20 Oct 20211019 Trade Review Gold

Play: Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- 2R

- Product

- Gold

- Open Sentiment

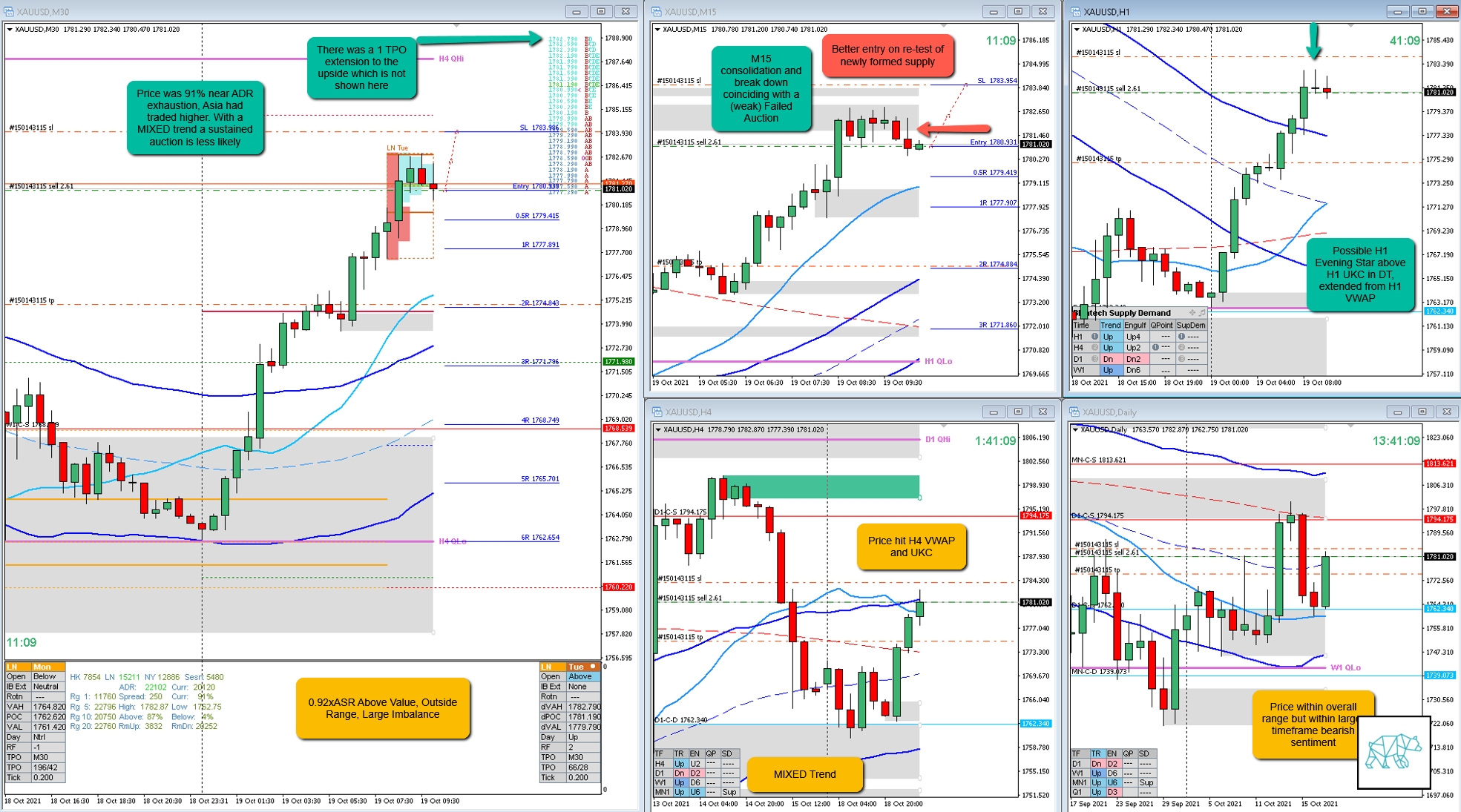

- 0.92xASR Above Value, Outside Range, Large Imbalance

- IBR

- 0.36xASR

- Hypo

- 2

- I named it Failed Auction Short but I should have called it a Reversal

- Attempted Setup

- Reversal

- Entry Technique

- Weak M30 Bear Engulf, M15 consolidation and break down

- SL placement

- 30 pips. Tighter than standard SL (38) as SL was placed well above IB.

- TPO period for Entry

- E TPO

- Trade Duration

- 1h51m

- Long/Short

- Short

- Leading Narrative

- Large Imbalance at the open. Price trading at H4 VWAP and UKC. Possible H1 Evening Star formed above H1 UKC in DT. Larger timeframe bearish sentiment.

Actual Development

Price transitioned to H1 Evening Star and proceeded to close lower on LTF extending to the opposite side forming a Neutral Day.

Good points

- Taking the trade even though theoretically in my mind I missed the ‘best entry’.

- Waiting for slightly more confirmation after M15 DBD failed to close below the consolidation.

Bad Points

- Could’ve been more aggressive and taken the entry off the close of the M15 DBD. Better even a re-test of newly formed M15 supply as a mean reversion in the ‘textbook’ sense was not in the card ie. not happening in the first two hours so this was a normal reversal near ADR level and a test of newly formed SD could’ve been in the cards. This didn’t matter as I did not need to fit a 2R target based on a Failed Auction setup.

- Letting the 1 TPO above IB extension in one of the toggle settings confuse and let me hesitate.

- Mistake this trade for a Failed Auction whereas this was a reversal and the FA (very weak by the way) was a confirming OODA-loop factor.

- Just noticed I took the trade off based on a tighter SL on my other platform and in fact this was only 1.6R… muppet…I guess in this case it actually helped…

Next Day Analysis

- Target hit?

- Yes, 2R

- Time-based Exit?

- 0.7R

- Overlap Noise?

- 0.9R

- End of Day?

- -1R

- Highest R multiple?

- 1.7R

TAGS: Above Value, Outside Range, Large Imbalance, Mixed Trend,

Premarket prep on the day:

No Comments