Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

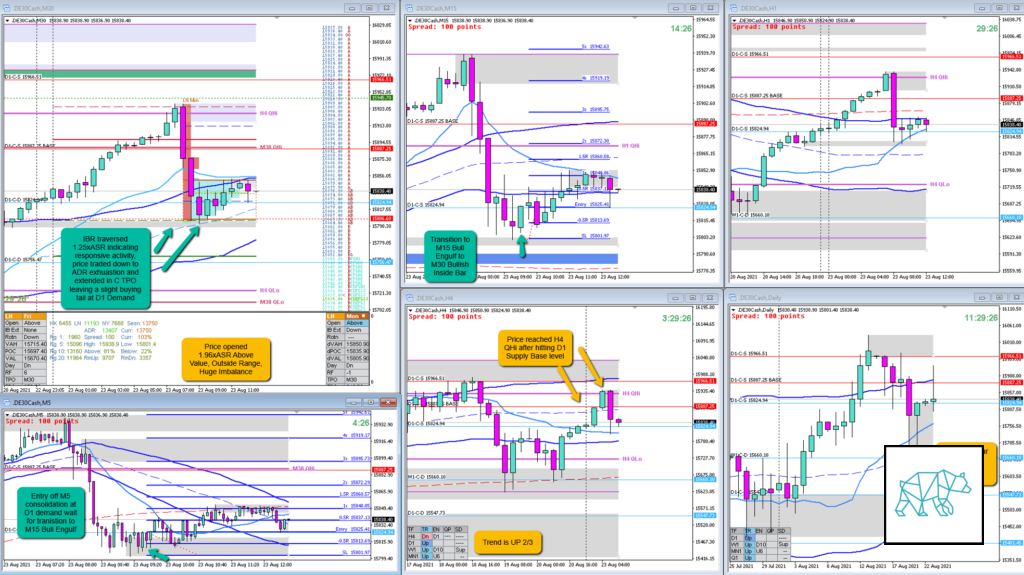

D1 Inside bar with long buying wick and base created some demand. Trend was up 2/3. Open sentiment was huge imbalance on account of 1.96xASR Above Value, Outside Range. This coupled with a huge IBR of 1.25xASR any sustained auctions would be less probable. Looking for ASR/ADR levels for confluence for a bounce is the way to go.

What hypo was it?

Hypo 2

Failed Auction Long, Possible Strength from within IBR

I actually intended this to be Hypo 1 but as I had done so in a previous prep but to my recollection I did it wrong that time I placed it as Hypo 2. Now I have reaffirmed that when IBR is this wide (and learned something new) at a huge imbalance open sentiment. We look for failed auction or strength from within IBR coinciding with technical levels such as ASR/ADR, SD zones etc.

How was the Entry?

I wanted to get a slightly better entry and saw that there was a M15 Bull Engulf developing. I took the M5 consolidation as my entry point and waited for a transition to M15 bull Engulf which came. This then proceeded to transition into a M30 Bullish Inside Bar.

How was the SL placement and sizing?

SL placement was slightly tighter due to the M5 entry. SL placement was just below the M5 demand formation.

How was the profit target?

If price had moved all the way through IBR it would have been a 4.8R target. However, on days where you have a huge IBR we should taper out expectations. This coupled with summer time trading I thought 1.5R would be achievable.

How was the Exit?

When M5 Failed to close above M5 VWAP I took this as my exit signal. What followed was a M15 Bear Engulf so in hindsight I feel this was the right call.

However, the market narrative of trading at a D1 demand, Failed Auction, plus this being equities having an upward bias, as well as a possible consolidation on M30 I could have stayed with the trade and I grasshoppered taking 0.5R profit.

What would a price action-based exit have done for the trade?

If the exit was based off the M15 Bear Engulf then I would have taken a ‑0.6R loss. However, due to price consolidation on M30 I could’ve left the trade go on longer. The trade eventually hit 1.1R before pulling back during my trading window so a time-based exit would’ve overruled.

What would a time-based exit have done for the trade?

0.9R. 0.6R in overlap noise.

What did I do well?

I did well to take the entry off the M5 consolidation as this is not something I do often. I was even thinking if I’m not just simply jumping the gun on the entry. However, due to the location and narrative I decided it was worth the opportunity. I did well here.

What could I have done better?

I could have let the trade go on longer. This has been a recurring theme where I get great trades but leave money on the table by grasshoppering out of them. My aim is to get comfortable again with staying in trades longer so will try to bose my exits off the M30 and not off the M5/M15.

Observations

I am getting better at finding good trades but lack the confidence to stick with them. To force myself to stick with a trade a while longer I will focus my exit off the M30.

Missed Opportunity

N.A.

TAGS: Trend is UP 2/3, Huge Imbalance, Above Value, Outside Range, Wide IBR,

Premarket prep on the day

Daily Report Card on the day