30 Apr Analyzing your Trading stats Month 11

#fintwit #orderflow #daytrading #tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! Almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Keep in mind that this is my journey and might not fit yours. It is up to you to decide what you’d like to take away from this and what to ignore. This is not advice whatsoever. Having said that… Let’s get it on!

Process

The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

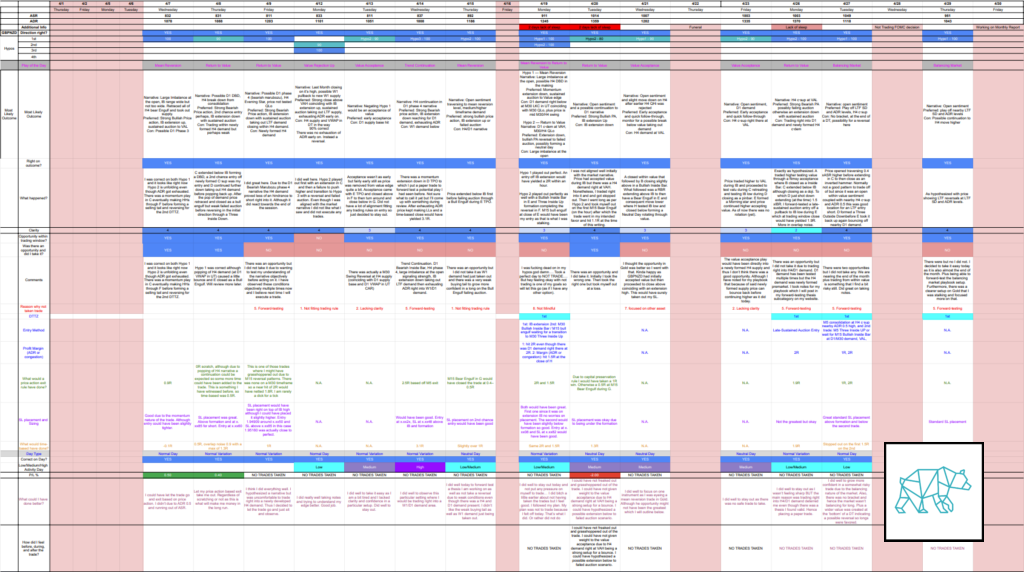

DRC Tracking Stats

Here you can find the details of my DRC tracking sheet. DRC stands for Daily Report Cards. If you would like to take a look at some examples you can do so here. Every trading day I recap my notes, trades, and performance. I grade myself on how well I executed my plan as this is the most important. Living in a probabilistic world of trading making money is a side-effect of trading your plan. No one real trader in the world has a 100% win rate (if they do please run away quickly). If you like to know more on how I track my stats just hit me up. I freely share this information.

STATS GALORE

First of all I gotta say… I love going through my stats. It’s a huge part of the process that tells me how well or not I am performing. Ultimately my process is the only thing I can control. My stats give me the insights I need to understand my edge better. Then tweak or let it be. Rinse and repeat.

April

This month has been weird for me. It started off okay but then my energy levels and thus focus took a turn for the worst. My girlfriend’s grandmother passed away (she lived to be 90) and it impacted my routine (which is okay). I won’t get too deep into this. This coupled with some poor dietary choices on my part resulting in a lack of sleep. On more than a few occasions I made the poor choice of eating something quite late (for me). I usually stop eating before 6. On these occasions I decided to eat something around 9–10pm. This caused me to have trouble falling asleep resulting in poor cognitive performance the next day. Do this a few days in a row and it really impairs you. Gladly, I caught my poor cognitive performance due to the process I have in place.

Last month I stated that trading a smaller account has perhaps made me complacent. Now that I am trading a bigger account I definitely feel less confident. There is an upside to this though: it forces me to go through Kolb’s learning cycle again. Helping to solidify the knowledge I know I have with more objective experience.

I was already tracking how many opportunities presented themselves throughout the trading month. On top of that I started tracking trades I missed including the reason. This way I can hopefully identify what areas I still need working on.

Opportunities Presented

I primarily focus on GBPNZD but when ranges are too tight (thus statistically obliterating my edge) I focus on Gold. Although I have been experimenting a little with trying to trade both assets at the same time. Trading one asset is already hard so the focus on this hasn’t been the greatest at this stage of my trading progress.

Here you can see that from the 13 days I observed I only traded 3 days in GBPNZD and from the 12 days observed in Gold I only traded 1.

A ratio of 25% on GBPNZD only. I will aim to increase this number for next month. This will be one of my objectives.

Trades Taken

For the whole month I sat down to observe the market (not trade, we don’t trade for trading sake. We observe, take notes, if an opportunity comes to us we execute): Not going to talk about the days that the range was too tight or I couldn’t, did not want to, whatever reason, not trade that day. However, I will cover trades that I missed for various reasons.

Here we can see that if I had stuck to a price action-based exit I would have ended up with 1.6R and 0.7R time-based. Nothing to write home about but still.

Let’s dive deeper. To do that I added a new format to my process where I go back and review my trades. This is on top of the Playbook review I do on the day. I like to go back and watch my screen recordings and see if I missed anything when having a clear head. These reviews you can find by clicking here: Trade Reviews. They include pictures of entries and exits as well as commentary on both. Therefore I am not going to discuss these here in detail as I have already done so.

Links to the trades:

- April 7th: https://www.bearmarkettrader.com/trade-review-gbpnzd-20210407/

- April 8th: https://www.bearmarkettrader.com/trade-review-gbpnzd-20210408/

- April 20th: https://www.bearmarkettrader.com/trade-review-gbpnzd-20210420/

- April 21st: https://www.bearmarkettrader.com/trade-review-gold-20210421/

▷ Or simply click here to go directly to all of the trades I have taken ◁

Missed Opportunities

This is where things get more interesting. I have tried teaching myself (to some success if I may add) to not take trades when I am not confident. If I am thinking too much on a trade then it is probably not a trade I should be in. This is where lots of screen-time comes into play.

I have classified these missed trades as following:

- Not fitting trading rule

- Doesn’t fit my trading rules in terms of profit factor, entry rules, etc.

- Lacking clarity

- Can’t find alignment with the market narrative (fancy way of saying I don’t know what’s going on)

- Hesitated

- For some reason I hesitated but it was still a valid trade. I have this separate from lacking clarity as I do sometimes have trades jump out at me but I decide for some reason not to take it.

- Not paying attention

- Forward-testing

- This is a mix of setups I have personally seen occur over and over that I am actively forward-testing. OR they are concepts taught through the Market Stalkers method that I am gaining confidence in.

- Not at desk

- Focused on other asset

- When I am stalking a trade in GBPNZD I don’t mind too much what is going on in Gold and vice versa

- Not Mindful

- This is where I am either cognitive not the best through lack of sleep, emotional, things are going on in my personal or work life outside of trading.

▷ For Playbook details on Missed Trades including pictures click here ◁

I have been documenting missed trades through entries into my playbook for quite some time now. Only recently have I begun to make the distinction of classifying them as missed trades. Therefore there aren’t that many uploaded to this category but be sure I will be adding them as they come along. MUST UPLOAD MORE!!!!! Sorry, I’m a bit weird…. 😀

From gathering this data I can tell that most of the reasons have been due to forward-testing. Thinking back I had thought it would have been mostly due to not being mindful. I believe that number should have been greater. I’d even say they go hand in hand a bit. This is because I forward-test certain setups I am not confident in. When am I the least confident? When I am tired or otherwise not mindful. I’ll keep tracking these for more data as this is the first time I am doing this.

▷ Again, for all missed trades CLICK HERE ◁

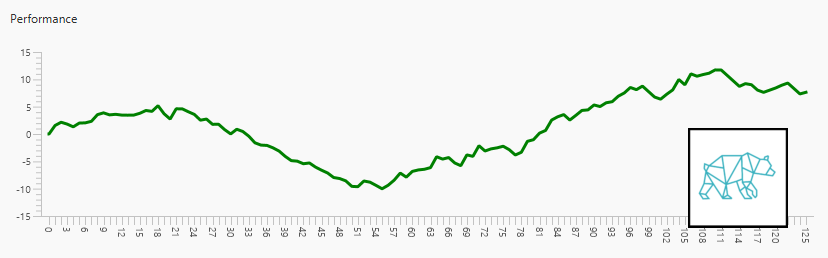

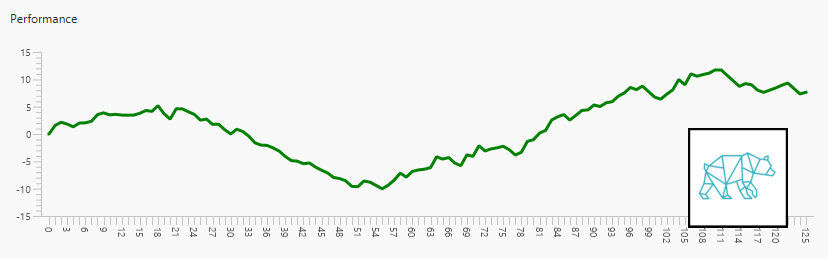

Equity curve

Started the month with +8.34% and currently I am at +7.48%. Down by ‑0.86%. Nothing to write home about here my friends. I’m a little bit of a drawdown from the top of my equity curve. I am focusing on aligning myself with my process and taking 1R profits until I am out of the drawdown.

The equity curve I show here is not that of my main account. This is the account I have been trading with for a while now and am gathering stats on each little factor of my trading. This way I have a more balanced overview of my trading whereas when I would show the new account you might think things aren’t going too well.

April

Overall Evaluation

The profit factor is what I am most focused on. Anything over 1 preferably 1.3 is good. As you can see here my profit factor for this month was only 0.6R. Not good. WIth last month and this month together it took my overall profit factor down to 1.26. This is mostly due to me having taken profits too soon for which I have created a Hard Exit Rule of: wait for M15 close before taking profits for the coming month.

Monthly DRC Tracking Stats

I don’t want to focus too much on these every month as I need a larger data sample for these stats to have more value. These stats I simply look at outliers. Stats that stick out rather than look at its entirety because they don’t matter as much. The outliers give me more insight in where I still need improvement or to tell me where my edge is slightly better. I will review these again in June.

Day of the week

Open Value Sentiment

Entry TPO

Hypos

Every trading day I formulate 1 to 3, sometimes 4, hypotheses. These give me a framework to what I expect to see in the market on that day. Then during the session I wait for price action to confirm or negate a hypothesis. If price action confirms I execute a trade. If the trade is based on a hypo it is more likely to be a good trade (no guarantees of course, we are simply looking for higher probability outcomes). So win or loss it was a good trade. This is not always the case as I of course make mistakes and execute a trade on the wrong hypo. But by tracking these stats I get better insights into 1) did I formulate the right hypo 2) did I execute based on the hypo and if not I gain insights into why I did not. Using these metrics I keep myself in check but also gather data on if I am hesitating more than not or if I am not aligned with market conditions.

Still most of the times it is Hypo 1 or Hypo 2 that plays out. I am happy with that as that shows that in my premarket plan I am mostly aligned with what I deem to be the MOST LIKELY OUTCOME of the trading session.

Objectives

My main objectives for the month of April were:

- Min. 3 times hitting the gym + mandatory cardio

- Started doing more cardio than lifting weights which is good but preferably I should do more of both. Hence this objective will remain the same for the coming month.

- Only trade the main account

- I have no issues trading the big account so I will stop tracking this objective

- Be mindful of DTTZs

- I do well here but I feel I can leave this on for another month

- Only price-action based exit rules (or if hit time stop comes earlier)

- This is where I lack the discipline. So as of this month I will focus on waiting for AT LEAST a M15 candle close before taking off the trade (unless during 2nd DTTZ).

- IF NOT… I will do a Bart Simpsons exercise of 7 days, 50 sentences of: “I will trust my trading skills and take my exits accordingly”.

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- I did well on this one but I will continue to track this.

My main objectives for the coming month are:

- Min. 3 times hitting the gym + mandatory cardio

- Be mindful of DTTZs

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

Aim to have a minimum of ONE TRADE per trading day

This DOES NOT mean I should willy-nilly take trades. However, my data (which as you can see I have gathered myself) shows me that more often than not I am aligned with the market. Furthermore, I have the knowledge. Just for some reason when lacking confidence I decide to sit on the sidelines. WHICH IS GOOD! However, I want to push myself out of my comfort zone because us traders are a bit Sadistic and Masochistic in one 🙂

The objective here is to feel comfortable not being comfortable but building on my own experience of knowing that more over than not… I am aligned with the market. See how I did not say I was right?! 🙂

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. This and I love me some stats 🙂 If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. Get in touch if you have any comments or questions or just come say Hi!