25 Jan 20220124 Trade Review DAX

Play: Auction Fade (Opportunistic Trade 2nd DTTZ)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

- Result

- 0.5R

- Product

- DAX

- Open Sentiment

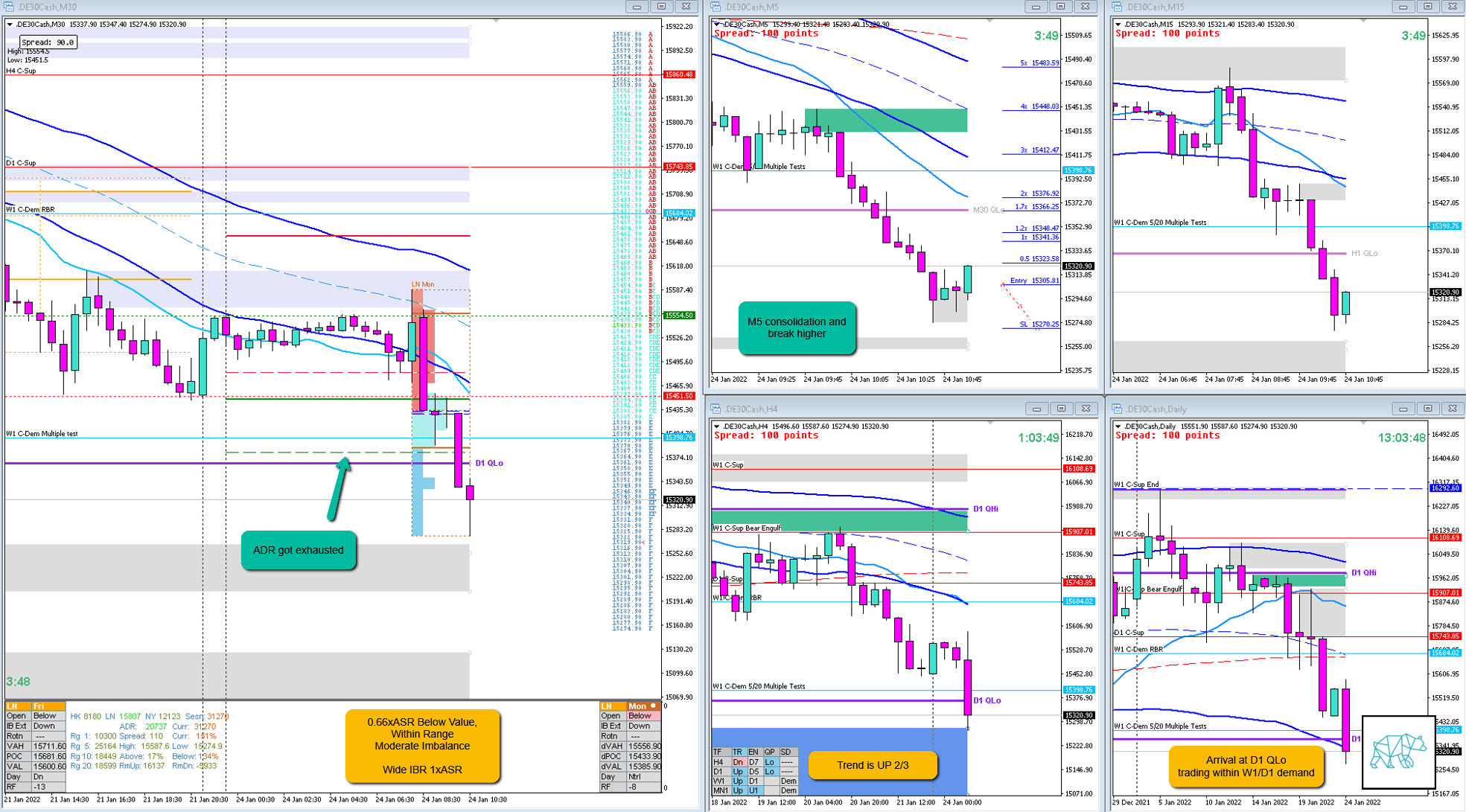

- 0.66xASR Below Value, Within Range

- Moderate Imbalance

- IBR

- Wide IBR 1xASR

- Hypo

- 2

- Long

- Auction Fade, possible reversal at W1/D1 demand

- Attempted Setup

- Auction Fade (Opportunistic Trade 2nd DTTZ)

- Entry Technique

- M5 consolidating at the right time of day

- SL placement

- Standard SL (35)

- TPO period for Entry

- F TPO

- Trade Duration

- 0h05m

- Long/Short

- Long

- Leading Narrative

- Price trading within W1/D1 demand after a sustained auction down

- Price trading within D1 QLo

- ADR got exhausted

- Right time of day 2nd DTTZ

- M5 consolidation and break higher

Actual Development

- Price continued higher hitting 2R before reversing and continuing the sustained auction down

Good points

- Stalking and taking the opportunistic trade (also after taking a loss on Gold)

Bad Points

- Not waiting for F TPO to close before taking the trade off which would have resulted in 0.7R

- Even though an opportunistic trade shouldn’t be kept too long I could have monitored price action more closely and seen that G TPO eventually pulled back higher hitting 2R before reversing

Next Day Analysis

- Target hit?

- Yes, although target was the close of F TPO which would have yielded 0.7R but I took 0.5R

- Time-based Exit?

- 0.2R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 2R

TAGS: Below Value, Within Range, Moderate Imbalance, Trend is UP 2/3,

Premarket prep on the day:

No Comments