14 Nov 20211112 Trade Review Gold

Posted at 10:11h

in Auction Fade, Gold Trade Review, Late-Sustained Auction Entry, Sustained Auction, Trade Reviews

0 Comments

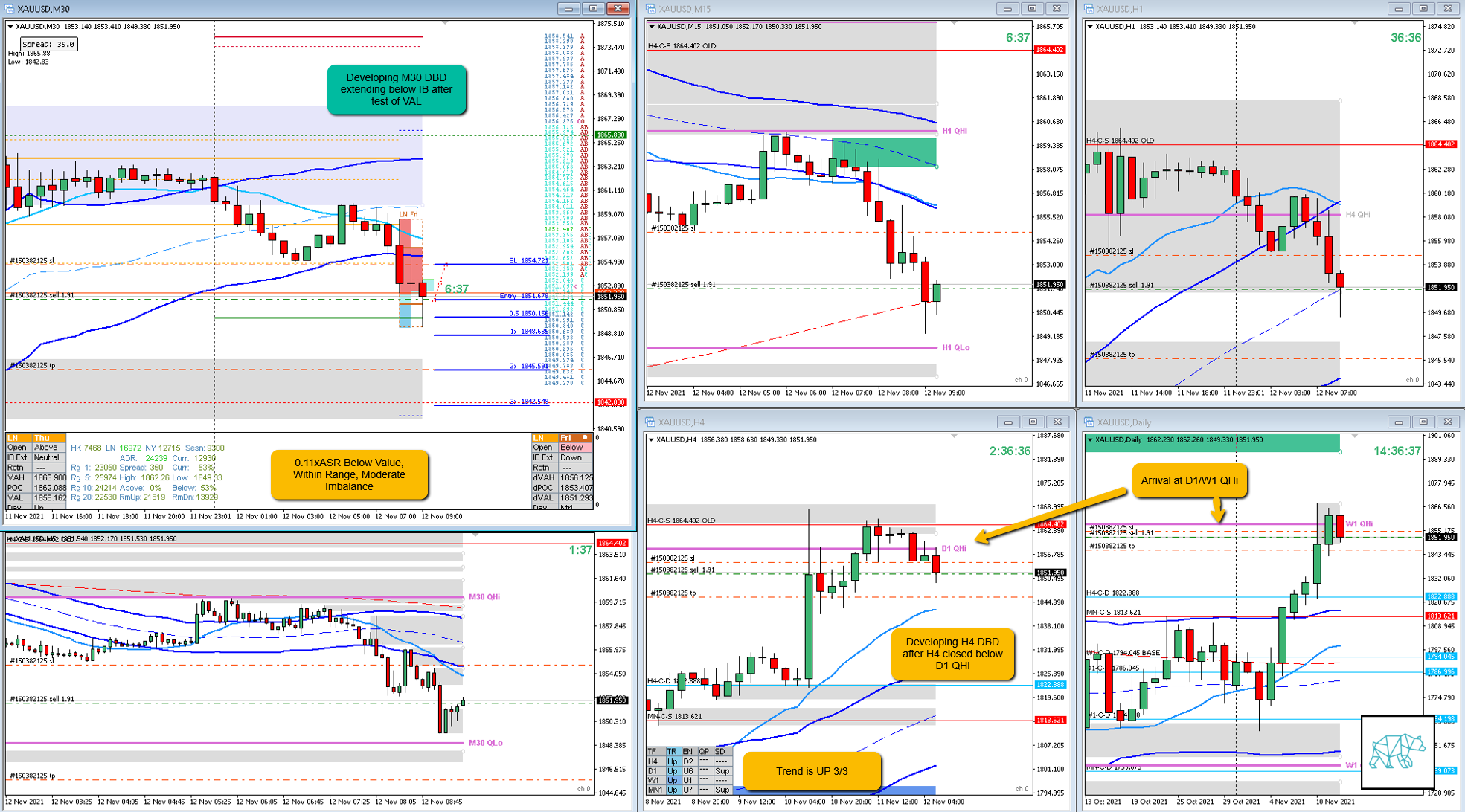

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 2R

- Product

- Gold

- Open Sentiment

- 0.11xASR Below Value, Within Range

- IBR

- 0.37xASR

- Hypo

- 3

- Sustained Auction Short

- Attempted Setup

- Sustained Auction

- Entry Technique

- Pullback to IB edge to join the sustained auction

- SL placement

- Tighter SL well above entry candle 30 pips

- TPO period for Entry

- C TPO

- Trade Duration

- 1h22m

- Long/Short

- Short

- Leading Narrative

- Arrival at W1/D1 QHi

- Open below value, within range, sentiment

- Friday profit-taking

Actual Development

C TPO closed below IB but with longer buying wick. D TPO closed as a Bullish Inside Bar with a short selling wick technically failing the auction. However, due to the D1/W1 and Friday profit-taking narrative it proved be a base as E TPO closed as another drop. Continued in F TPO before reversing.

Good points

- Going against the strong uptrend due to open sentiment and time of day/week

- I didn’t enter on break of IB but waited for a re-test of IB edge (approximately) before entering. I have this tendency to let a trade go when I think there was a better entry (in hindsight I was wrong about this early entry during IB). What was good that I still took the trade afterwards.

Bad Points

- Not taking the Auction Fade trade afterwards with supporting H4 demand due to only 1+R profit target. I know I should just focus on 2R trades but as I was stalking the trade I thought I could’ve pulled the trigger on it. The trade would’ve hit 2R but that is not the statistically viable target for an Auction Fade. In hindsight I am thinking that this wasn’t an Auction Fade setup rather a reversal at demand level and using the auction fade within OODA loops to monitor the trade.

Next Day Analysis

- Target hit?

- Yes, 2R

- Time-based Exit?

- 1.1R

- Overlap Noise?

- -0.3R

- End of Day?

- -1R

- Highest R multiple?

- 2.8R

TAGS: Below Value, Within Range, Moderate Imbalance, Trend is UP 3/3,

Premarket prep on the day: