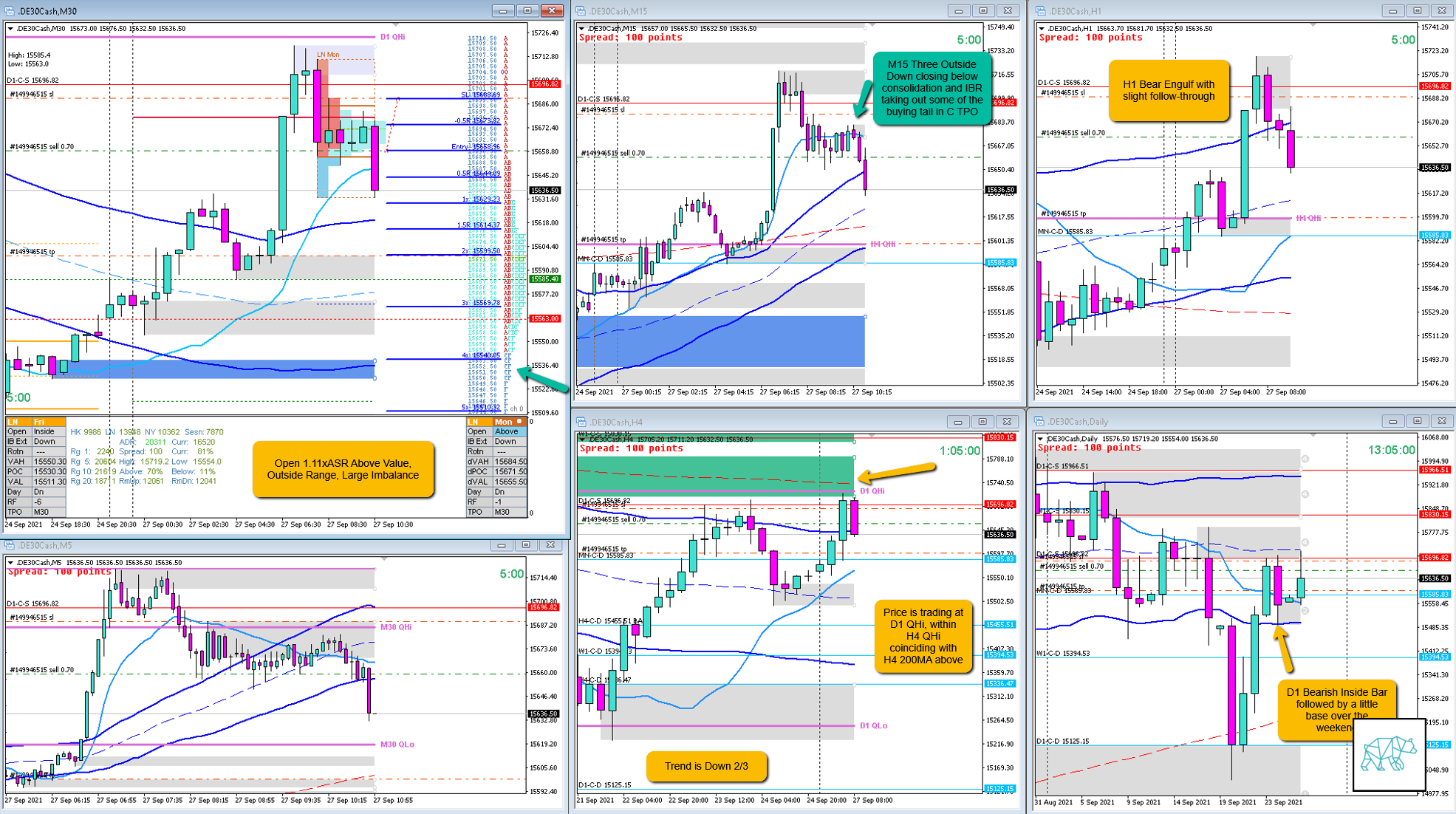

27 Sep 20210927 Trade Review DAX

Play: Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 2R

- Product

- DAX

- Open Sentiment

- Open 1.11xASR Above Value, Outside Range, Large Imbalance

- IBR

- 0.39xASR

- Hypo

- 1

- Mean Reversion, sustained auction down

- Attempted Setup

- Sustained Auction

- Entry Technique

- M15 Three Outside Down at 2nd DTTZ closing below previous consolidation range and IB. F started taking out the buying tail left in C TPO.

- SL placement

- 30 pips. Slightly tighter than standard SL (35).

- TPO period for Entry

- F TPO

- Trade Duration

- 1:21

- Long/Short

- Short

- Leading Narrative

- Large Imbalance at the open with nearby D1 Supply / D1 QHi with Trend being Down 2/3. Proceeded by a failure to close the gap during the first two hours even though there was an extension in C TPO faking a failed auction. Expectation is for a possible closing of the gap later on in the session.

Actual Development

Price saw a quick follow-through and F TPO closed well below IB and continued making LLs. 2R target was at LTF demand which got hit and taken out. Price is trading at 3R right now. Will check back in tomorrow to see how it developed further.

Good points

- Good that I spotted the narrative and executed

Bad Points

- I really wanted to take the trade off early due to moves at 2nd DTTZ usually being short in nature. Especially when M5 printed a big Bull Engulf. But due to the fact that the 2nd DTTZ was in line with the 1st gave me some comfort. Another point I was considering is that H4 could very well close higher leaving behind a buying wick (this was actually not the case and H4 closed as a bear engulf). Not being allowed to take early exits definitely helped me here.

Next Day Analysis

- Target hit?

- Yes, 2R

- Time-based Exit?

- 2.3R

- Overlap Noise?

- 2R

- End of Day?

- 1.9R

- Highest R multiple?

- 3.7R

TAGS: Above Value, Outside Range, Large Imbalance,

Premarket prep on the day:

No Comments