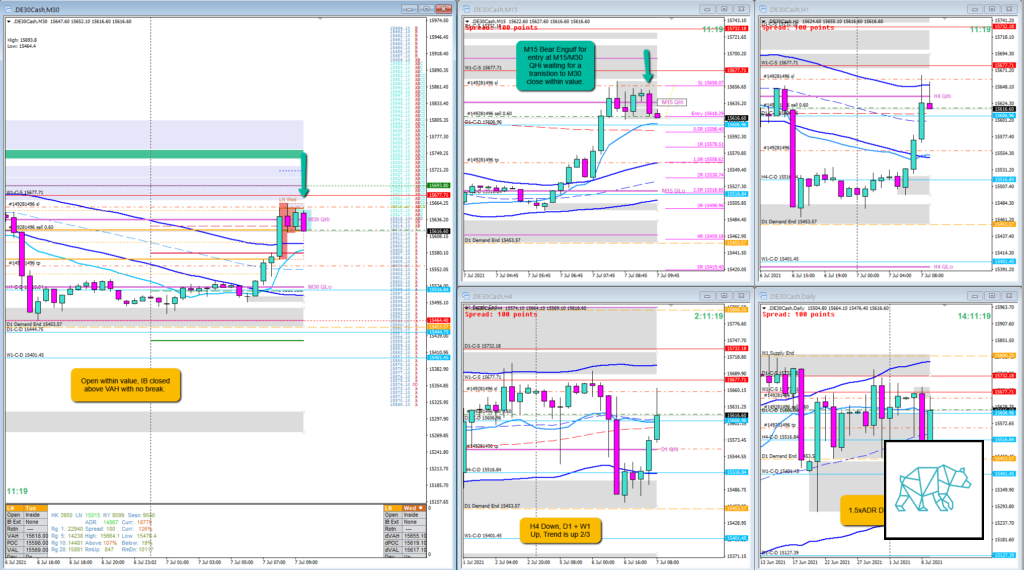

Play: M30 QHi Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Market Narrative

Previous day traversed 1.5xADR down. Expectancy is for this day to trade higher. Which it did during FF and IB (which opened within Value). A closed above VAH followed by some meandering without breaking IB confirming the value rejection. After price had already retraced most of the previous day’s range price halted at W1 Supply after exhausting ADR.

How was the Entry?

Price traded at M30/M15 QHi and at 1st DTTZ, D TPO there was a M15 Bear Engulf closing below the QHi. The plan was to wait for a transition into a M30 Bear Engulf closing within value.

How was the SL placement and sizing?

Standard SL size.

How was the profit target?

I was aiming for a 1R+ target at IB Low even though it wasn’t a failed auction

How was the Exit?

Exit was good as M30 failed to close within value so I expected this consolidation above VAH to take price higher. Which it did. ‑0.3R.

What would a price action-based exit have done for the trade?

-0.3R

What would a time-based exit have done for the trade?

-1R

What did I do well?

I did well to try and take the trade as well as staying objective.

What could I have done better?

I did very well here.

Observations

On responsive days we can us swing highs/lows together with ADR/ASR exhaustion for a possible reversal.

Failure to close within value is a counter move to the trade.

Missed Opportunity

N.A.

TAGS: Open Within Value, Prev. Day Exceeded ADR, Trend is up 2/3,

Premarket prep on the day

Daily Report Card on the day