22 Nov 20211122 Premarket Prep DAX

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my premarket prep for today’s European session for DAX. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

- Possible developing MN Three Outside Up

- Last week closed as an Inverted Hammer and price is trading above last week’s body but still within range

Non-conjecture observations of the market

- Price action

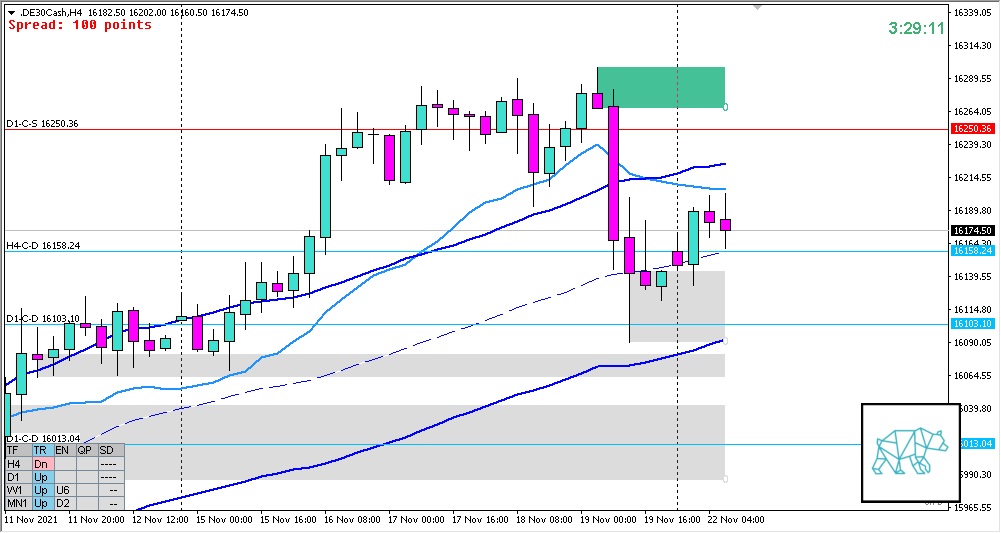

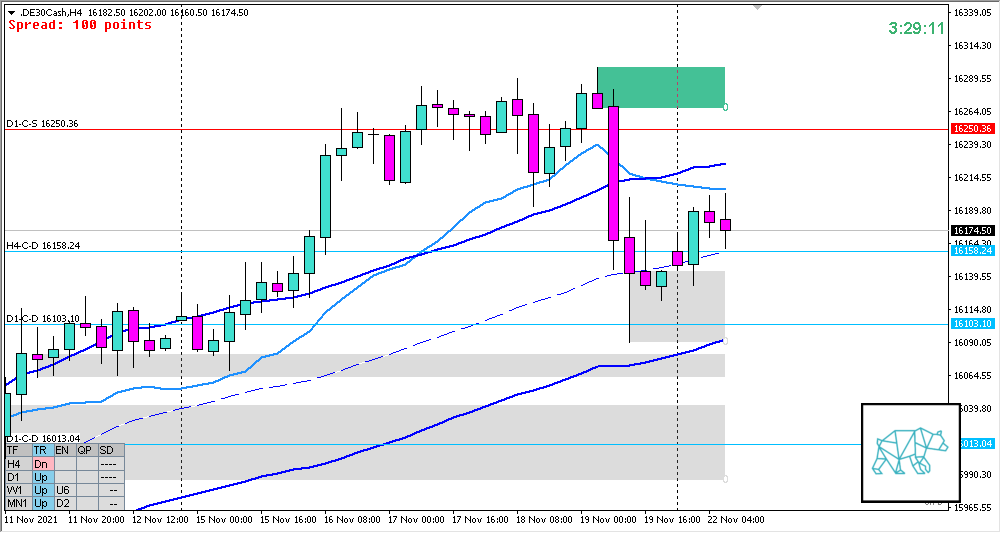

- D1 consolidation and break down but D1-C‑D 16103.10 is showing some reaction

- H4 Bull Engulf giving H4-C‑D 16158.24

- Trend: H4 Down, D1 Up, W1 Up

- Prevailing trend: Trend is UP 2/3

- Market Profile

- Wide value created below 2 previous overlapping values

- Daily Range

- ADR: 10828

- ASR: 8162

- 2041

- ASR Short: 7266

- 1817

- Day

- Yesterday’s High 16297.93

- Yesterday’s Low 16089.59

Sentiment

- LN open

- Open Within Value

- Open distance to value

- N.A.

- Narrative

- Balancing Market. Although the open was inside value, the value is quite wide. Trend changed from 3/3 to 2/3. Asia extended to the upside. LN Range is 80+ again. H4 Bull Engulf with an Inside Bar formed in permarket. Friday’s ADR exceeded ADR by 1.96. ADR exhaustion below newly formed D1-C‑S 16250.36.

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Failed Auction Long

- Hypo 2

- Failed Auction Short,

- Hypo 3

- Reversal at D1 C‑sup

- Hypo 4

- Late-sustained auction short

- Hypo 5

- Auction Fade Long

Additional notes

- N.A.

ZOIs for Possible Shorts

- Not favored in equities

- D1-C‑S 16250.36

ZOIs for Possible Long

- H4-C-D16158.24

- D1-C‑D 16103.10

Mindful Trading (lack of sleep?)

- Feeling Okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- No early exits, either hit SL or 2R target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Process

- Keep trade review comments short

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments