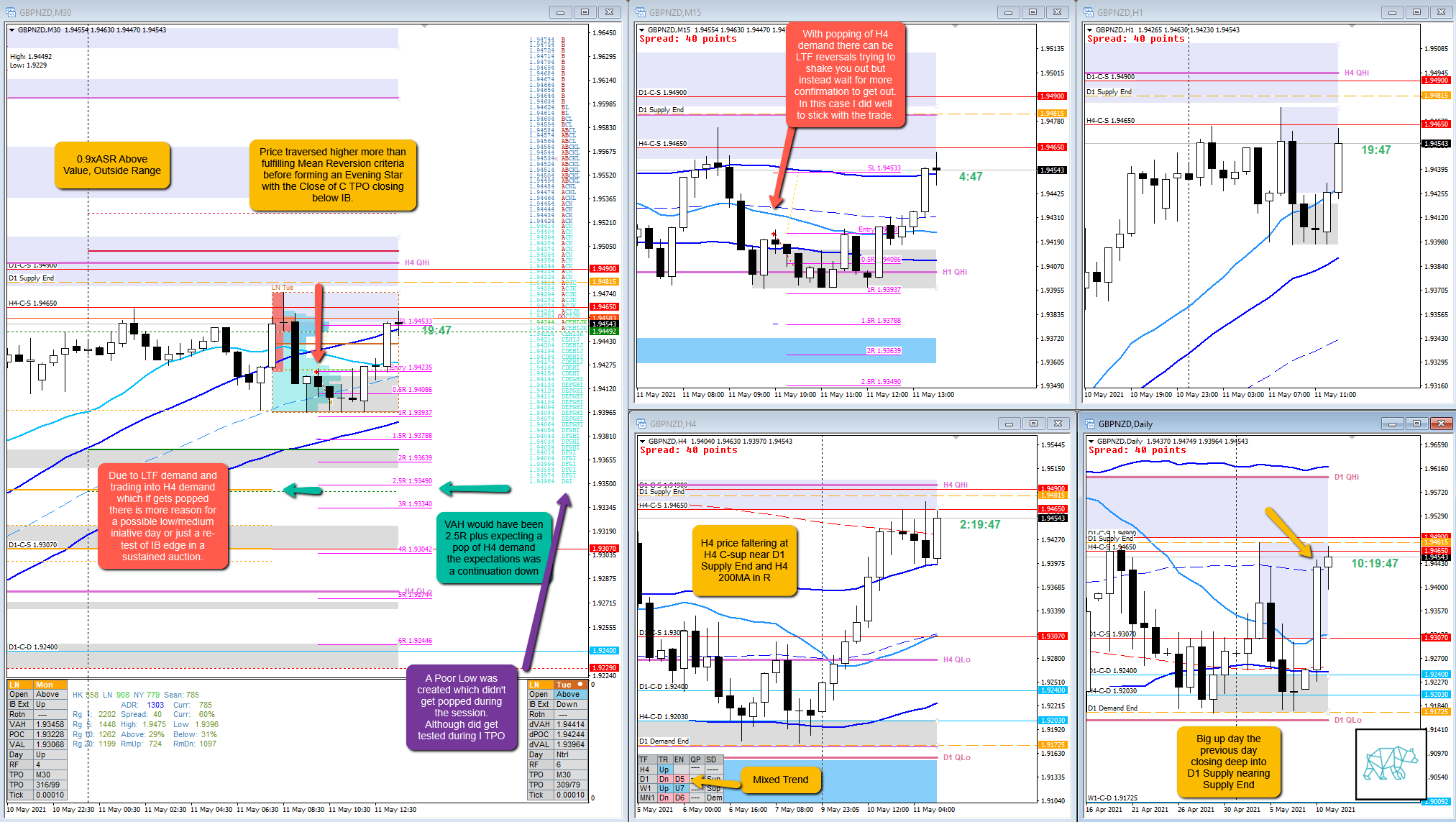

11 May 20210511 Trade Review GBPNZD

Play: Mean Reversion

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Here I rewatch the screen recordings of the trades I took to see if I could have done anything better.

How was the Entry?

There was a large imbalance at the open which even extended higher above value, outside range before forming an Evening star and extended below IB. Extension of IB could have been my entry but I felt like I wanted more confluence and a better price entry.

I had initially put in a Sell Limit Order ⅓ of the range in C for a possible pullback but this never came.

Thus I visualized a potential popping of LTF and H4 demand and consequent little bounce to IB edge low for a late-sustained auction entry. I placed a Sell Limit Order at IB low and sure enough D closed as a Hammer (terrible reversal pattern) and E hit my order ever slightly before continuing down.

Odds enhancer: large imbalance, above value, outside range, IB Extension Down, H4 demand popped, Late-sustained auction entry, Sell Limit Order, M30 Hammer, mean reversion,

How was the SL placement and sizing?

Due to having the same entry as a momentum trade I deem it to be good. Entry was at x.xx23 with SL at x.xx53.

How was the profit target?

VAH would have been 2.5R and expecting H4 demand to get taken out there would be ample room for the trade to move.

How was the Exit?

I’m fine with my exit. It was getting close to making a new low (as well as 1R target) and I gathered that by doing so it would need to take out M15 Demand and thus there might be another short term bounce from there as there was low/medium initiative in the intended direction (later I find out there was no intention in that direction at all). I decided almost to my target was good enough and took profits. I did well here as I stuck with the trade longer and pocketed more.

What would a price action-based exit have done for the trade?

0.6R through a M15 Bullish Inside Bar at 2nd DTTZ

What would a time-based exit have done for the trade?

0.6R

What did I do well?

I did well to stalk the opportunity. Visualize what I wanted to see before taking an entry. Let the market come and hit my Sell Limit Order based off a late-sustained auction entry.

What could I have done better?

Took 0.8R profit. I think I did well today. Based on the market narrative I visualized what I wanted to see and I acted on it when it developed. Then… I let the trade do its thing by monitoring the profile for LLs and a sustained auction. Gathering it was going to be a low/medium initiative activity day due to underlying LTF demand and popping of H4 demand, I stayed with the trade until it nearly hit my 1R target. Did well here although I do keep thinking at the time I expected the move to continue. Ah well. Progress, not perfection. Did well and on to the next.

Observations

When H4 SD area gets popped, price often sees a LTF reversal that might shake you out of a perfectly good trade.

Missed Opportunity

N.A.

Premarket prep on the day

Daily Report Card on the day

No Comments