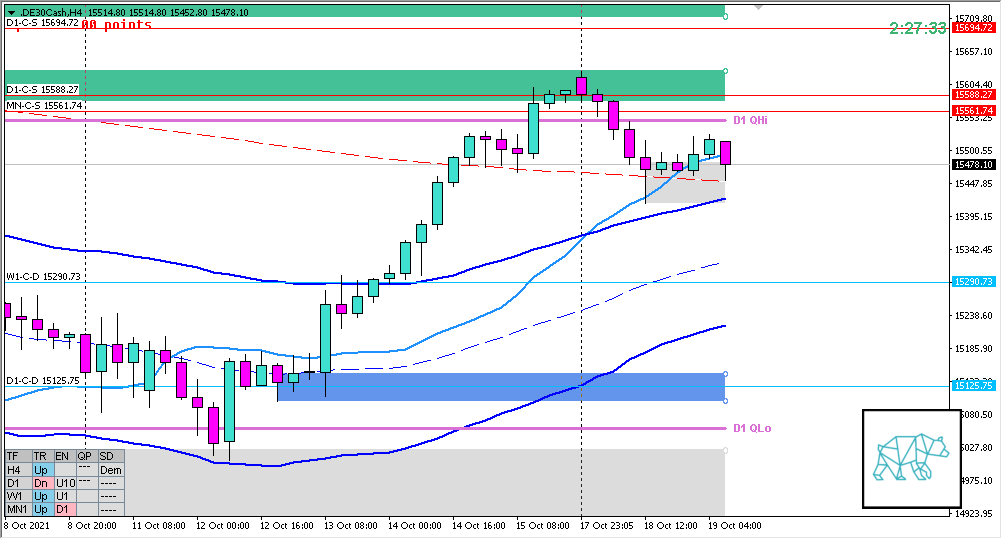

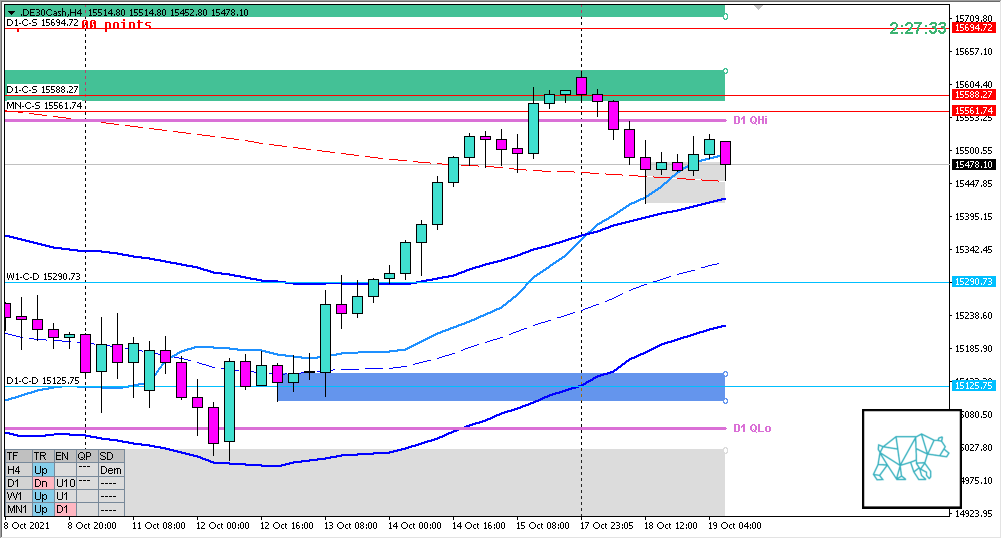

19 Oct 20211019 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Price trading within last week’s body with a slight pullback to W1 demand

Non-conjecture observations of the market

- Price action

- D1 Three Outside Down with price trading within its body

- H4 consolidation and Break higher trading within H4 QHi

- Trend: H4 Up, D1 Down, W1 Up

- Prevailing trend: Mixed Trend

- Market Profile

- 2 overlapping values indicating slowdown in price

- Daily Range

- ADR: 16366

- ASR: 13705

- 3426

- ASR Short: 11959

- 2990

- Day

- Yesterday’s High 15597.10

- Yesterday’s Low 15415.70

Sentiment

- LN open

- Open Within Value

- Open distance to value

- N.A.

- Narrative

- Balancing Market. Price formed a D1 Three Outside Down (rejecting D1 QHi) at new MN C‑sup possibility for a continuation down. IBR traversed 0.45xASR down closing below VAL but no extension yet. Extension down is met with newly formed H4 demand. ADR 0.5 below yesterday session low nearby ASR and ADR exhaustion.

- Clarity (1–5, 5 being best)

- 3

- Hypo 1

- Failed Auction Long

- Hypo 2

- Sustained Auction Down, value rejection, late-sustained auction entry preferred

- Hypo 3

- Failed Auction Short

- Hypo 4

- Sustained Auction Long, value rejection, late-sustained auction entry preferred

- Hypo 5

- Auction Fade Long, variation to hypo 2

Additional notes

- N.A.

ZOIs for Possible Shorts

- Not favored in equities

- D1-C‑S 15588.27

ZOIs for Possible Long

- W1-C‑D 15290.73

Mindful Trading (lack of sleep?)

- Feeling okay, but might be distracted with personal life

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No early exits, either hit SL or 2R target

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments