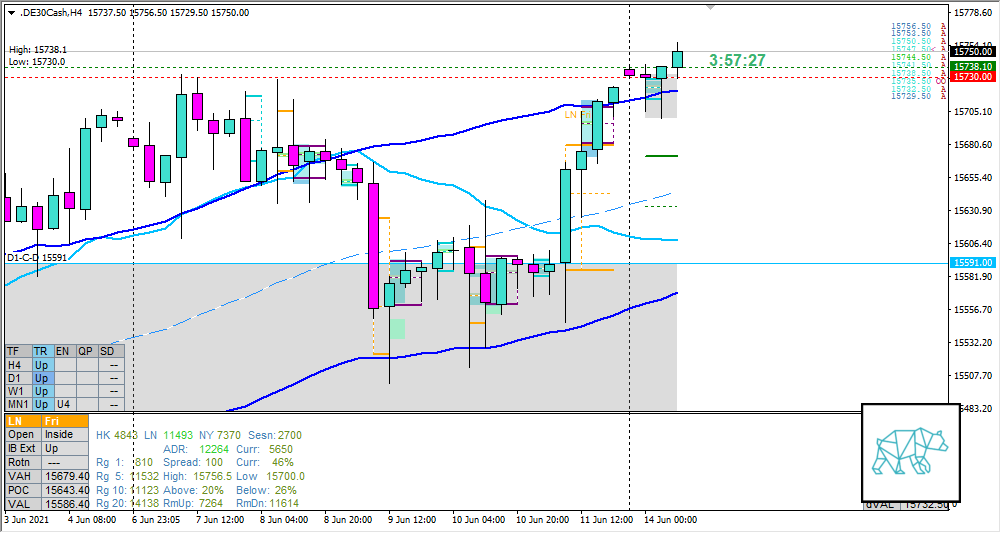

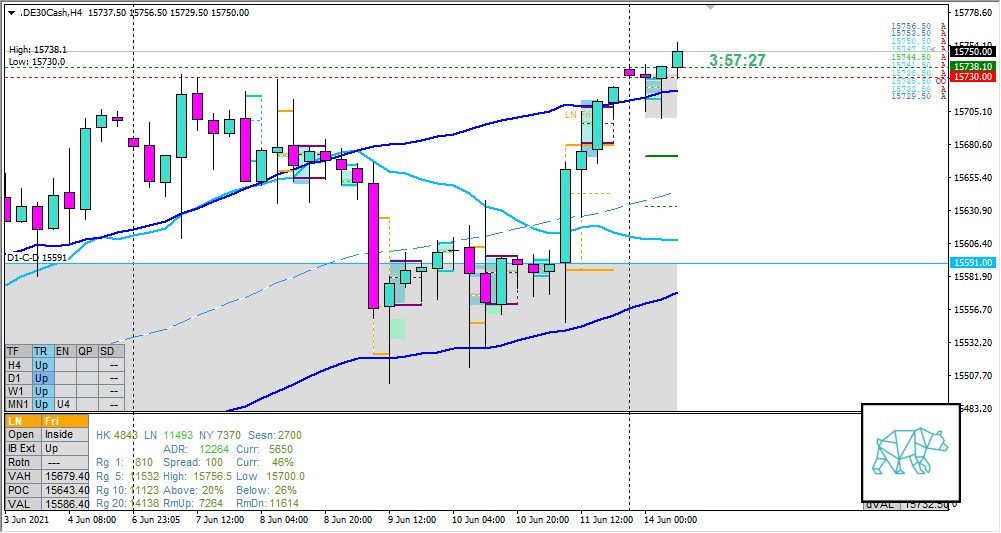

14 Jun Premarket Prep DAX 20210614

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price made a slight HH trading at the top of last week’s range/body

Non-conjecture observations of the market

- Price action

- Price took out D1 Supply and formed a spinning top with nearly no wicks

- H4 Bearish Hammer with price extended above H4 VWAp in DT

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is UP 3/3

- Market Profile

- 3‑day bracket

- Daily Range

- ADR: 12264

- ASR: 11493

- 287

- Day

- Yesterday’s High 15738.10

- Yesterday’s Low 15547.40

Sentiment

- Locations

- D1-C‑D 15591 within value at VAL

- M30 demand at VAH

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 0.5xASR

- Premarket

- H4 Bull Engulf with long buying wick

- Narrative

- Moderate to large imbalance at the open. H4 Created a bull engulf with long buying wick

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Trend Continuation

- Narrative: H4 Bull Engulf premarket. Equities tendency, D1 Supply taken out, open sentiment

- Preferred: IB extension up (momentum) sustained auction, exhausting ADR

- Con: all-time highs

- Hypo 2 — Return to Value

- Narrative: Same as Hypo 1

- Preferred: IB extension down to failed auction, LTF demand at VAH, possible test of value

- Con: If M30 closes within value

- Hypo 3 — Value Acceptance

- Narrative: Open sentiment, all-time high, Friday traded higher, ADR exhaustion at VAH,

- Preferred: Early acceptance and quick follow-through

- Con: Equities long-biased, D1 C‑dem at VAL

- Hypo 4 — Auction Fade

- Narrative: Variation to Hypo 1

- Preferred: Hypo 1 playing out, building structure and PA reversal to IB edge

- Con: shorting equities

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- Not favored in equities

ZOIs for Possible Long

- D1-C‑D 15591.00

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING