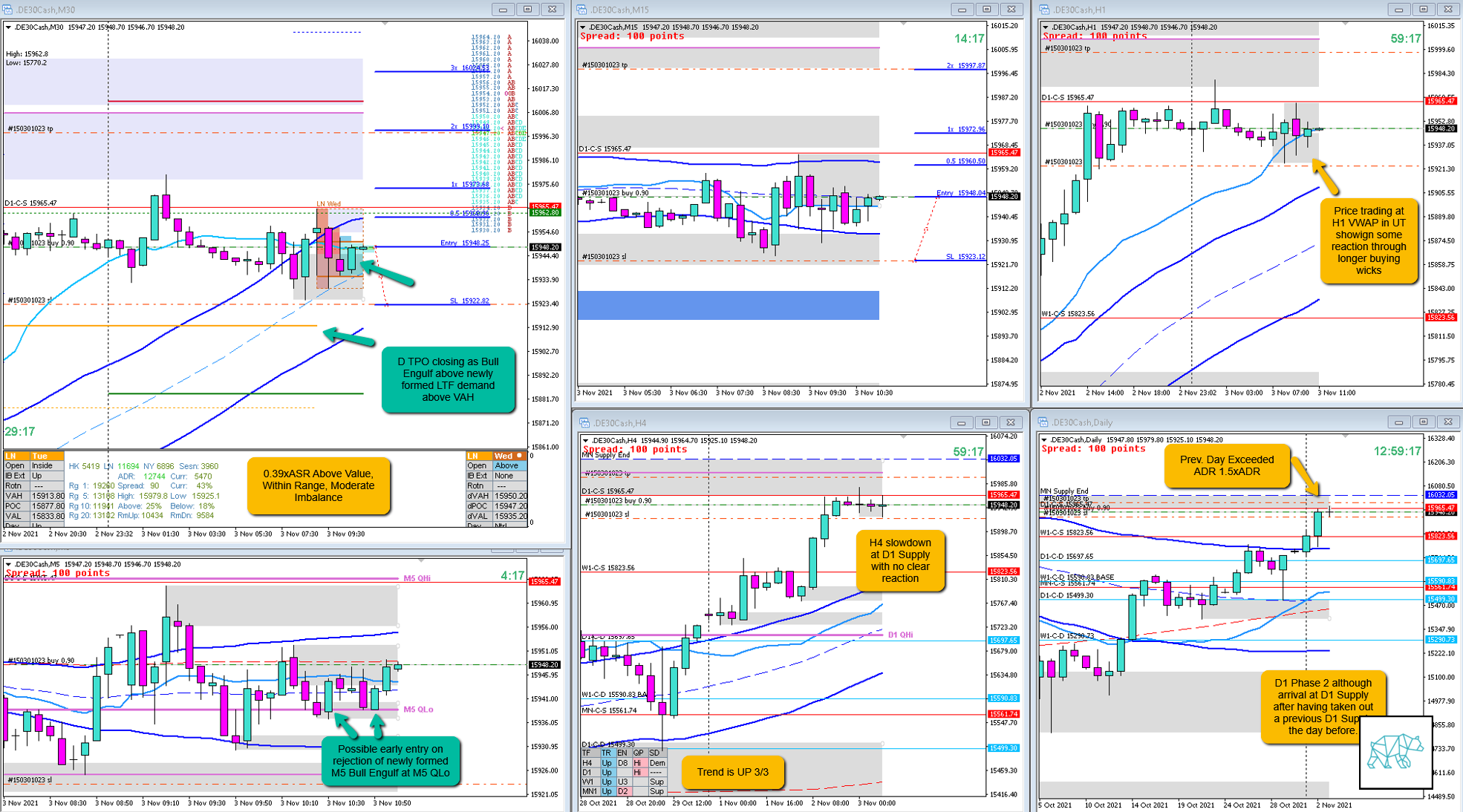

04 Nov 20211103 Trade Review DAX

Play: Return to Value Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- -1R

- Product

- DAX

- Open Sentiment

- 0.39xASR Above Value, Within Range, Moderate Imbalance

- IBR

- 0.30xASR

- Hypo

- 1

- Return to Value, Value Edge reversal, possible Failed Auction Long

- Attempted Setup

- Reversal

- Entry Technique

- M30 Bull Engulf on the close of D TPO (2nd DTTZ)

- SL placement

- 25 pips due to tighter IBR and SL was placed well below IB low and PA formation

- ASR/4 was 29, ASR short 27, 25 was within margin of error

- TPO period for Entry

- E TPO

- Trade Duration

- 5h30m

- Long/Short

- Long

- Leading Narrative

- Previous day closing near it’s high

- Previous D1 Supply got taken out

- Open sentiment: above value, within range, moderate imbalance

- Larger timeframe bullish sentiment overruling D1 Supply (higher likelihood for it to get taken out)

- WARNING CONJECTURE (just logging the situation for my playbook): Possible move ahead of rate decision as I initially thought this move to take out Larger timeframe supply could happen tomorrow (Thursday) or even on Friday.

Actual Development

Price moved higher but did not extend IBR until H TPO. H then closed right at IB high before reversing Failing the Auction. PRice then proceeded to extend slightly to the downside forming a Neutral Day.

When NY opened price took out my SL by 3, 4 pips before shooting higher and eventually reaching over 4R.

Good points

- Taking a trade when uncomfortable with aftermath of getting my 2nd shot

- Taking a trade in the first week of the month. I usually don’t like that as non-farm and rate decision make price action ‘weird’.

- I took the trade even though trading right below D1 Supply,

- Recognizing Prev. Day had exceeded ADR and with that a possibility for a pullback (which did indeed come later). I decided for a retracement of prev. Day to happen in a strong uptrend price would need to accept value which I deemed less likely especially in equities.

- Going to bed and let the trade do its thing

Bad Points

- SL could’ve been slightly wider as price took it out and reversed almost instantly after

- Entry was taken right into M30 congestion and wasn’t the strongest play. Better would have been if the congestion had been cleared before looking for an entry.

Next Day Analysis

- Target hit?

- No, ‑1R

- Time-based Exit?

- 0.7R

- Overlap Noise?

- 0.1R

- End of Day?

- -1R

- Highest R multiple?

- 1R

TAGS: Above Value, Within Range, Moderate Imbalance, Trend is UP 3/3, Prev. Day Exceeded ADR, Move Ahead of Rate Decision,

Premarket prep on the day:

No Comments