08 Sep 20210908 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

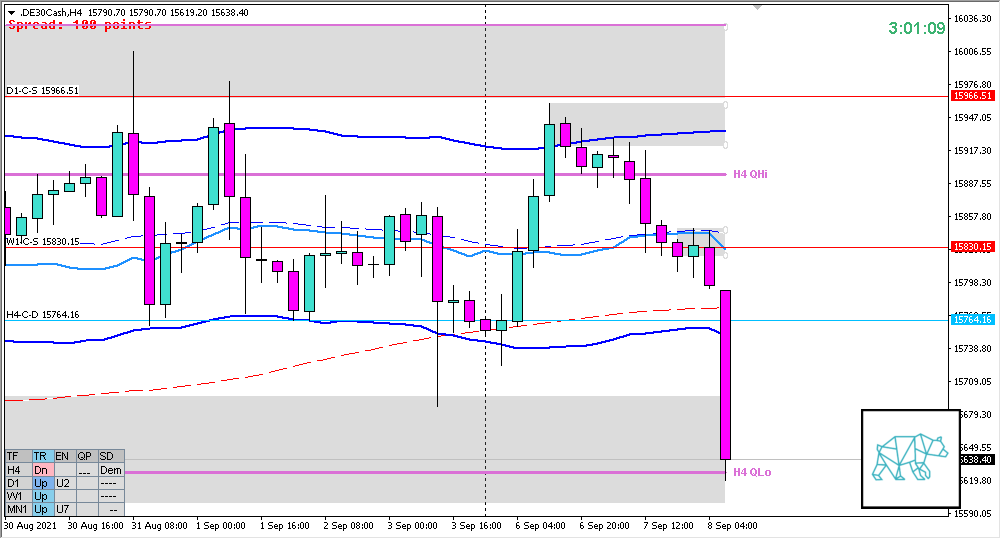

- Price tested W1 Supply and started reacting and is currently trading within last week’s body after failing to make a HH (still early in the week though)

Non-conjecture observations of the market

- Price action

- D1 Bearish Inside Bar at W1 Supply closing at D1 demand

- H4 Phase 4 coming from H4 QHi rejection with no arrival at QLo (yet) trading mid swing

- Trend: H4 , D1 , W1

- Prevailing trend:

- Market Profile

- Value created above bracketing range 2 days in a row with price currently trading below

- Daily Range

- ADR: 13545

- ASR: 11015

- 2750

- Day

- Yesterday’s High 15928.30

- Yesterday’s Low 15808.50

Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.83xASR

- Narrative

- Large Imbalance. IBR traded down 1.56xASR taking out D1 demand arriving at H4 QLo. Price trading at W1-C‑D 15664.00 (coinciding with W1 VWAP in UT)

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Strength From Within IBR

- Hypo 2

- Failed Auction Long

- Hypo 3

- Weakness from within IBR, variation to Hypo 1, 2

- Hypo 4

- Unidirectional Day as Asia traded down as well, sustained auction down (risky)

Additional notes

- N.A.

ZOIs for Possible Shorts

- Not favored in equities

- D1-C‑S 15966.51

- W1-C‑S 15830.15

ZOIs for Possible Long

- W1-C‑D 15664.00

- MN-C‑D 15585.83

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments