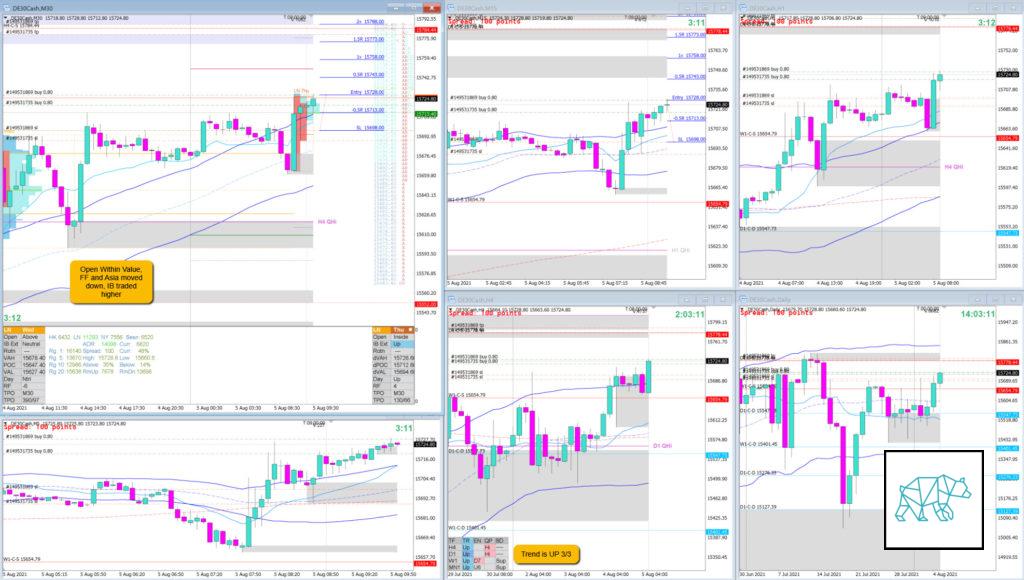

Play: Sustained Auction (Bad Trading Idea)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

There was a D1 Three Outside Up the day before which had potential for a continuation on this day. Especially considering the upward bias in equities. Although the preceding day had exceed ADR slightly. There was an open inside value which is never good for a momentum trade. Although due to the D1 Three Outside Up I went for it.

How was the Entry?

Entry was off a Buy Stop Order that got triggered upon break of IB. I had initially put it slightly higher but then lowered it. All good though because the trade idea was bad regardless.

How was the SL placement and sizing?

Standard size.

How was the profit target?

1.8R at the next significant supply.

How was the Exit?

I saw M15 faltering already but I thought perhaps it would be a low initiative activity day. This was one of those moments I should have listened to myself. I wanted a clear cut PA exit signal though since I’ve been known to grasshopper out of low initiative activity days where there is a slow sustained auction.

I closed it off the close of E TPO closing as a Bear Engulf for ‑0.7R.

What would a price action-based exit have done for the trade?

-0.7R

What would a time-based exit have done for the trade?

-1R

What did I do well?

Well, it was a bad trading idea. I guess it was good I tried the trade to solidify my knowledge of not taking momentum trades on open inside days.

What could I have done better?

I could have put the likelihood of a sustained auction as a lower probability hypo. Then waited for a sustained move first and joined the auction through a late-sustained auction entry.

Observations

Momentum trades on Open Inside Days are very suspect.

Missed Opportunity

N.A.

TAGS: Open Within Value, Trend is UP 3/3,

Premarket prep on the day

Daily Report Card on the day