31 Aug 20210830 Trade Review DAX T1

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

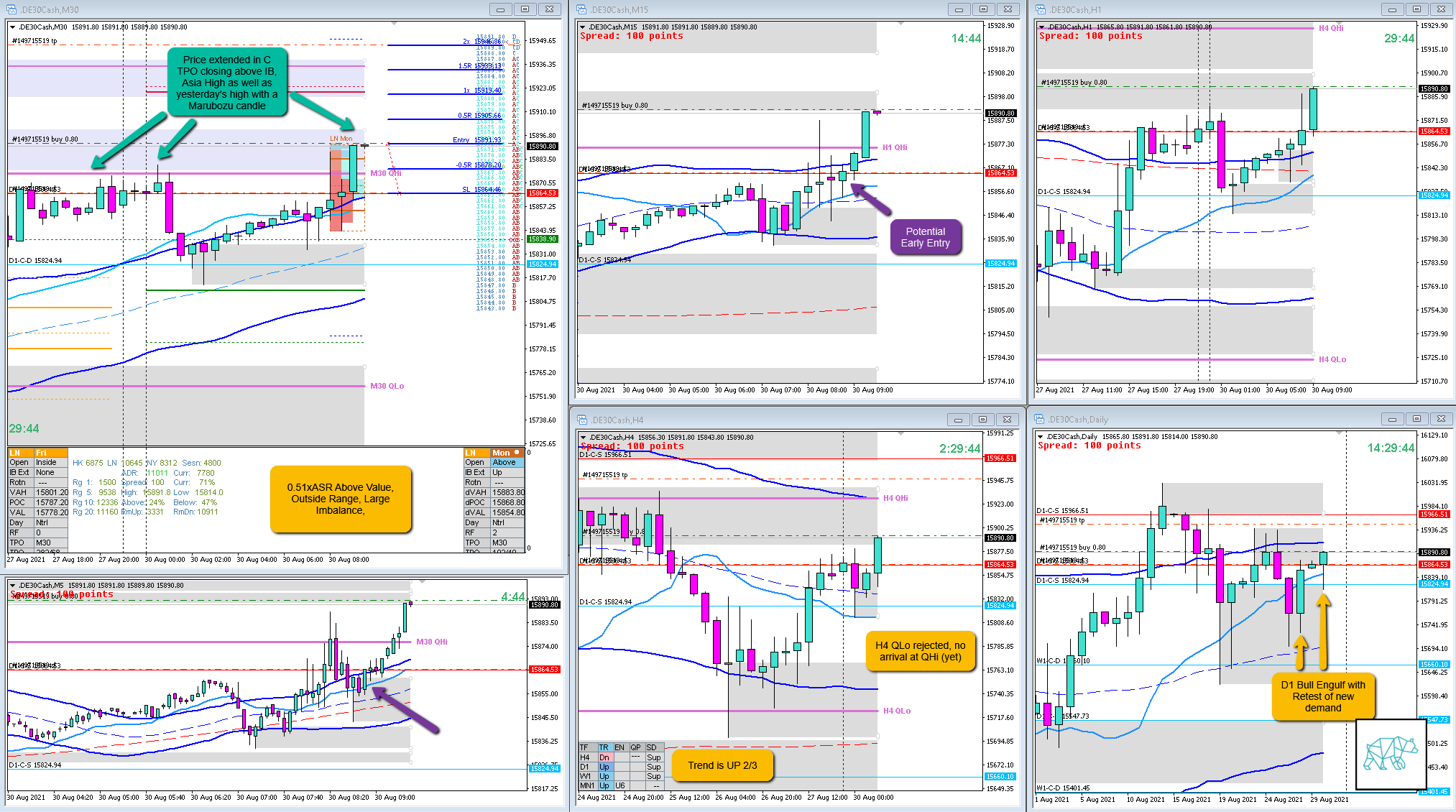

There was a retest of newly formed D1 Bull Engulf C‑line. Trend is up 2/3. Open sentiment was on large imbalance 0.51xASR above value, outside range. Price was coming off from a H4 QLo rejection and is trading mid-swing.

What hypo was it?

Hypo 3

Sustained Auction Up

I did not think this as too probable on the day hence I put it as Hypo 3. But when C TPo closed above IB as well as Asia and yesterday’s high as a Marubozu candle I thought to give it a try.

How was the Entry?

Entry was on the close of C TPO. In hindsight I should’ve known that there would be some reaction to get in later. Although due to the Marubozu candle and extension in C TPO I thought there could potentially be momentum behind the move.

Another thing I am considering is that I could have gotten a better entry due to a strength from within IBR play using the M15 Bull Engulf as a potential entry. .

How was the SL placement and sizing?

Standard SL sizing due to the momentum nature of the trade. If I had that early entry on the strength from within IBR there could have been a tighter SL placement.

How was the profit target?

ADR exhaustion is not far above if hit there could be a continuation to the move and 2R wasn’t far off.

How was the Exit?

D and E had made a HH although E failed to close above IB and instead Failed the Auction. Which I took as my exit for ‑0.3R. I kind of regretted it after getting out due to the HH being made. But with price trading within D1 Supply and not making a meaningful move I thought it was still the right decision. I then reversed my position to short which I will detail in the next post.

What would a price action-based exit have done for the trade?

-0.3R

What would a time-based exit have done for the trade?

-0.6R, ‑0.7R in overlap noise

What did I do well?

I did well to act on a possible opportunity. Alas, it didn’t pan out which is okay.

What could I have done better?

At the time I thought I should’ve stuck with the trade a little longer due to profile having made HHs. Then when it failed to do so again I could have cut the trade and reversed. Hindsight is 20/20 as they say.

Observations

N.A.

Missed Opportunity

Failed Auction Short will be discussed in my next post which wasn’t missed. I actually took the trade.

TAGS: Above Value, Outside Range, Moderate to Large Imbalance,

Premarket prep on the day

Daily Report Card on the day

No Comments