07 Jul 20210707 Premarket Prep Gold

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading above last week’s body and range

Non-conjecture observations of the market

- Price action

- D1 Inverted Hammer reacting off D1 VWAP in DT

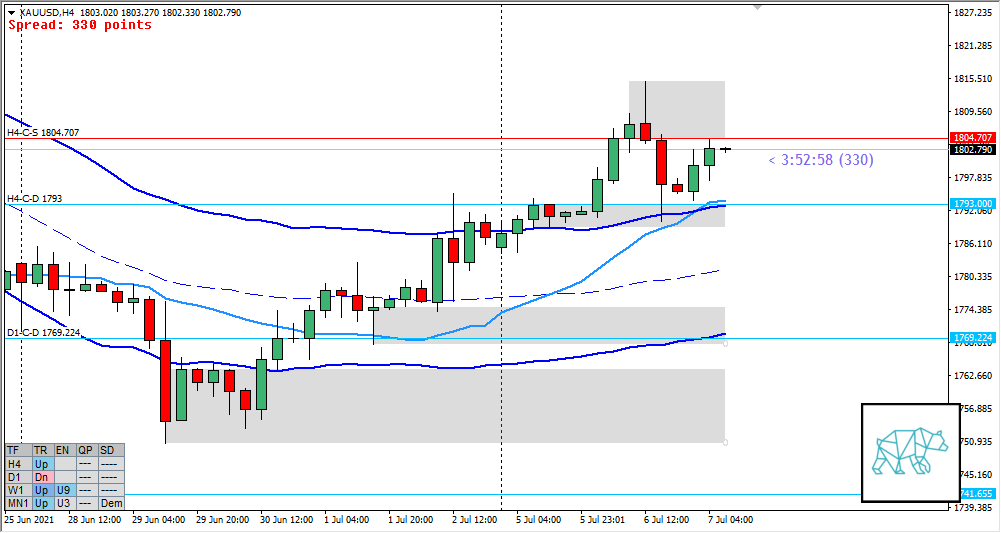

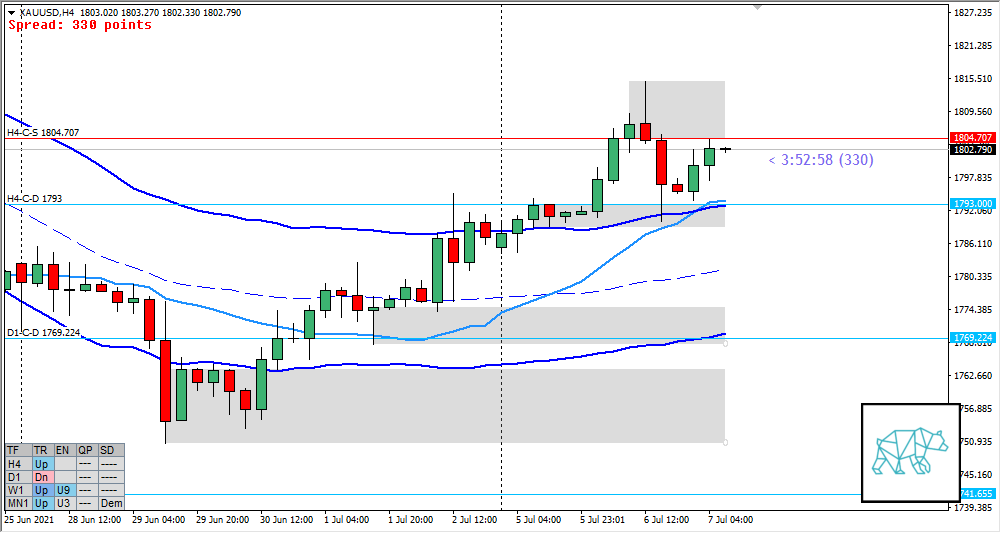

- H4 Bear Engulf giving H4-C‑S 1804.707 (at LN VAL) followed by no continuation instead a H4 Bull Engulf at previous demand H4-C‑D 1793

- Trend: H4 Up, D1 Down, W1 Up

- Prevailing trend: Mixed Trend

- Market Profile

- Values in UT although yesterday more extended 1xASR from the previous

- Daily Range

- ADR: 20916

- ASR: 12611

- 315

- Day

- Yesterday’s High 1814.890

- Yesterday’s Low 1790.010

Sentiment

- LN open

- Below Value, Within Range

- Open distance to value

- 0.17xASR

- Narrative

- Moderate Imbalance. D1 closed higher with an Inverted Hammer trading above last week’s body and range. W1 QHi was rejected and no arrival at QLo (yet). Price currently trading in the middle of W1/D1/H4 Swing. H4 supply at VAL. FF traded slightly higher.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- Reversal at VAL, possible probe of value

- Hypo 2

- Value Acceptance, value not wide plus supply making for subpar TP

- Hypo 3

- Failed Auction short

- Hypo 4

- Auction Fade Short, variant to Hypo 2

Additional notes

- Capital preservation rule in effect

ZOIs for Possible Shorts

- W1-C‑S 1888.863

- H4-C‑S 1804.707

ZOIs for Possible Long

- H4-C‑D 1793

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments