18 Aug 20210817 Trade Review DAX T2

Play: Frankie Fakeout to Value Acceptance

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

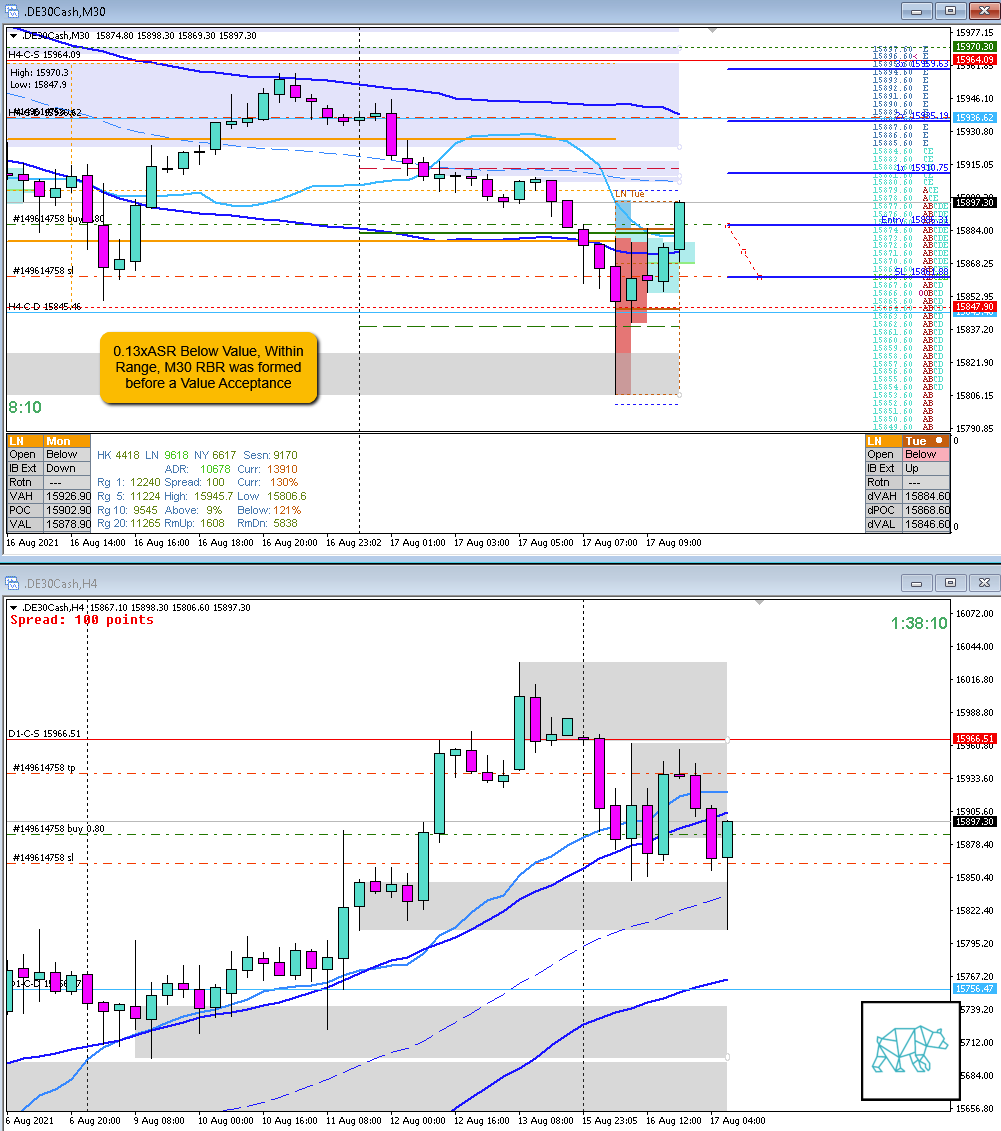

D1 supply was formed and the open sentiment was below value and within range. A continuation was possible. Although with trend being up 2/3 and close proximity to value edge a value acceptance was more likely.

What hypo was it?

Hypo 1

Value Acceptance, sustained auction long

How was the Entry?

I waited for a M15 acceptance of value. Then I waited for a pullback which didn’t really come as much. I was hoping for a re-test of VAL before going long but when I saw M5 unable to pullback further down I just went long. This was good.

Although it could have been better. Due to the nature of equities and the Frankie Fakeout I could have gone long before waiting for a confirmation of acceptance of value. In other assets this is a big no-no. Along these lines I could have entered on the close of the M30 RBR and gotten a better entry.

Better Entry

How was the SL placement and sizing?

Standard sizing. Although I should have scaled my stop better.

If I had that better entry I could have easily gotten a 2R profit target with better scaling of the stop at about 15 pips.

How was the profit target?

Profit target was tillLTF supply at ASR exhaustion and wasn’t much on my entry and SL scaling. Again if I had used better scaling this could have been better. Even more so with that better entry.

How was the Exit?

When price hit LTF supply within value I took 0.6R. Basically scratching on the dat at ‑0.1R with the first bad trade.

What would a price action-based exit have done for the trade?

0.6R

What would a time-based exit have done for the trade?

0.3R

What did I do well?

I did well to quickly change my bias and wait for price action to confirm said bias and then execute on it.

What could I have done better?

I know now that I could have entered earlier as was instructed by my mentor Dee based on the Frankie fakeout there was no need to wait for acceptance of value.

Observations

Equities and Frankie Fakeout can supercede the conditions of a value acceptance.

Missed Opportunity

N.A.

TAGS: Below Value, Within Range, Moderate Imbalance, Extended Frankie Fakeout, Strength from within IBR,

Premarket prep on the day

Daily Report Card on the day

No Comments