17 Sep 20210916 Trade Review DAX

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

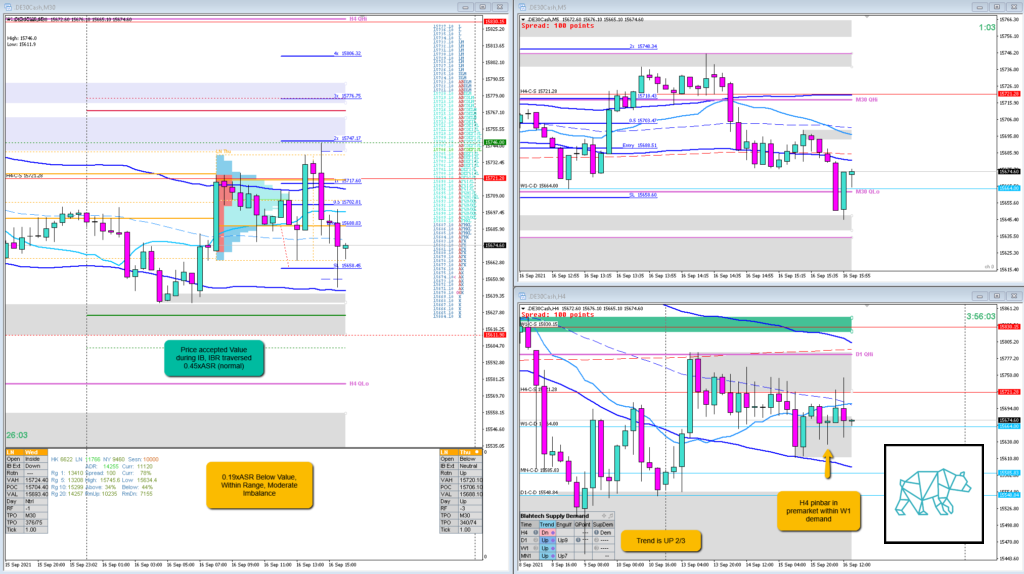

There was a D1 Inside Bar followed by a long-legged doji with implications for either a D1 DBD or a potential Morning Star. Price opened at H4 demand and closed as a pinbar in premarket indication a potential for downside but it was right at W1 demand. Equities being equities the upside is more preferred.

There was a moderate imbalance at the open 0.19xASR below value, within range. IB accepted value and rotated through further indicating price wanting to trade higher. With H4 supply at VAH I expected some pullback first before continuing in a possible slow sustained auction up.

What hypo was it?

Hypo 2

Sustained Auction Up after Value rotation

This was okay.

How was the Entry?

DAX often likes to reverse or continue in the intended direction in the later half of the session. So when I saw price pulling back to within IB (after having extended above IB slightly during D) I waited for some kind of PA confirmation. There was a M5 Three Inside Up ‘rejecting’ IB low followed by a M5 Bull Engulf.

H4 was developing an Evening Star to which the further implication would be more upside (at least momentarily to hopefully reach my target).

How was the SL placement and sizing?

I used a standard sized SL as I have been getting stopped out a few times even scaling the SL by a few pips. M5 being M5 there is usually some wiggling around before making a move. I set the trade and left.

How was the profit target?

The expectation was for a sustained auction up (albeit possibly slow) with an entry off a pullback within IB 2R should’ve been okay I gathered.

This expectation was negated due to the extension to the opposite side and change in approach of OODA and expectations would’ve been valid.

How was the Exit?

SL got taken out as per my current rules. This happened after price missed the 2R target by 2–3 pips before reversing. Normally, if I would be sitting at my desk I would have taken 1.9R but since I am not allowed to take any early exits I figured I just leave and attend to other matters. Also practicing with being okay with committing to a trade and see what it does. Hey, I’m still alive!

In this case if I had used a slightly tighter stop, price would’ve hit my target. Due to a LTF entry I thought standard size was good due to the aforementioned wiggling before making a move.

Another fact to note is that if I was actively observing this, the extension below IB would’ve negated my sustained auction thesis and I’d have to change my expectations. I wasn’t at my desk so I just let the trade do its thing (as well as not being allowed to change the trade). Price reversed and took out my stop ‑1R.

What would a price action-based exit have done for the trade?

If I would’ve taken the extension to the opposing side this would’ve been a ‑0.7R loss. However since D TPO already extended to the upside the more plausible reasoning would’ve been a move up due to the Neutral Day implications. Perhaps some early profit-taking around IB high (1.3R) would’ve been warranted. Solely on price action it would’ve been about the same through a M15 Three Outside Down (although somewhat weak).

What would a time-based exit have done for the trade?

0.2R at normal cut-off, 0.6R at overlap cut off, ‑1R end of day cut off.

What did I do well?

I thought I did well although I am considering that the price having rotated through value implications a bit more and will discuss this with my mentor for furthers notes on this. If value had been accepted but not rotated through this play could’ve been a more valid play perhaps.

What could I have done better?

I think I did well on this. Also, the setting and walking away part. I went to a meeting and did well not to think about the trade too much.

Observations

N.A.

Missed Opportunity

Possibly the Failed Auction after D TPO extended above at H4 supply. Although this was at VAH after a rotation. Plus not much of a selling tail. And value had been rotated through.

TAGS: Moderate Imbalance, below value, within range,

Premarket prep on the day

No Comments