failed auction to push price higher.

Missed Opportunity

I could have acted on the failed auction but since the prior day was a holiday this could have been a slower auction so I let the opportunity go.

TAGS: Above Value, Outside Range, Large Imbalance, Mixed Trend,

Premarket prep on the day

Daily Report Card on the day