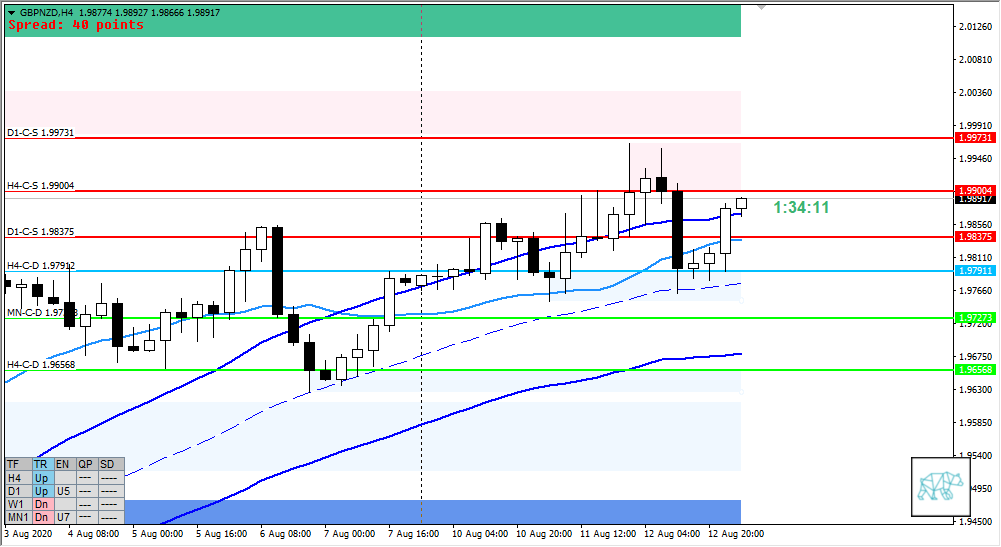

13 Aug Premarket Prep GBPNZD 08132020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

- D1-C‑S 1.99731 proved reactive and ended the day with a bear engulf that had long selling and buying wick (selling wick slightly longer) creating new C‑Sup D1-C‑S 1.98375 where the H4 was previously

- D1-C‑S 1.98375 shares the same level with existing demand

- Possible Phase 3 still in effect even though slightly moving higher still

- Newly formed H4-C‑S 1.99004 with clean break away testing previous H4-C‑D 1.97912 which proved reactive again and messy reversal but clean arrival to new supply

- Market Profile

- ADR 1314

- ASR 1099

- Price currently trading at VAL edge within range (coinciding with ADR 0.5), will reassess at LN open for possible open within

- ADR exhaustion within value inside M30 QHi

- H4-C‑S 1.99004 within value below M30 QHi above ADR 0.5

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 trading above previous week’s body still touching VWAP

- H4, D1 trend is up, W1 is down

Sentiment — Neutral to Slightly Bearish

- At the moment of writing price is at VAL edge but not close inside yet. Will need to reassess at LN open.

- Due to ‘weaker’ D1 bear engulf we could see further upwards move on the short to medium term

Additional notes

- Open Inside value could warrant a potential rejection down due to nearby M30 QHi, H4 C‑sup, ADR exhaustion

- If open below but inside range we might see a continuation to the slight imbalance

ZOIs for Possible Shorts

- D1-C‑S 1.99731

- H4-C‑S 1.99004

- D1-C‑S 1.98375

ZOIs for Possible Long

- H4-C‑D 1.97912

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Taking a trade is not a priority

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING