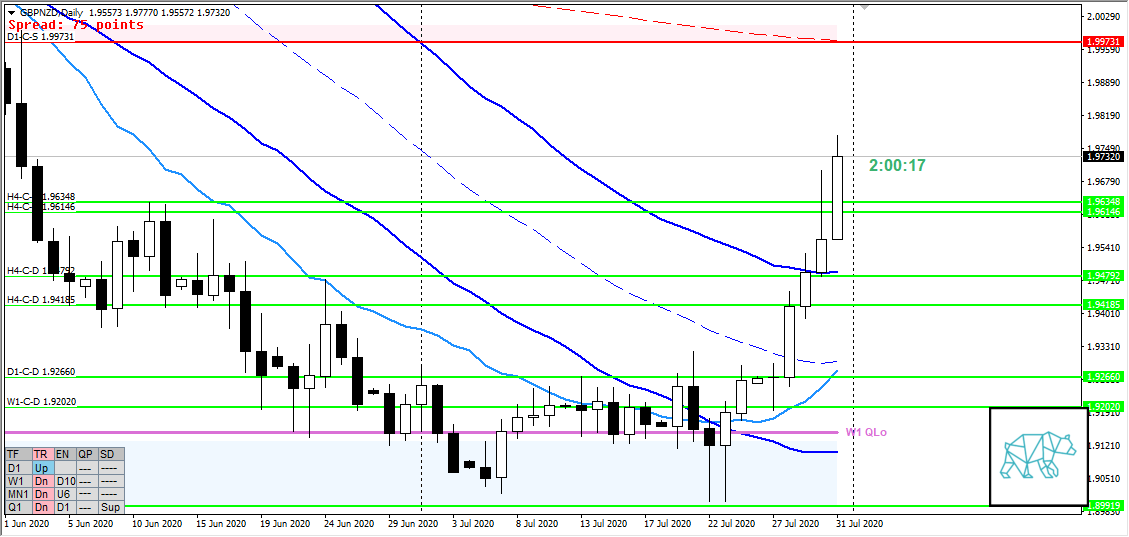

01 Aug GBPNZD Week 32 Trading Plan

#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bullish

- Q1 QLo and MN-C-D1.89919 reactive and price closed above MN VWAP retracing ¾ of preceding month

Weekly — Slightly Bullish

- W1-C‑D 1.92020 formed through RBR and last week a strong move higher reaching for VWAP in a ranging market

Daily — Slightly Bullish

- Strong uptrend after bounce of W1/D1 QLO with price above UKC and VWAP and Friday closing near its high

- Ranges were decreasing slightly to then increase significantly on Friday

- No supply until D1-C‑S 1.99731

H4 — Slightly Bullish

- Strong demands being formed one after another however latest (H4-C‑D 1.96146) not as strong due to come consolidation before a continuation

- Consolidation break out with bull engulf giving H4-C‑D 1.96348

Market Profile — Neutral to Slightly Bullish

- Several uptrending days followed by the last day opening below value within range to then break out to new highs — possible exhaustion

Sentiment summary — Slightly Bullish

- Due to daily ranges initially decreasing but then ending with a severely increased range ie. strong move up. Combined with the profile showing a day where we opened below value (above value would be more in line with a sustained uptrend) we could be looking at an exhaustion in the market for the short to medium term although intraday sentiment needs to be assessed for further clues. We could just be building up steam.

ZOIs for Possible Shorts

- D1-C‑S 1.99731

ZOIs for Possible Long

- MN-C-D1.89919

- W1-C‑D 1.92020

- D1-C‑D 1.92660

- H4-C‑D 1.96146

- H4-C‑D 1.94792

- H4-C‑D 1.94185

- H4-C‑D 1.96348

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Apply the right strategy to current market conditions

- Risk Management

- Only take 1 trades a day and 1R target to claw back out of drawdown

- Only trade off M30 candles or momentum trades

- 2 consecutive days of lack of sleep = NO TRADING