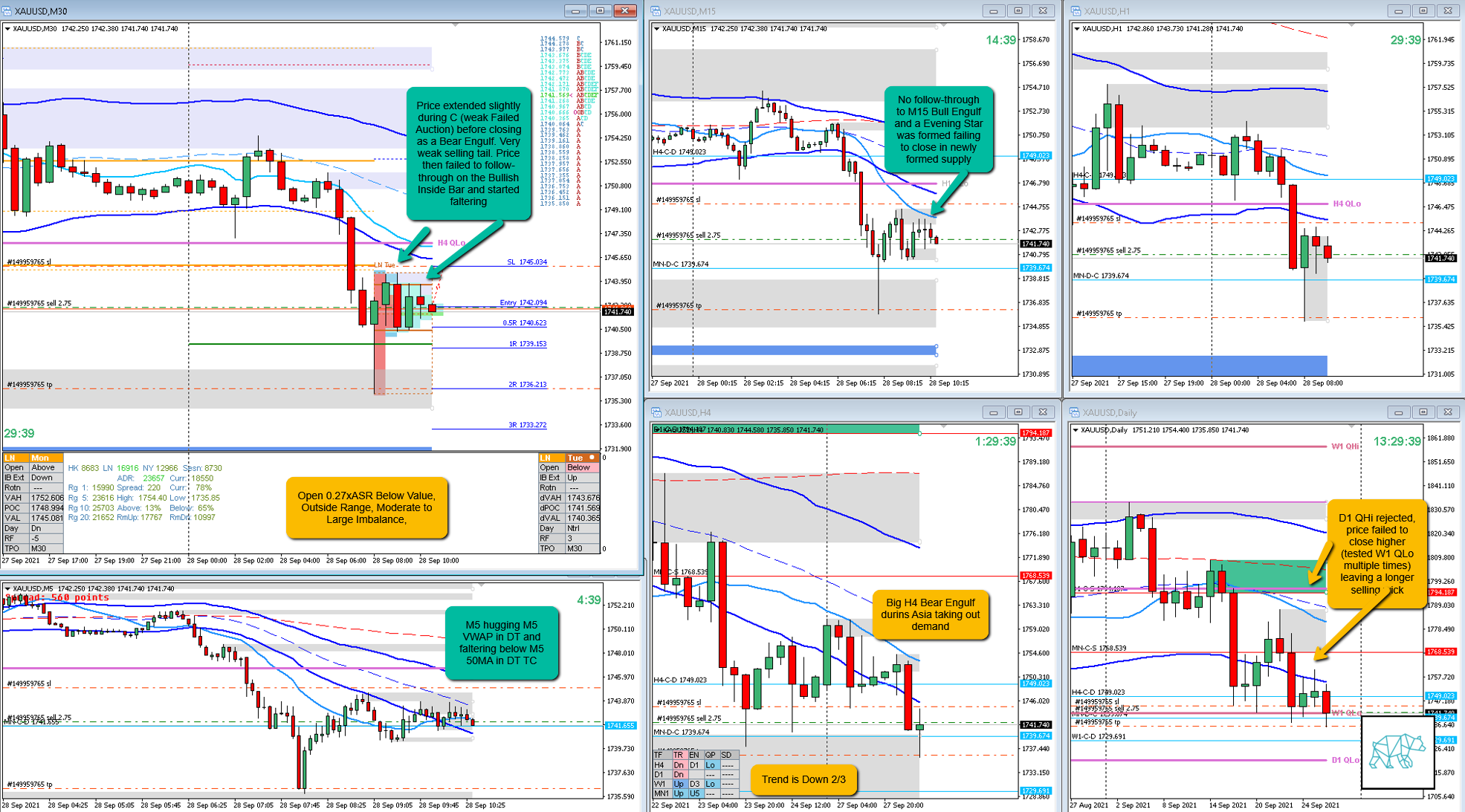

29 Sep 20210928 Trade Review Gold

Play: Value Edge Reversal / Failed Auction Hybrid

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 2R

- Product

- Gold

- Open Sentiment

- Open 0.27xASR Below Value, Outside Range, Moderate to Large Imbalance,

- IBR

- 0.53xASR

- Hypo

- 1

- Return to Value, Failed Auction Short

- Attempted Setup

- Failed Auction / Value Edge Hybrid. I believe this is a Value edge reversal using the auction process as a confirming factor as price hadn’t extended much in C TPO making it not the best Failed Auction setup.

- Entry Technique

- M15 faltering below newly formed supply after M30 had formed a Bear Engulf, M15 Evening Star for entry.

- SL placement

- 30 pip SL. Tighter than allowed 42 pips standard SL due to scaling to accommodate a 2R target at IB low as well as SL placement being above IB.

- TPO period for Entry

- F TPO

- Trade Duration

- 1h15m

- Long/Short

- Short

- Leading Narrative

- Larger timeframe Bearish Sentiment. Price had taken out newly formed demand. Price opened below value, outside range although not far so on moderate to large imbalance. Bear Engulf was formed after a slight extension above IB then failed to close above IB and price started faltering.

Actual Development

Price continued and closed down forming a M30 Three Inside Down. This was followed by an Inside Bar possibly signifying a continued move through DBD. This eventually came and hit 2R target.

Good points

- That I understood the narrative and executed based on it

- That I didn’t let the weak selling tail bother me and underwood it was more of a value edge reversal with the failed auction as a enhancing factor.

Bad Points

- I could have included a value edge reversal in my hypo

- I could’ve included a sustained auction as hypo 4 — the reason I didn’t do is because at the time of writing price had already extended slightly above IB). If that wasn’t the case a sustained auction would’ve been valid to include.

Next Day Analysis

- Target hit?

- Yes, 2R

- Time-based Exit?

- 2.9R

- Overlap Noise?

- 3.1R

- End of Day?

- 3R

- Highest R multiple?

- 4.8R

TAGS: Below Value, Outside Range, Moderate to Large Imbalance,

Premarket prep on the day: