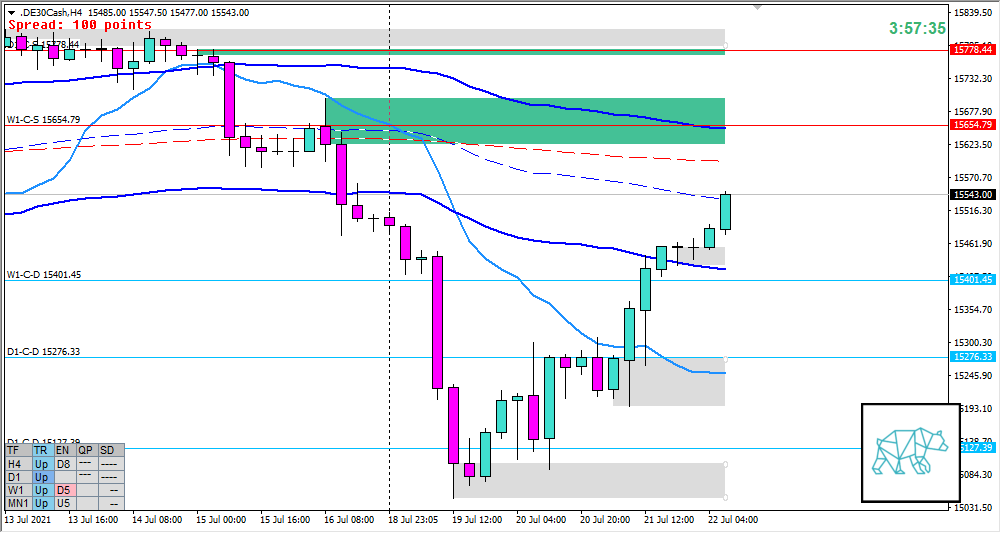

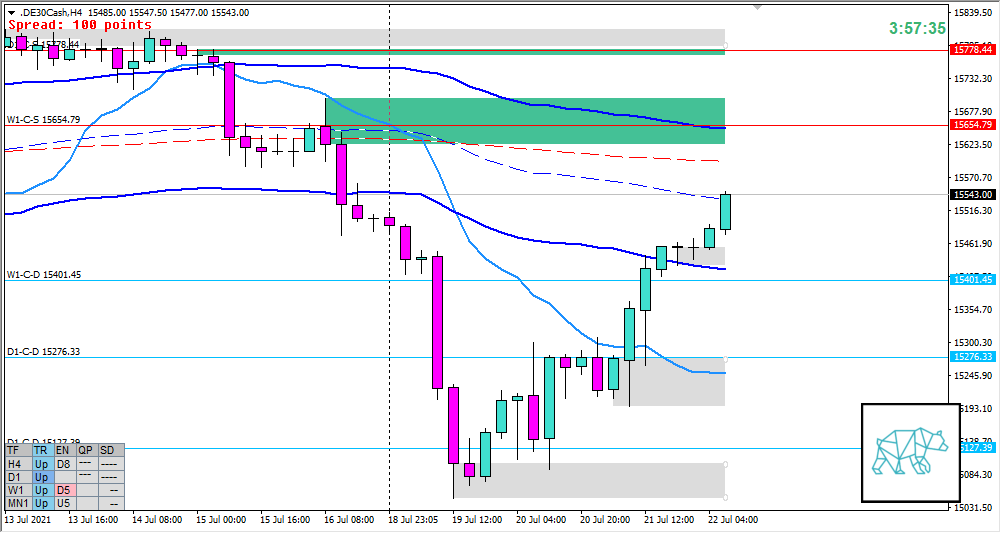

22 Jul 20210722 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- MN made a LL but is currently trading within last month’s body again

- Price trading below W1 Bear Engulf with continuation lower followed by a reaction off W1 VWAP in UT trading above W1 demand.

Non-conjecture observations of the market

- Price action

- D1 Three Inside Up giving D1-C‑D 15276.33 reacting off D1-C‑D 15127.39 with yesterday having traversed 1.32xADR

- H4 consolidation and Break out from H4 VWAP in DT, currently consolidating at a previous H4 base level.

- Trend: H4 Down, D1 Up, W1 Up

- Prevailing trend: Trend is UP 2/3

- Market Profile

- Value created above the previous but still within the range of the 2‑day range

- Daily Range

- ADR: 20197

- ASR: 16727

- 4182

- Day

- Yesterday’s High 15463.20

- Yesterday’s Low 15195.50

Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 0.72xASR

- Narrative

- Large Imbalance. Price opened above yesterday’s high. H4 consolidation breaking higher. IB traversed higher, taking out an old H4 Base supply level currently hitting D1 QHi. Yesterday’s range exceeded x1.32ADR although possible upward pressure through D1 V‑shaped correction.

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Mean Reversion, possible reversal within IBR, less likely a Failed Auction Short

- Hypo 2

- Trend Continuation, sustained auction long, possible pullback from within IBR, risky due to trading at D1 QHi and W1/D1 Supply

- Hypo 3

- Auction Fade Short, variation to Hypo 2

- Hypo 4

- Auction Fade Long, variation to Hypo 1

Additional notes

- Capital Preservation Rule in effect

ZOIs for Possible Shorts

- Not favored in equities

- W1-C‑S 15654.79

ZOIs for Possible Long

- W1-C‑D 15401.45

- D1-C‑D 15276.33

- D1-C‑D 15127.39

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments