03 Mar 20220302 Trade Review Gold

Play: Late-Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 1.2R

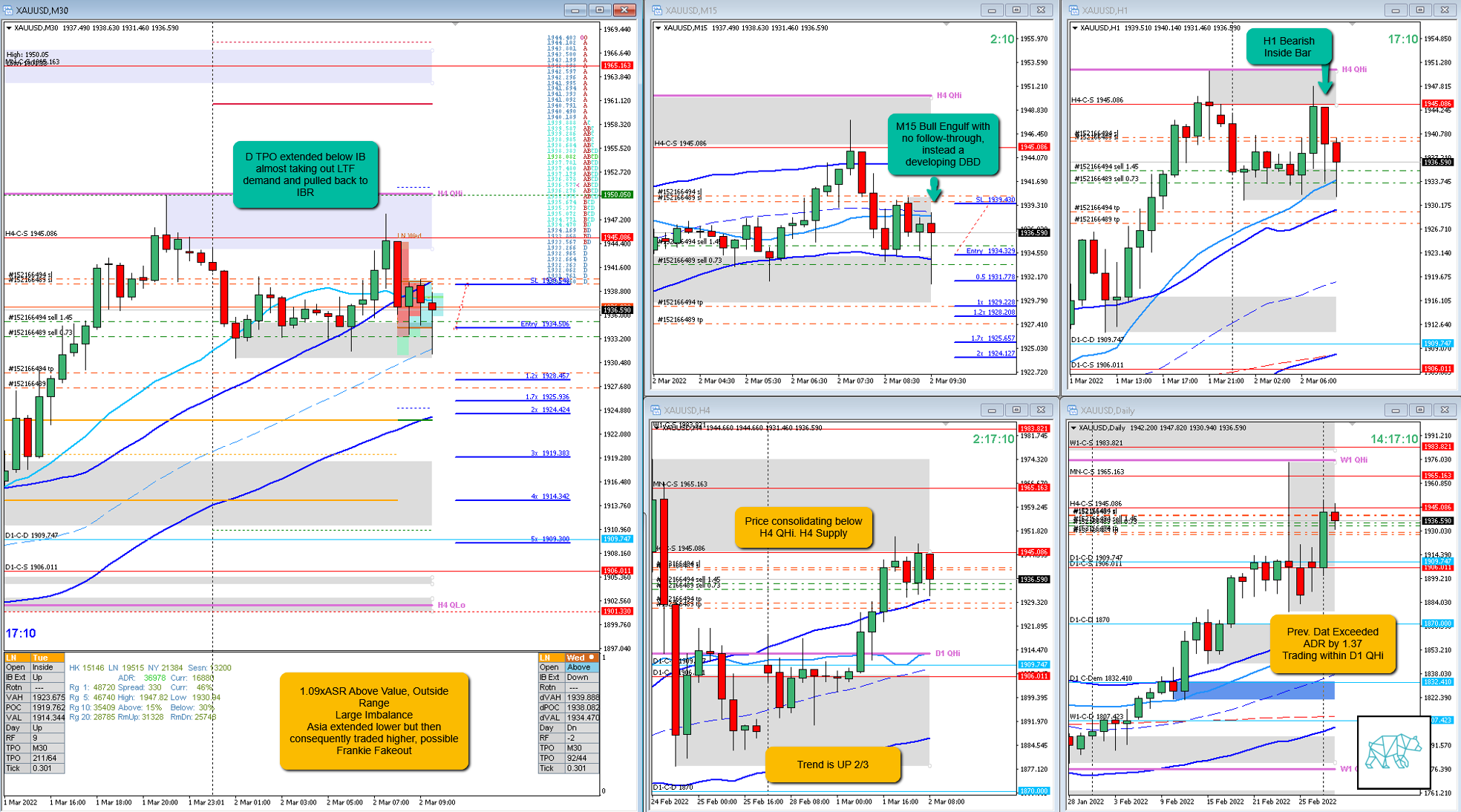

- Open Sentiment

- 1.09xASR Above Value, Outside Range

- Large Imbalance

- Asia extended lower but then consequently traded higher, possible Frankie Fakeout

- IBR

- 0.56xASR

- Trend

- Trend is UP 2/3

- H4: Down

- D1: Up

- W1: Up

- Hypo

- 1

- Short

- Mean Reversion, Late-sustained auction due to M30 Bull Engulf in the way

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- D TPO extended below IB, M15 had formed a Bull Engulf but followed by a M15 Bearish Inside Bar and a possible M15 base. The consequent developing DBD extended IB. On a Pullback to IB I went short with a full position.

- When price dove deeper into IBR testing developing M15 RBR I decided to cut my position in half and re-enter with another position

- Sadly I entered with another full position so had to cut half of this one as well as to have 1R risk on the table.

- SL placement

- Standard SL (500)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h52m

- Long/Short

- Short

- Leading Narrative

- Prev. Day Exceeded ADR by 1.37

- Open sentiment: 1.09xASR Above Value, Outside Range

- Open at H4 Supply, H4 QHi

Actual Development

- D TPO closed below IB and then low liquidity during E TPO smashed target and eventually accepted value and rotated through

Good points

- Taking the trade

- I was somewhat patient and focused on other things while the trade was developing

- Good that I realized I could get a better entry and cut off sizing to add more at a better price

- I believe due to the lack of liquidity my demo platform broker cut off the trade at a higher price (due to wider spread) originating in a lower profit. Luckily my real broker has a fixed spread and cut it off accordingly at the target.

Bad Points

- In my prep I wrote I would wait for a close below IB before getting involved so I jumped the gun on this one. I was tired yesterday and this must’ve affected my judgment

- I fumbled cutting my position in half and then adding for a better entry. I added another full position and had to cut that up in half again.

- Then when price moved in my direction I covered one half to cover the losses incurred with my fumbling. The other half hit the target and ended up lower than intended. Progress but far from perfect. I was tired and definitely not thinking my best. I will continue working on this.

Next Day Analysis

- Target hit?

- Yes, 1.2R

- Time-based Exit?

- 1.1R

- Overlap Noise?

- 2.1R

- End of Day?

- 1.9R

- Highest R multiple?

- 4.1R

TAGS: Prev. Day Exceeded ADR, Trend is UP 2/3, Above Value, Outside Range, Large Imbalance,

Premarket prep on the day: