10 Jul 20210708 Trade Review DAX

Play: Failed Auction (bad), Unidirectional Day

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

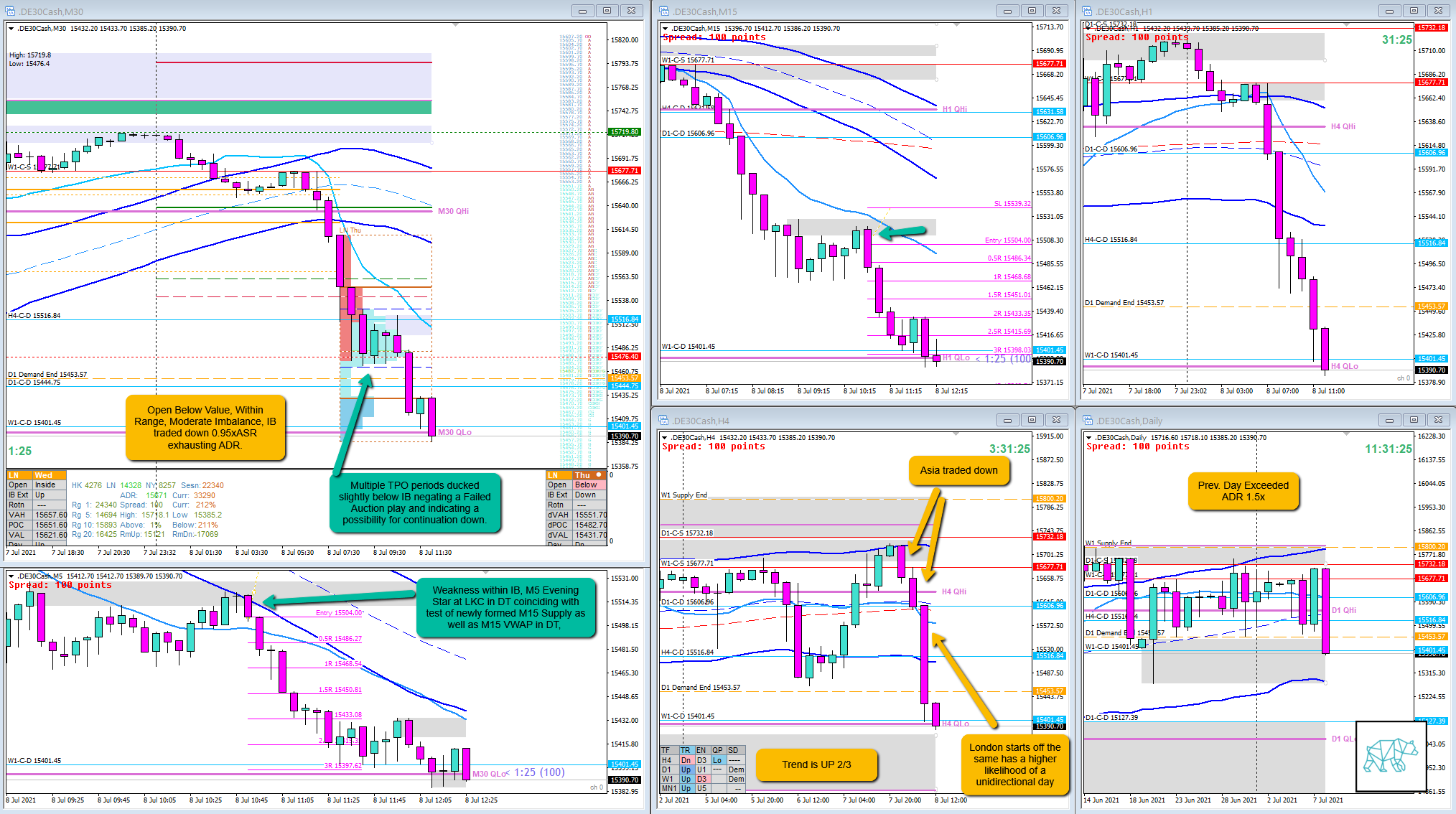

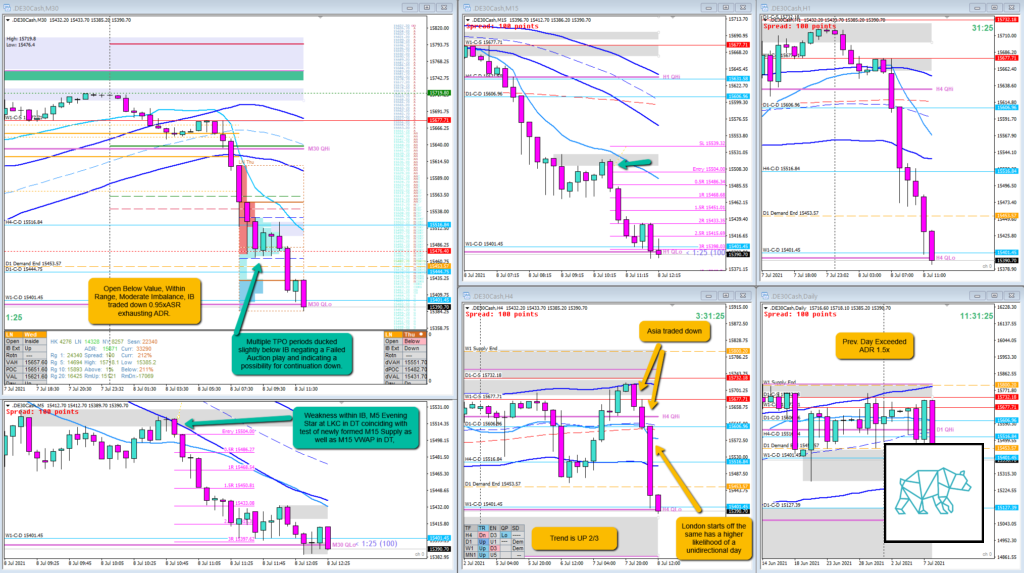

Market Narrative

Previous day exceeded ADR by 1.5x closing as a Bull Engulf. Expectancy is for price to at least retrace that. Which it did. 0.1xASR Open Below Value, within range, moderate imbalance. IB traversed down 0.95xASR.

How was the Entry?

I failed to notice that there Price ducked below IB in C as well as D negating a higher probability for a failed auction. Also, the possibility for a unidirectional day as Asia had traded down as well as Frankie Fakeout. Then London followed suit. So this Failed Auction play was bad.

I had entered on a M15 Inside Bar expecting a transition to M15 Three Inside Up / M30 Bullish Inside Bar. Which did come. But again, due to the nature of the context this was a wrong play.

How was the SL placement and sizing?

Good. Standard size.

How was the profit target?

3R

How was the Exit?

I scratched the trade after having been pointed out to the actual narrative. 0R. Waited for a pullback to entry and cut the trade. The trade did go to over 0.5R before violently reversing and it would have stopped me out.

What would a price action-based exit have done for the trade?

-1R

What would a time-based exit have done for the trade?

-1R

What did I do well?

I did well to try out if not taking into consideration the wrong narrative I was expecting. I expected due to the long-bias in equities as well as FF had traded down. As well as IB traversing 0.95xASR (expecting responsive activity) that there was a higher likelihood for a Failed Auction.

What could I have done better?

I could have noticed the possibility for a unidirectional day due to Asia and London having traded down. Then I could have taken note of price having ducked below IB more than 1 TPO period making the chances for a Failed Auction slimmer.

Observations

Asia, FF, London trading down makes a higher probability for a unidirectional day.

Missed Opportunity

Due to the narrative I could have entered on a short looking for a weakness from within IB. This came in the form of a M5 Evening Star at M15 Supply (coinciding with M15 VWAP in DT)

TAGS: Below Value, Within Range, Moderate Imbalance, Unidirectional Day, ADR got Exhausted, Wide IB, Trend is UP 2/3, Prev. Day Exceeded ADR,

Premarket prep on the day

Daily Report Card on the day