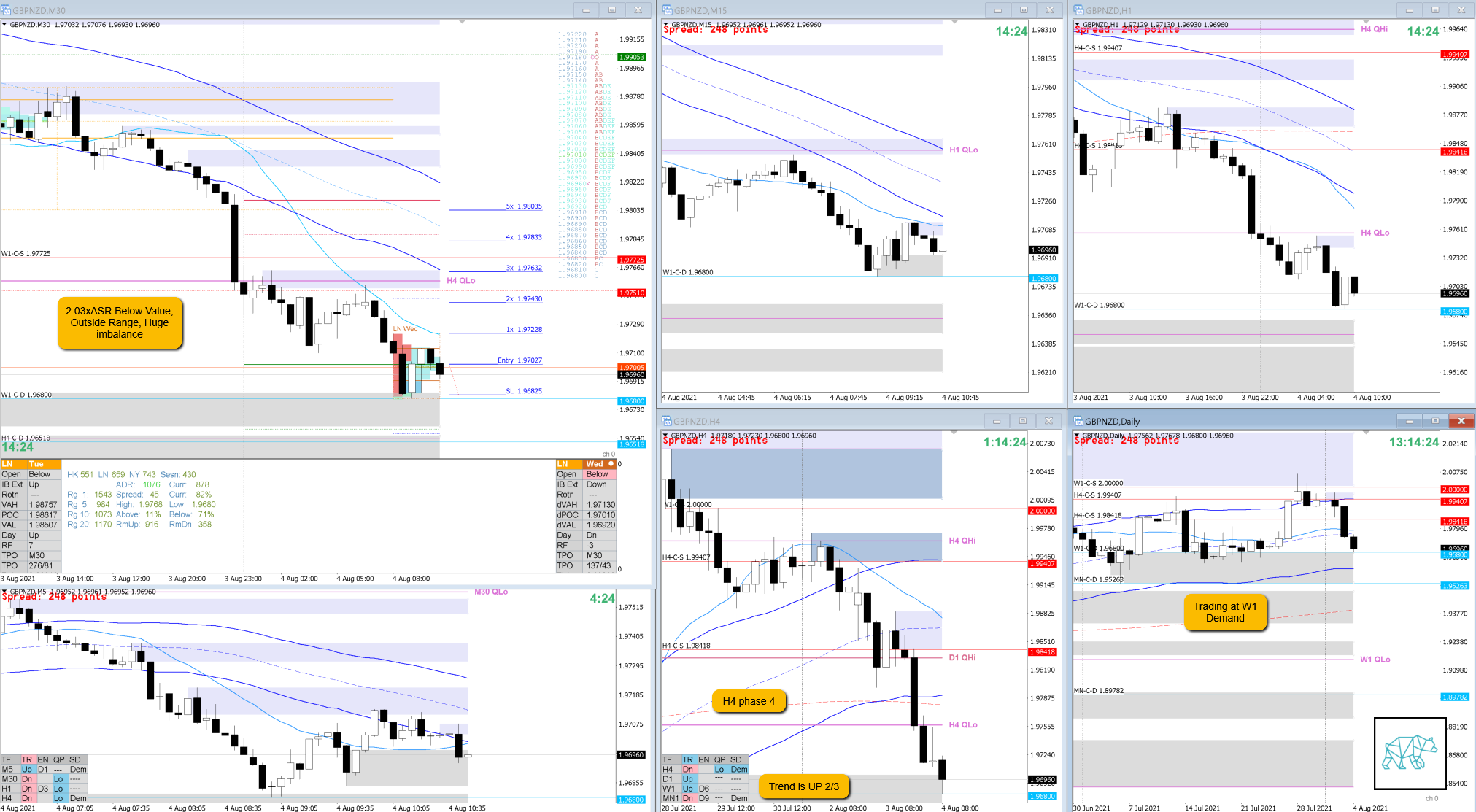

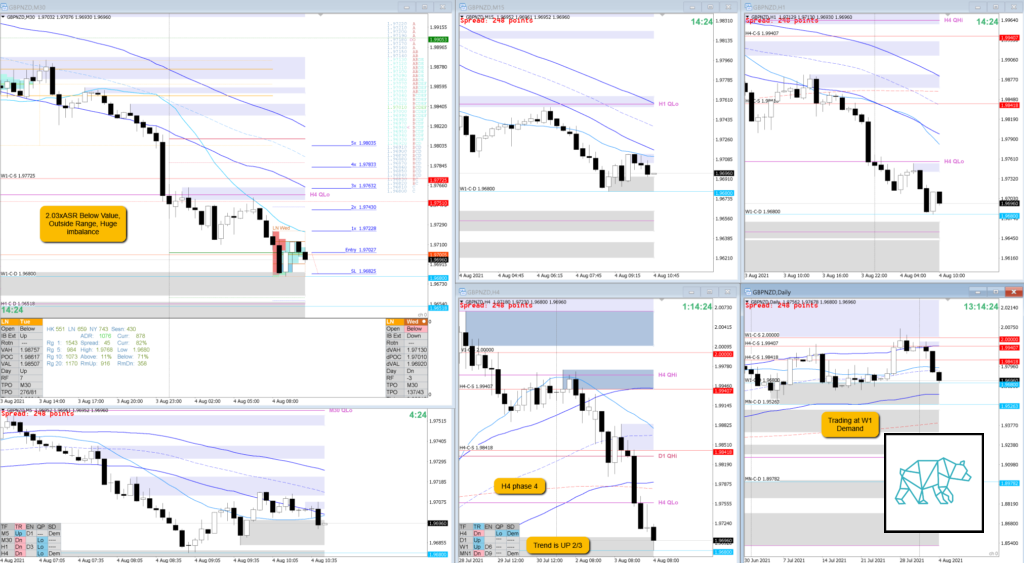

05 Aug 20210804 Trade Review GBPNZD

Play: Failed Auction (Bad Trading Idea)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

Market Narrative

There was a huge imbalance at the open of 2.03xASR. Price was trading at W1 demand and extended slightly below IB before failing auction in C through a Bullish Inside Bar / M15 Three Inside Up. H4 was still in phase 4 though and D1 had traded and closed lower as well.

How was the Entry?

I waited for the completion of the M30 Bullish Inside Bar and then a pullback to newly formed M15 C‑dem for entry. In other circumstances this would have been a good entry. Not in this one as I should not have been in this trade to begin with. Details of which I will explain later.

How was the SL placement and sizing?

Slightly bigger than standard SL size at 20 pips. Standard would have been 17.

How was the profit target?

1R so a bit subpar although expecting a failed auction to move through IB to IB high I thought to take a chance.

How was the Exit?

When E closed bearish I took the trade off at my entry level for breakeven. 0R.

What would a price action-based exit have done for the trade?

-1R

What would a time-based exit have done for the trade?

-1R

What did I do well?

I did well to wait for a better entry instead of going in after the M15 Three Inside Up.

What could I have done better?

I should not have taken this trade to begin with. Reason being that H4 was potentially making a DBD formation as Asia had printed a Gravestone Doji in premarket. Also, the lack of a strong bullish price action like a Bull Engulf to go long.

Observations

Huge imbalance does not necessarily mean a mean reversion.

Missed Opportunity

N.A.

TAGS: Trend is up 2/3, Huge Imbalance,

Premarket prep on the day

No Comments