06 Oct Premarket Prep GBPNZD 10062020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly goal

- Formulate hypos in order of likelihood and track with actual development on the day

Non-conjecture observations of the market

- Price action

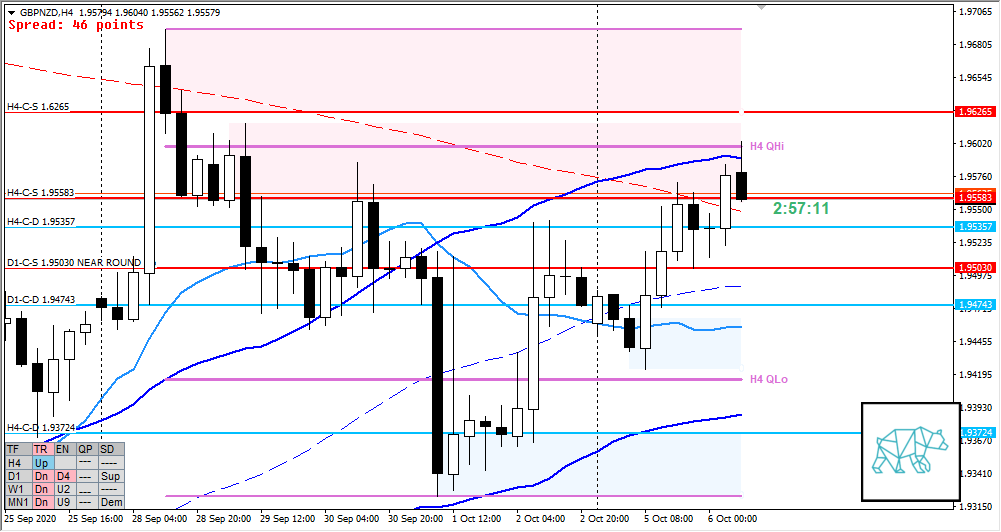

- D1 close within overhead supply of D1-C‑S 1.95030 with slightly longer buying wick pushing off D1-C‑D 1.94743 and VWAP CAS

- H4 Bull Engulf above H4 QLo and D1-C‑D 1.94743 and move higher with slight pushback from overhead supply until reaching H4-C‑S 1.95583 (not entirely at QHi but there is a lot of congestion in the way) forming a possible RBR or D due to the inside bar. Will need to check at the end of current H4 candle for more clues.

- Market Profile

- Profiles still bracketing

- ADR: 1389

- ASR: 1448

- 36

- Day

- Yesterday’s High 1.95709

- Yesterday’s Low 1.94235

- Currently price trading above VAH within range

Compared against Weekly Trading Plan

- Trading above last week’s body but within range. IF we keep this up (big IF since it’s only Tuesday) we could close as a RBR breaking out from VWAP. Big IF still so could go either way.

Sentiment

- Locations

- ADR 0.5 high at H4 QHi but a lot of congestion in the way

- D1-C‑S 1.95030 just below VAH but new LTF demand created on top of VAH

- ADR 0.5 Low just below VAL, D1-C‑D 1.94743 and LTF strong demand

- Sentiment

- LN open

- Above value, outside range

- Open distance to value

- 0.5xASR

- Sentiment

- H4 closed forming a morning star and indicating more bullishness. Price hit H4 QHi so going with the move might prove a bit risky. The distance suggest it can go either way in terms of sentiment. Confluence of ADR 0.5, LTF supply, QHi and H4-C-S‑1.96171 suggest a reversal might be the safest play.

- LN open

- Clarity (1–5, 5 being best)

- 3

- Hypo 1 — Reversal (short)

- ADR 0.5, LTF supply, QHi and H4-C-S‑1.96171 with price action confirming a reversal

- Preferred: strong Bearish Candle leaving enough R/R,

- Cons: H4 closing higher into overhead supply indicating a possible momentum on the bullish side. M30 VWAP again in the way. Early entry might have been best.

- Hypo 2 — Return to value (long)

- VAH at H4-C‑D 1.95357, M30 VWAP, H4 closing higher

- Preferred: IB extension down, PA reversal at VAH, failed auction, forming Neutral Day extending over IB taking out LTF supplies.

- Hypo 3 — Value Acceptance (short)

- Too much congestion due to LTF demands and higher time frame c‑dem

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1.95030 NRN

ZOIs for Possible Long

- H4-C‑D 1.95357

- D1-C‑D 1.94743

- H4-C‑D 1.93724

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING