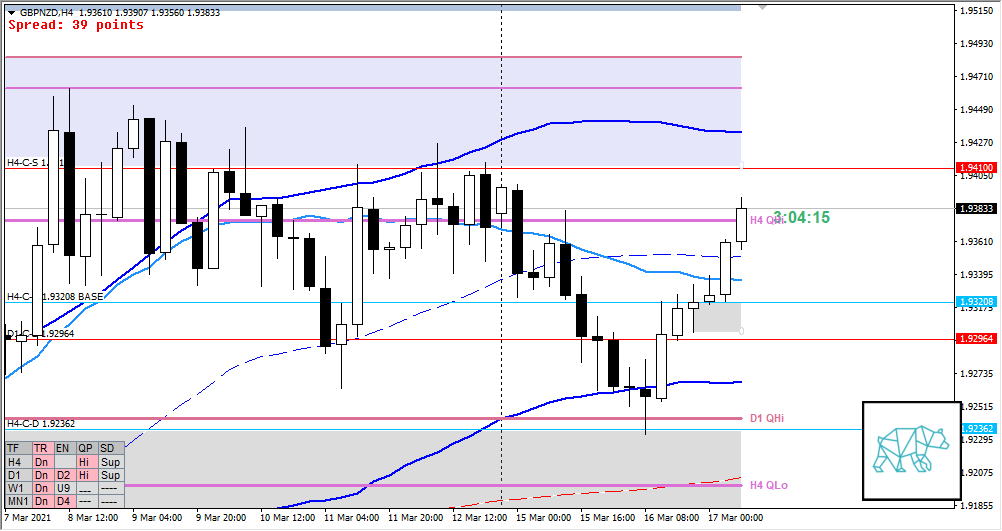

17 Mar Premarket Prep GBPNZD 20210317

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade the main account

- Focus on time-based exits

- Don’t look at M5 chart unless within the last hour of trading window

Compared against Weekly Trading Plan

- Price trading within last week’s body

Non-conjecture observations of the market

- Price action

- D1 hammer (although a slight selling wick present) after reacting off D1 VWAP in UT

- H4 Bull Engulf after reacting off H4-C-D1.92362 with continuation higher returning to H4-C‑S 1.93372 with some reaction although still trading higher currently testing H4 VWAP.

- Premarket: Took out H4-C‑S 1.93372 trading higher

- Trend: H4 Down, D1 Down, W1 Down

- Market Profile

- Values in DT

- ADR: 1162

- ASR: 899

- Day

- Yesterday’s High 1.93324

- Yesterday’s Low 1.92330

Sentiment

- Locations

- H4-C‑S 1.92964 within H4 QHi

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 0.9xASR

- Narrative

- Large Imbalance. Open sentiment might warrant a mean reversion after H4 has traded much higher. Price trading within H4 QHi could warrant this as well with trend being down. Although larger timeframe is still bullish until we have a significant close showing the opposite.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Mean Reversion / Swing Reversal

- Narrative: Open sentiment, price within H4/M30 QHi,

- Preferred: Strong Bearish price action, IB extension down with sustained auction. Low/medium initiative perhaps due to lots of LTF demands.

- Con: Larger timeframe still bullish

- Hypo 2 — Trend Continuation

- Narrative: Larger timeframe bullish sentiment

- Preferred: Strong bullish price action, IB extension up with sustained auction

- Con: Supply overhead

Additional notes

- FOMC later today. Extra caution is advised.

ZOIs for Possible Shorts

- H4-C‑S 1.93372

- D1-C‑S 1.92964

ZOIs for Possible Long

- H4-C‑D 1.93208 BASE

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING