25 Jan 20220124 Trade Review Gold

Posted at 05:14h

in Bad Trading Idea, Failed Auction, Gold Trade Review, Late-Sustained Auction Entry, Sustained Auction, Trade Reviews

0 Comments

Play: Late-Sustained Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- -1R

- Product

- Gold

- Open Sentiment

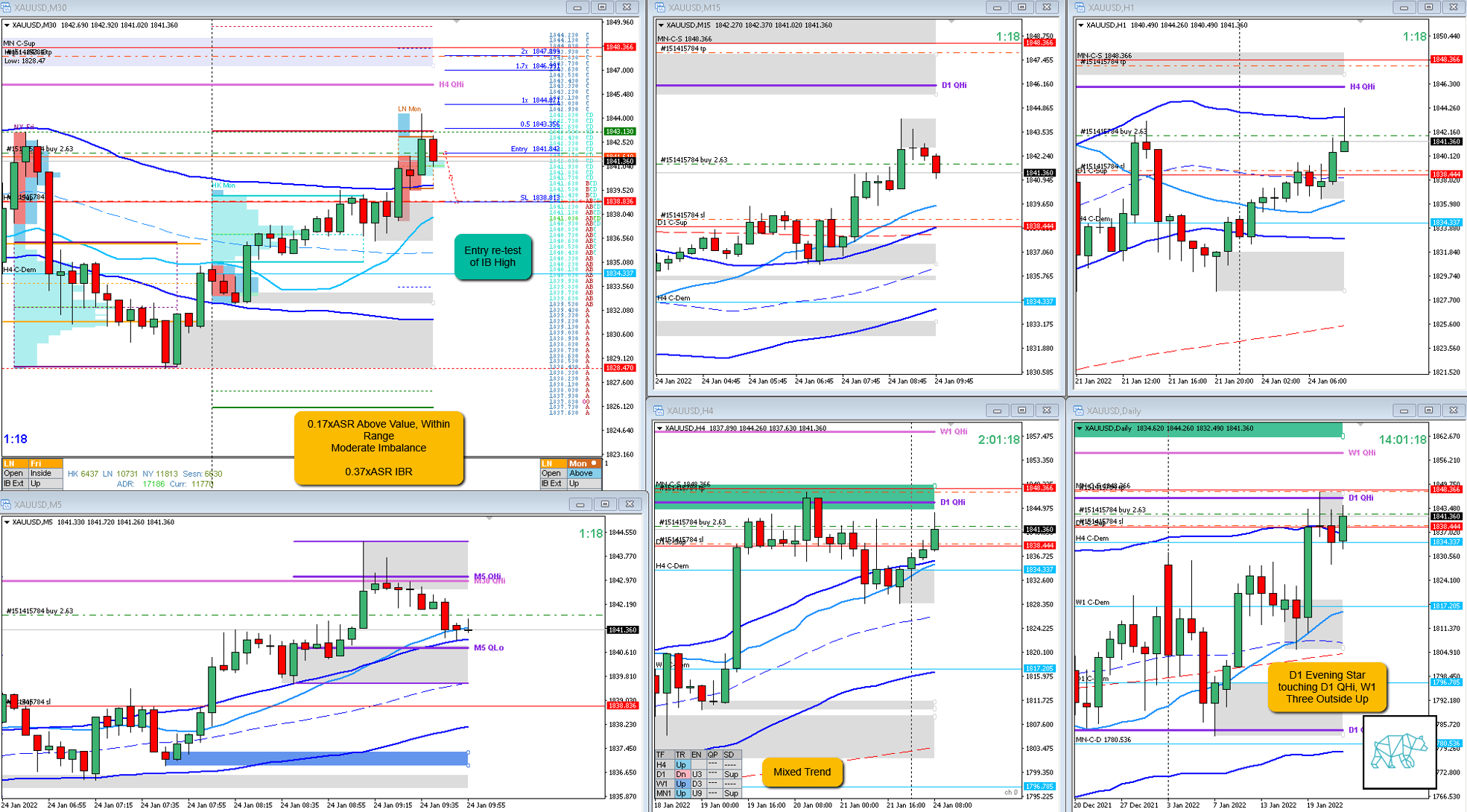

- 0.17xASR Above Value, Within Range

- Moderate Imbalance

- IBR

- 0.37xASR

- Hypo

- 2

- Late-sustained auction entry

- Risky due to trading into D1 QHi so price would need to take out and close above previous day’s high

- Possible entry off re-test of IB high

- Attempted Setup

- Late-Sustained Auction entry

- Entry Technique

- Re-test of IB high after C TPO close above taking out LTF supply

- SL placement

- Standard SL placement (30)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h32m

- Long/Short

- Long

- Leading Narrative

- Moderate Imbalance with open above value sentiment

- C TPO closing above IB taking out LTF supply

- Weak D1 Evening Star with W1 Three Outside Up preceding, potential for new D1 supply to get taken out

Actual Development

- D TPO closed as a Bearish Inside Bar failing the auction and what followed was a rotation through IBR

- A reversal followed by a Failed Auction would have yielded 1.7R which was the play I should’ve taken

Good points

- Waiting for the trade to develop (although not completely as listed under bad points) before getting involved

Bad Points

- C TPO did close above IB taking out LTF supply although it did not hold above yesterday’s high as was my plan

- M15 showed a reversal although a weak M15 Evening Star a reversal nonetheless

- Trading at H4/D1 QHi

Next Day Analysis

- Target hit?

- No, ‑1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.4R

TAGS: Moderate Imbalance, Above Value, Within Range, Mixed Trend,

Premarket prep on the day:

No Comments