09 Jun 20210608 Trade Review GBPNZD

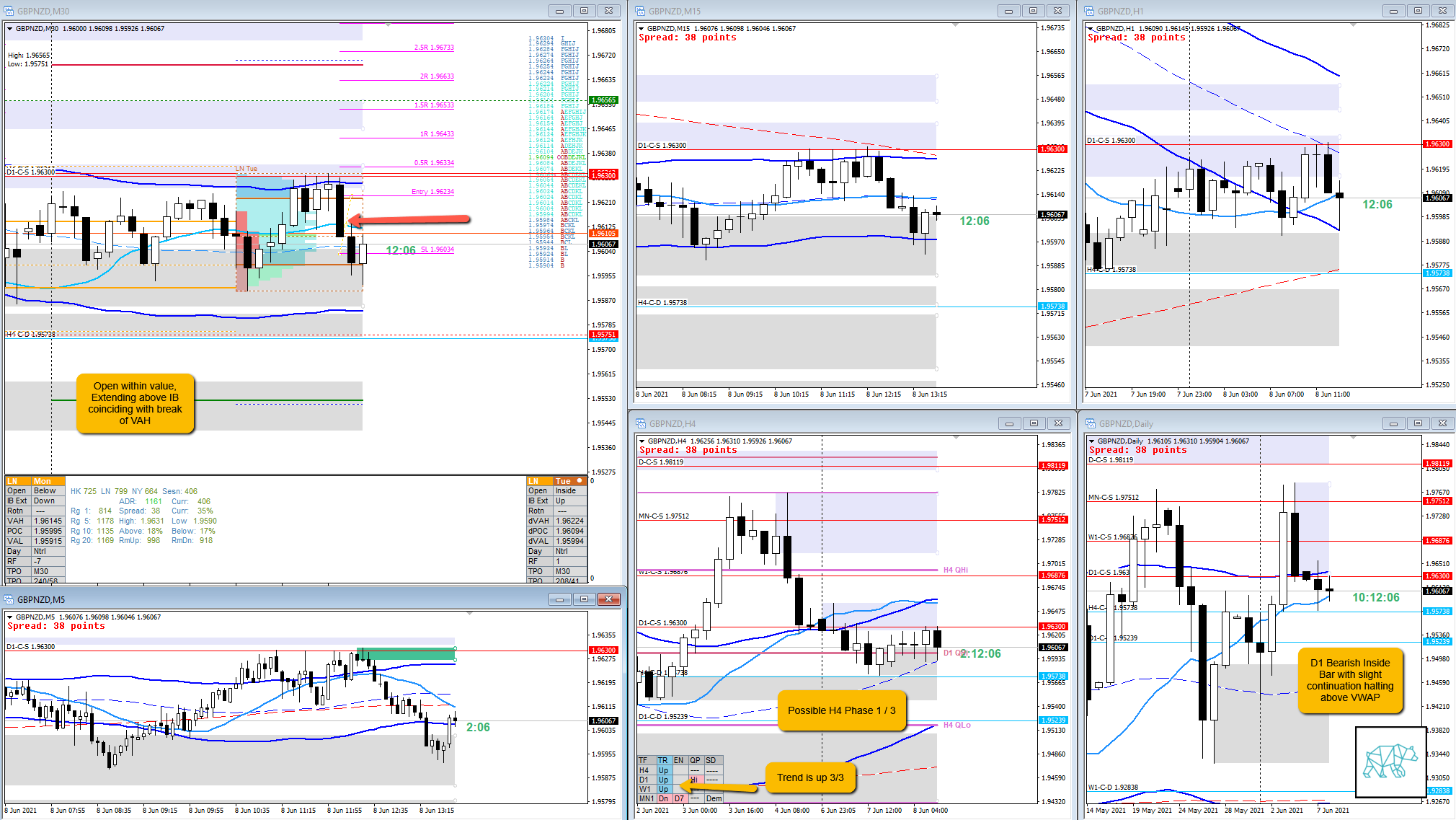

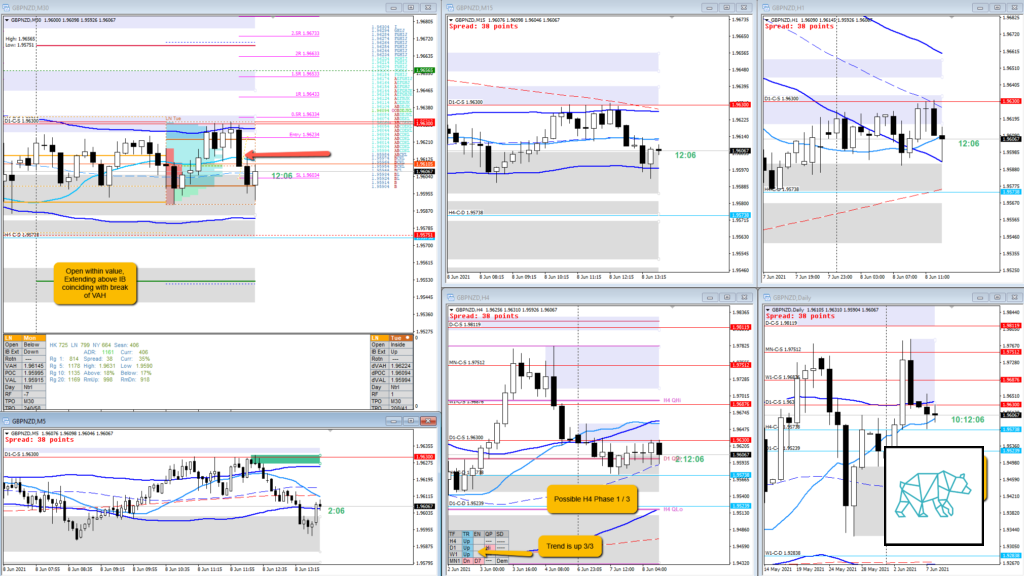

Play: Value Rejection

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Market Narrative

Price opened within value and there was no bracketing range. There was a possible H4 Phase 1 / 3 and not much continuation to the D1 Bearish Inside Bar as price halted above VWAP.

During IB price tested both VAH and VAL then proceeded to form a Bullish Inside Bar in C then a RBR finally extending in F confirming the value rejection. There was a D1 Supply right above which had been tested multiple times and along with D1 not showing a break away from D1 Bearish Inside Bar there could be upside potential and orderflow was backing this up.

How was the Entry?

Entry was off the break of IB with a market position. In times of low liquidity I have seen my buy orders get hit before a break of IB occurred and did not want to risk that.

How was the SL placement and sizing?

Due to the momentum nature of the trade the SL placement was good.

How was the profit target?

Not the greatest as D1 C‑sup was at 0.5R but the expectancy was for momentum to kick in with a sustained auction closing deeper into D1 Supply.

How was the Exit?

I apparently forgot to take a screenshot of the exit so did this later. FX synergy was still set to cut off trades automatically at 1pm London time and due to the 2–3 minutes difference between my computer and my broker the trade cut off midway during J TPO and saved me some money. Good job automation 🙂

What would a price action-based exit have done for the trade?

So due to looking at a sustained auction I decided to let the trade on as it could have been a low initiative day as TPO structure was kept building and closing above IB. Normally I would have taken the trade off at the first sign of a LTF reversal since it I held the trade into the overlap noise but held on to see if the auction was sustained after all. It felt good to go through the OODA loops and making ‘slower’ decisions as I am a grasshopper. It felt good to have a trade on. See it go against me and not feel bad about it as I was trying something new.

What would a time-based exit have done for the trade?

This would have netted 0.2R, 0.3R at overlap noise cutoff with a max of only 0.4R.

What did I do well?

I did well to take the trade and then I did well to stick with it.

What could I have done better?

I think I did well on this trade trying something new (going into overlap noise)

Observations

A poor high of 3+ TPOs probably possibly doesn’t bode well for a continuation in that direction. I will dub this very originally: Poor 3+ High/Low 🙂 so I can track it for my Playbook.

Missed Opportunity

N.A.

TAGS: Poor 3+ High/Low, Possible H4 Phase 1 / 3, Trend is up 3/3, Open within value,

Premarket prep on the day

Daily Report Card on the day