Play: Failed Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

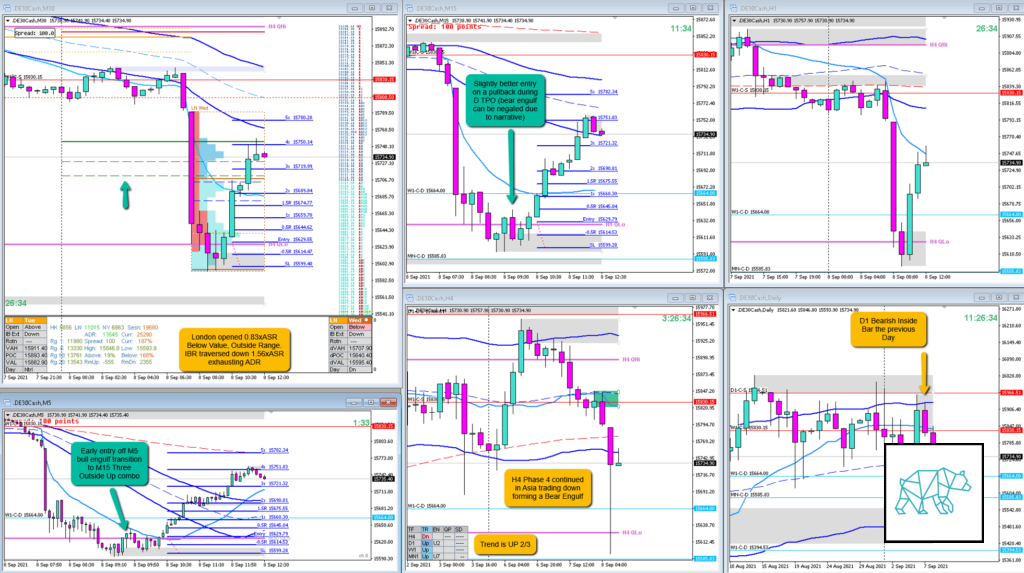

Previous day was a D1 Bearish Inside Bar. London opened 0.83xASR Below Value, Outside Range. IBR traversed down 1.56xASR. When London opened on a large imbalance price saw a continuation to the H4 Phase 4 and Asia Bear Engulf during IB. The wide IBR indicated a higher potential for responsive activity in for example a Failed Auction. IB also traded into W1 Demand after taking out D1 demand and exhausting ADR.

What hypo was it?

Hypo 2

Failed Auction Long

Due to the Huge IBR this was the most preferred play but as strength from within IBR was possible as well I had put that as Hypo 1. It was the most preferable since it is much clearer when price probes outside of IBR and then failed to find business outside of it for a sustained auction. Much clearer.

How was the Entry?

Entry was good. I used a M5 Bull Engulf as my guide and waited for M15 to close bullish which came as a Three Outside Up. Then entered on a slight pullback. I then let the trade develop and waited for a transition to M30 Bull Engulf officially failing the auction which came by the close of E TPO.

How was the SL placement and sizing?

SL placement was slightly bigger than standard SL size but within the margins of 10–11%. I use FX synergy with standard SL sizing and pick the nearest one to the one I need. In the end this kind of helped me I think because price retraced missing my SL by a few pips before moving higher.

How was the profit target?

Due to the Wide IBR I was somewhat worried if 2R was possible. The wide IBR indicates responsive activity and as such a slightly quicker profit can be taken. Although due to the strict rules I am under I had no choice to see if my 2R target would get hit. And oh boy did it get hit and then some. Trade eventually made it to 4.2R before reversing in line with Hypo 3.

How was the Exit?

2R target reached

What would a price action-based exit have done for the trade?

Technically the M15 Bear Engulf could have thrown me out for ‑0.6R but understanding that the narrative was still valid would’ve overruled the early exit.

What would a time-based exit have done for the trade?

3.4R at Normal Cut-off. 3.6 at Overlap Noise Cut-off. ‑1 at end of day which wouldn’t have been as target was already hit.

What did I do well?

I did well to understand the narrative and filter out the noise of a developing D1 Three Inside Down Narrative which ensued later on. I did well to understand that because of that narrative my hypo 3 weakness from within IBR was highly probable as well. Then I did well to take the trade and not touch it until price reached my target.

What could I have done better?

I did well on this trade. Can’t think of something I could’ve done better. Maybe I could’ve gotten a better entry waiting for a test of M5 demand before entering as the first M5 bull engulf after a big drop is rarely the immediate precursor to a reversal. Usually there is 2 or 3 before the actual reversal comes around. Ah well. I identified the reversal zone and found an okay risk/reward opportunity and that’s that.

Observations

Based on the timeframe there can be two (or more) contradicting narratives playing out. This is key to understand. A move higher on a lower timeframe can just merely be a pullback on a higher timeframe. It is up to you to identify and synch up with that. This all comes with screen time my friend. That and Process, Patience, Persistence.

Missed Opportunity

Weakness from IBR according to Hypo 3. In the overlap noise price reversed and I could’ve taken that trade but I wasn’t at home when it happened.

TAGS: Below Value, Outside Range, Large Imbalance, Wide IBR, ADR exhaustion, Trend is UP 2/3,

Premarket prep on the day

Daily Report Card on the day