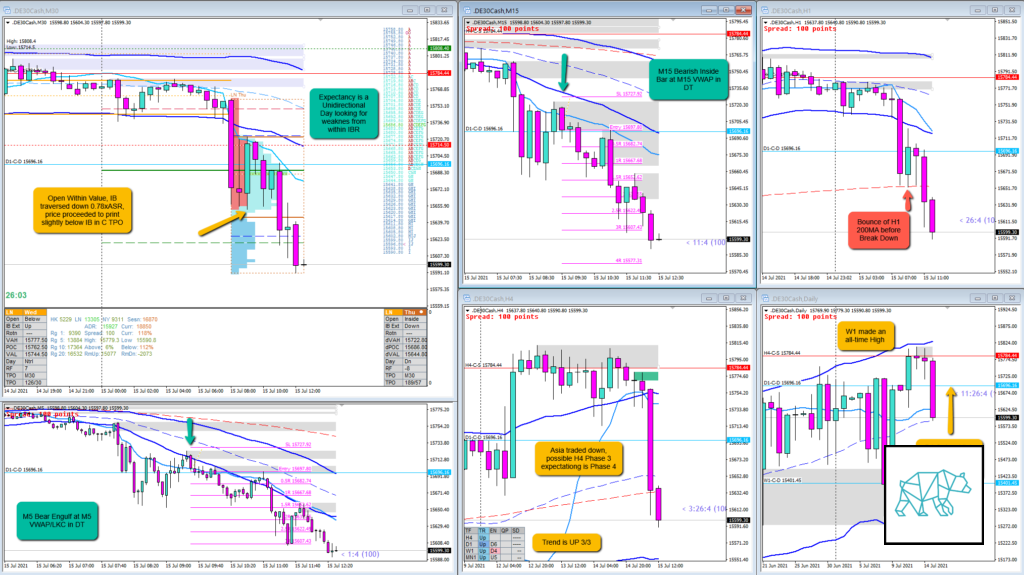

Play: Unidirectional Day Weakness from within IBR, Value Rejection Down

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

Asia traded down and continued during London’s IB. IB traversed 0.78xASR down after it opened within value. W1 had made an all-time high but then faltered. D1 Closed down with a weak D1 Three Outside Down. Possible H4 Phase 3 so expectations favor a transition to H4 Phase 4.

I missed the trade because I was forward testing the narrative as I don’t have much experience on this. That, but also because C closed as a technical failed auction through a Bull Engulf closing within IB.

What would have been the Entry?

Trade 1

DTTZ: 1st DTTZ

Entry Method: M15 Bearish Inside Bar at M15 VWP in DT / M5 Bear Engulf at M5 VWAP/LKC in DT

How was the SL placement and sizing?

Trade 1

SL placement: About standard size SL would have been nicely above the M15 formation

How was the profit target?

Trade 1

Profit target: 1.4R at IB low, trade eventually went up to 3.7R

What would a price action-based exit have done for the trade?

Trade 1

Exit: There was a M15 Bull Engulf after testing IB low that could have been an exit at 0.2R. Although due to the bearish sentiment this could be negated as price just tested newly formed M15 supply and continued down reaching 2R.

What would a time-based exit have done for the trade?

Trade 1

Exit: 2.1R, 3.7R in overlap noise

TAGS: All-time High, open within value, weakness from within IBR, Trend is UP 3/3, possible H4 Phase 3, Asia traded down,

Extra Observations

Expecting a unidirectional day we can look for weakness from within IBR

Premarket prep on the day

Daily Report Card on the day