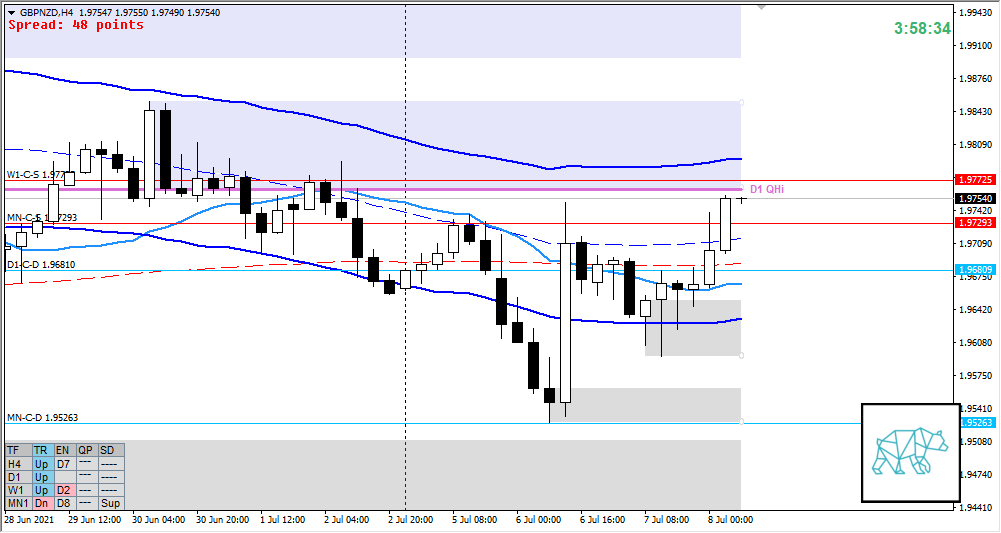

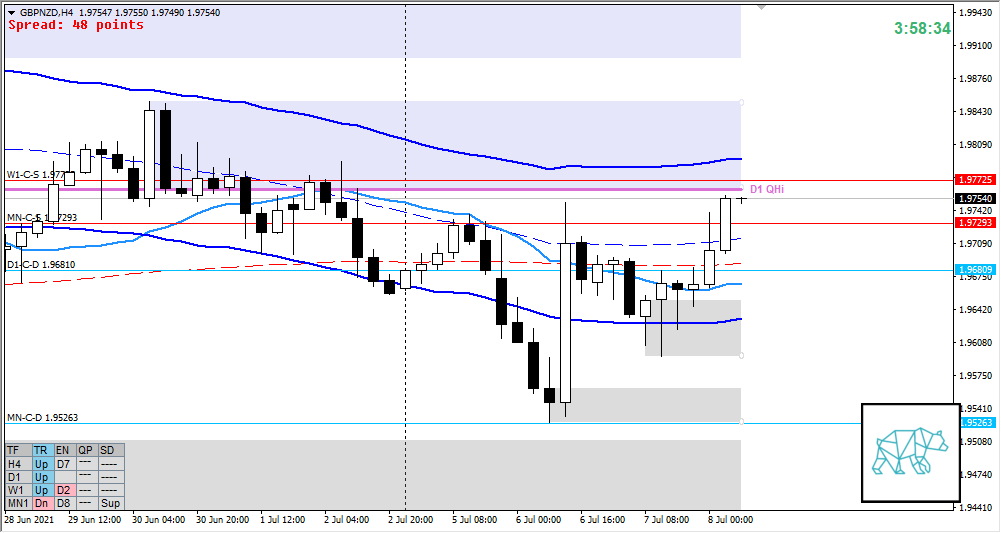

08 Jul Premarket Prep GBPNZD 20210708

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading above last week’s body but within range

Non-conjecture observations of the market

- Price action

- Possible D1 RBR in the making following yesterday’s Hammer

- H4 consolidation and break higher giving H4-C‑D 1.96674 closing deeper into Supply.

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is UP 3/3

- Market Profile

- Value created extended below with yesterday’s value created above it.

- Daily Range

- ADR: 1182

- ASR: 862

- 22

- Day

- Yesterday’s High 1.96945

- Yesterday’s Low 1.95940

Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1.32xASR

- Narrative

- Large imbalance. FF traded higher taking out D1 supply but running into the next. Trend is UP.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- Mean Reversion, sustained auction down

- Hypo 2

- Return to Value, Auction Fade Long

- Hypo 3

- Failed Auction Long, if mean reversion doesn’t work out in the first 2 hours

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- W1-C‑S 1.96876

- MN-C‑S 1.97293

ZOIs for Possible Long

- MN-C‑D 1.95263

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING