28 Aug 20210827 Trade Review DAX

Play: Weakness From Within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

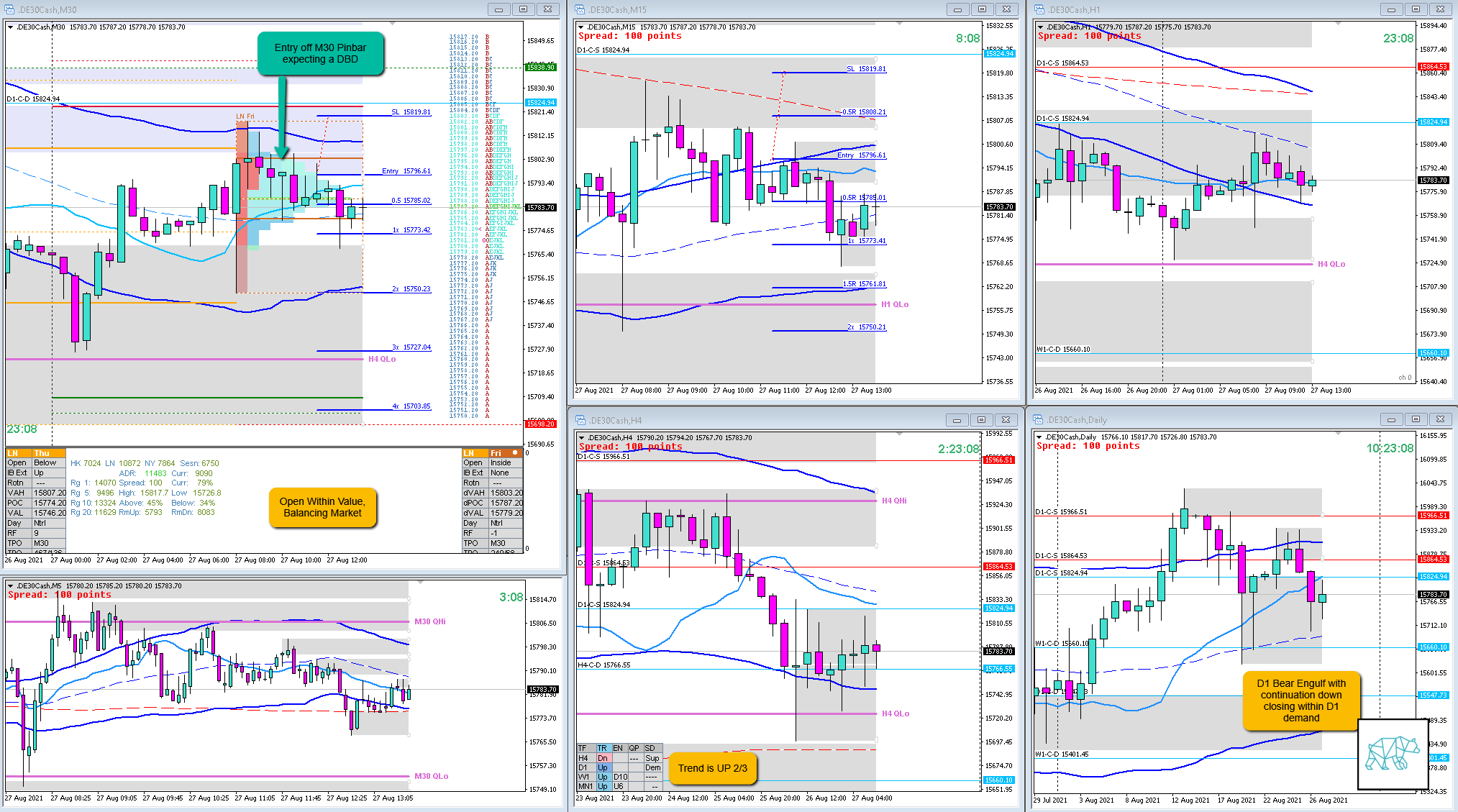

There was a D1 Bear Engulf with follow-through closing within D1 demand. A H4 Three Inside Up with a base formed in premarket. The session opened within value testing newly formed H4 demand and made an effort to probe above value. IB failed to extend to the upside and started reversing. C closed as a Bear Engulf at LTF Supply / VAH.

I failed to enter off the close of C TPO and waited for more confirmation as there was still that aforementioned demand within value at VAL.

What hypo was it?

Hypo 5

Weakness within IBR

Initially I was long-biased due to it being equities and trading within D1 demand and having made a new H4 demand within it.

How was the Entry?

Not the best. I entered in late as I was hesitant to short equities as well as trading right into demand. When I saw that E closed as a pinbar I suspected a continuation rather than a reversal to form a DBD formation. This did happen after which price kinda struggled to push further down.

How was the SL placement and sizing?

It was tighter than a standard SL placement so that was good. What was also good was that it was placed above IB high. Although I am thinking I could have potentially had a tighter SL placement. But all in all not bad still. If I had that first entry I would have definitely had a tighter stop.

How was the profit target?

2R at IB Low although due to responsive activity I would have considered taking 1R.

How was the Exit?

Price hit 0.6R at the max and I let it go trying to be patient. When at my normal cut-off time the M15 closed as a Bearish Inside Bar I decided to give it some more time going into overlap noise. When at the close of I TPO there was still no push down I decided it was enough and took 0.2R. YAAAYYY LAMBOS FOR EVERYONE.

What would a price action-based exit have done for the trade?

0.5R, although price would’ve reached 1.3R which I would’ve taken but this came deeper into the overlap noise and I was already out.

What would a time-based exit have done for the trade?

This was a time-based exit. 0.2R.

What did I do well?

I did well to take the trade, even later, as I understood it was the right play to go with.

What could I have done better?

I could have entered off the M30 Bear Engulf in C as an open within value will often play/bounce off nearby LTF/ASR/ADR levels.

Observations

N.A.

Missed Opportunity

N.A.

TAGS: Open Within Value, Balancing Market, Trend is UP 2/3,

Premarket prep on the day

No Comments