Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

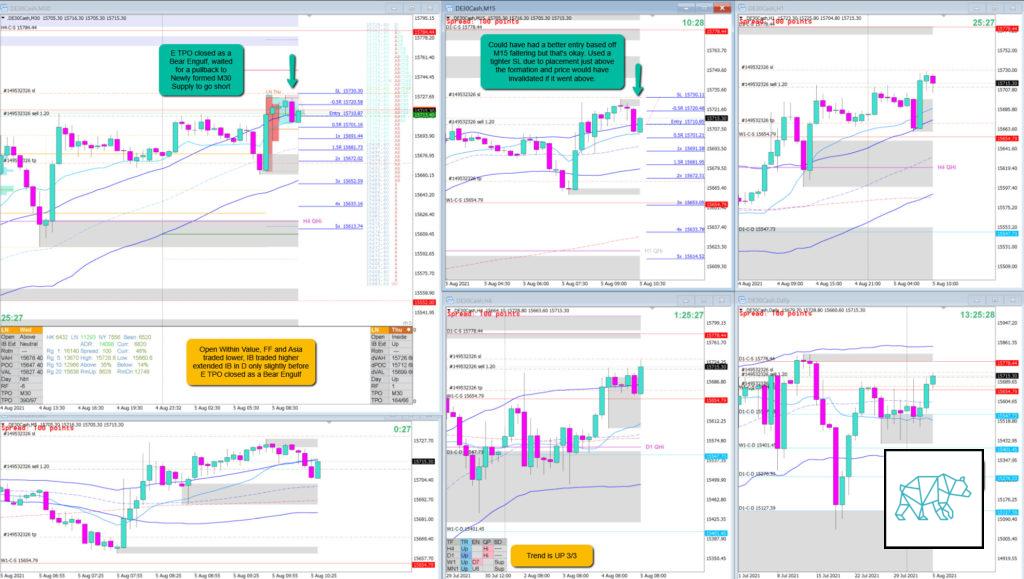

There was an open within value which is more conducive to a failed auction. D ducked above IB slightly before failing the auction in E TPO closing as a Bear Engulf.

How was the Entry?

After I cut off my first trade (bad trade idea) on the close of E TPO, I waited for a slight pullback to newly formed supply. This was off the M30 Bear Engulf before going short. This was great.

How was the SL placement and sizing?

SL placement was tighter due to not needing a large SL as it was placed just above the formation. If price had moved higher to this level it would have invalidated my trading idea anyway.

How was the profit target?

2.6R at IB Low. 1.7R at M30 demand at IB low / VAH

How was the Exit?

Exit was okay as I had a previous loss and price traded at M5 LKC nearby 200MA as well as H1 demand. I took 1.2R. Price didn’t really extend much further down afterwards anyway.

What would a price action-based exit have done for the trade?

Time-based would have overruled. 1R. 1.2R at Overlap noise.

What would a time-based exit have done for the trade?

1R. 1.2R at Overlap noise.

What did I do well?

I did well to stay clear-headed after taking a loss. Understand the situation and wait for a pullback to get a better entry before getting involved. Then I did well to let the trade work because it took some time for the trade to make its move. When it did I let it go on a bit before hitting a LTF exit signal.

What could I have done better?

I did well here.

Observations

N.A.

Missed Opportunity

N.A.

TAGS: Open Within Value, Trend is UP 3/3,

Premarket prep on the day

Daily Report Card on the day