#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

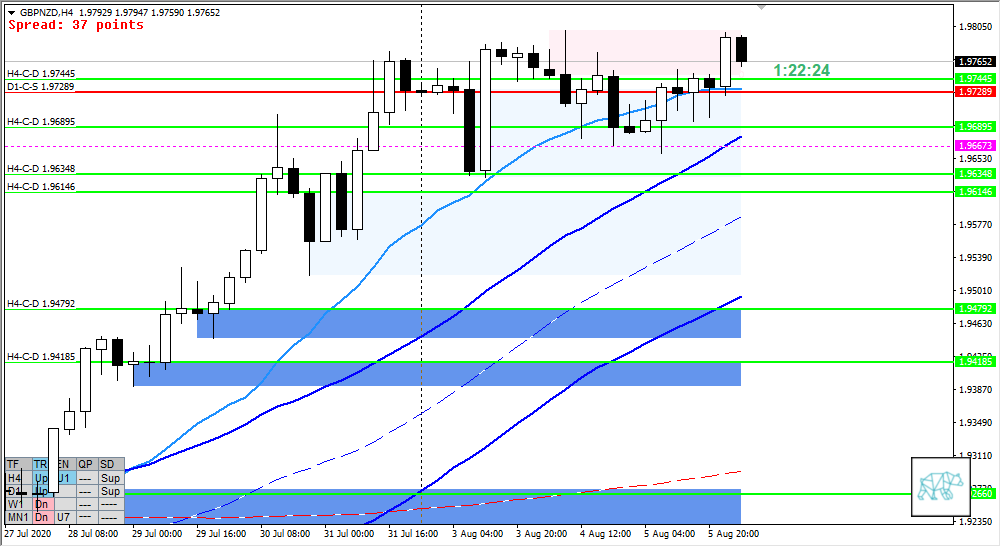

- D1 inside bar retracing more than 50% closing slightly within supply D1-C‑S 1.97289

- Newly formed H4-C‑D 1.97445 through bull engulf not taking out the overhead supply H4-C‑S 1.97491 but near

- Medium term time frame range

- Market Profile

- Price traded higher during AS hitting ADR 0.5 near swing high of the range

- Currently above value and range

- Mild-moderate imbalance

- ASR 1100

- MAX SL (including/excluding spread)

- Short 33 pips

- Long 23

- MAX SL (including/excluding spread)

- ADR 1272

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 trading above previous week’s body after a small retracement, stil two days left

- H4, D1 trend is up, W1 is down

Hypos

- If open above value and range, I’d like to see a bullish price action confirmation at VAH & H4-C‑D 1.97445. Possible early entry warranted (perhaps based on lower time frame) could be considered. Otherwise a possible momentum trade trading off IB extension up. ADR exhaustion does coincide with M30 supply so that could make for a good profit target. Preferably a sustained auction through TPO leaving single prints behind exhaustion ADR to form a unidirectional day. A medium initiative day would have TPOs not closing within IB but price action confirming a slow and steady incline.

- If auction is not sustained we could see either single prints faded or a close within IB confirming a failed auction. Based on if price action confirms and price hasn’t extended IB to the downside, there might be an opportunity for an early entry before value acceptance

- Another option could be (early) value acceptance through a confident M30 (or M15 on the hour or half hour) close within value for a possible value rotation, VAL coinciding with ADR 0.5 and exhaustion

Sentiment — Slightly Bearish

Additional notes

- Today

- BOE Gov Bailey Speaks

ZOIs for Possible Shorts

- D1-C‑S 1.99731

- D1-C‑S 1.97289

- H4-C‑S 1.97491

- H1-C‑S 1.97817

ZOIs for Possible Long

- H4-C‑D 1.97445

Mindful Trading

- Slept okay but woke up a few times.

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Trade idea considering market context based on larger time frame analysis

- Risk Management

- 1 allowed products, no rules under active experimentation

- GBPNZD

- 1 active opened positions

- 3 trades with 1% risk

- 2 consecutive days of lack of sleep = NO TRADING

- 1 allowed products, no rules under active experimentation