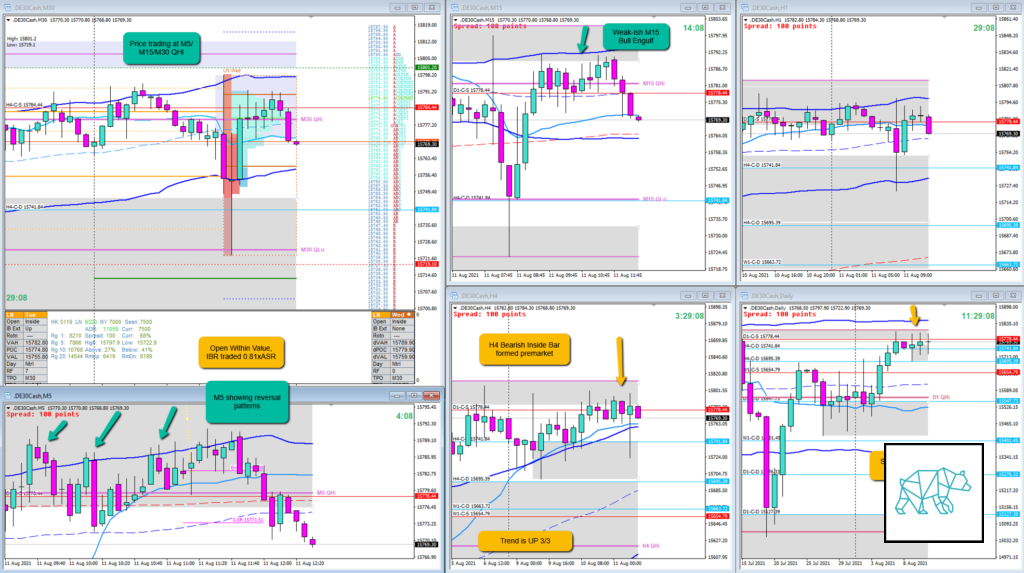

12 Aug 20210811 Trade Review DAX

Play: Reversal / Weakness from within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

There was some slowdown at D1 Supply. Price trading at the top of the overall range. There was an open inside value. IBR traversed 0.81xASR. Looking for weakness from within IBR on responsive days.

How was the Entry?

Entry was okay. There was a M5 Three Inside Down that closed slightly below M5 VWAP. This was in line with the previous M5 Bear Engulf and I tried a short off a little pullback.

How was the SL placement and sizing?

I placed a scaled down stop due to expecting a quick trade and trying to get the most out of it. SL was 2000 pips. This was okay as it was above the formation.

How was the profit target?

Reaching LTF QLo would have yielded 2+R but this was not the target. Just a quick 1–1.5 would have been good on a responsive day.

How was the Exit?

When price failed to transition into a M15 Bearish candle I cut the trade at breakeven.

What would a price action-based exit have done for the trade?

0R as this was how I cut the trade.

What would a time-based exit have done for the trade?

0–0.1R. In overlap noise this would have been 0.7R.

What did I do well?

I did well to try and find a trade on a hugely responsive day. I did well to cut the trade even though my direction was correct the move came later on in the session.

What could I have done better?

I could have tried taking another entry short off the M15 Bear Engulf that formed during H TPO. But because it was this late in the session I didn’t want to risk it. If I had still been in the trade I could have considered going into the overlap before cutting the trade.

Observations

On huge responsive days we can look for weakness from within IBR following swing extremes or LTF continuation patterns.

Missed Opportunity

Addressed above.

TAGS: Open Within Value, Trend is UP 3/3,

Premarket prep on the day

Daily Report Card on the day

No Comments