25 Jun 20210625 Premarket Prep Gold

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

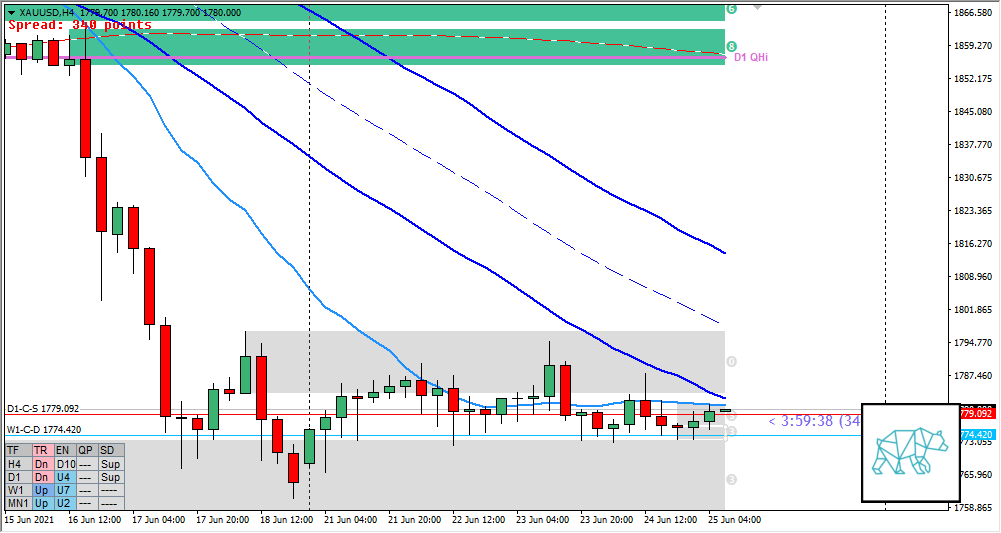

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price retraced to MN demand with slight reaction

- Price trading within last week’s range below VWAP

Non-conjecture observations of the market

- Price action

- D1 failed to close higher instead a slight DBD giving D1-C‑S 1779.092 with longer selling wicks

- D1/W1 demand tested 4 times

- H4 Phase 1 / 3, H4 Bull Engulf with slight continuation higher in premarket.

- Trend: H4 Down, D1 Down, W1 Up

- Prevailing trend: Trend is DOWN 2/3

- Market Profile

- 4‑day bracket

- Daily Range

- ADR: 26656

- ASR: 16464

- 412

- Day

- Yesterday’s High 1787.910

- Yesterday’s Low 1772.920

Sentiment

- LN open

- Open Within Value

- Open distance to value

- N.A.

- Narrative

- Balancing market. Open within value, 4‑day bracket. D1-C‑S 1779.092 at VAL. Although H4 closed higher but still trading below H4 VWAP. D1 did not close within demand (although tested multiple times) so could also be a possible D1 Phase 1 / 3

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- Failed Auction Short, open sentiment,

- Hypo 2

- Sustained Auction Short, value rejection,

- Hypo 3

- Auction Fade Short, trading within D1 Supply

- Hypo 4

- Sustained Auction Long, possible H4/D1 phase 1 above MN demand

Additional notes

- Capital preservation rule in effect

ZOIs for Possible Shorts

- D1-C‑S 1779.092

ZOIs for Possible Long

- W1-C‑D 1774.420

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments