05 May 20220504 Trade Review Gold

Posted at 04:46h

in Bad Trading Idea, Gold Trade Review, Late-Sustained Auction Entry, Sustained Auction, Trade Reviews

0 Comments

Mistakes. Find them all!

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #Gold #XAUUSD

- Result

- -1R

- Open Sentiment

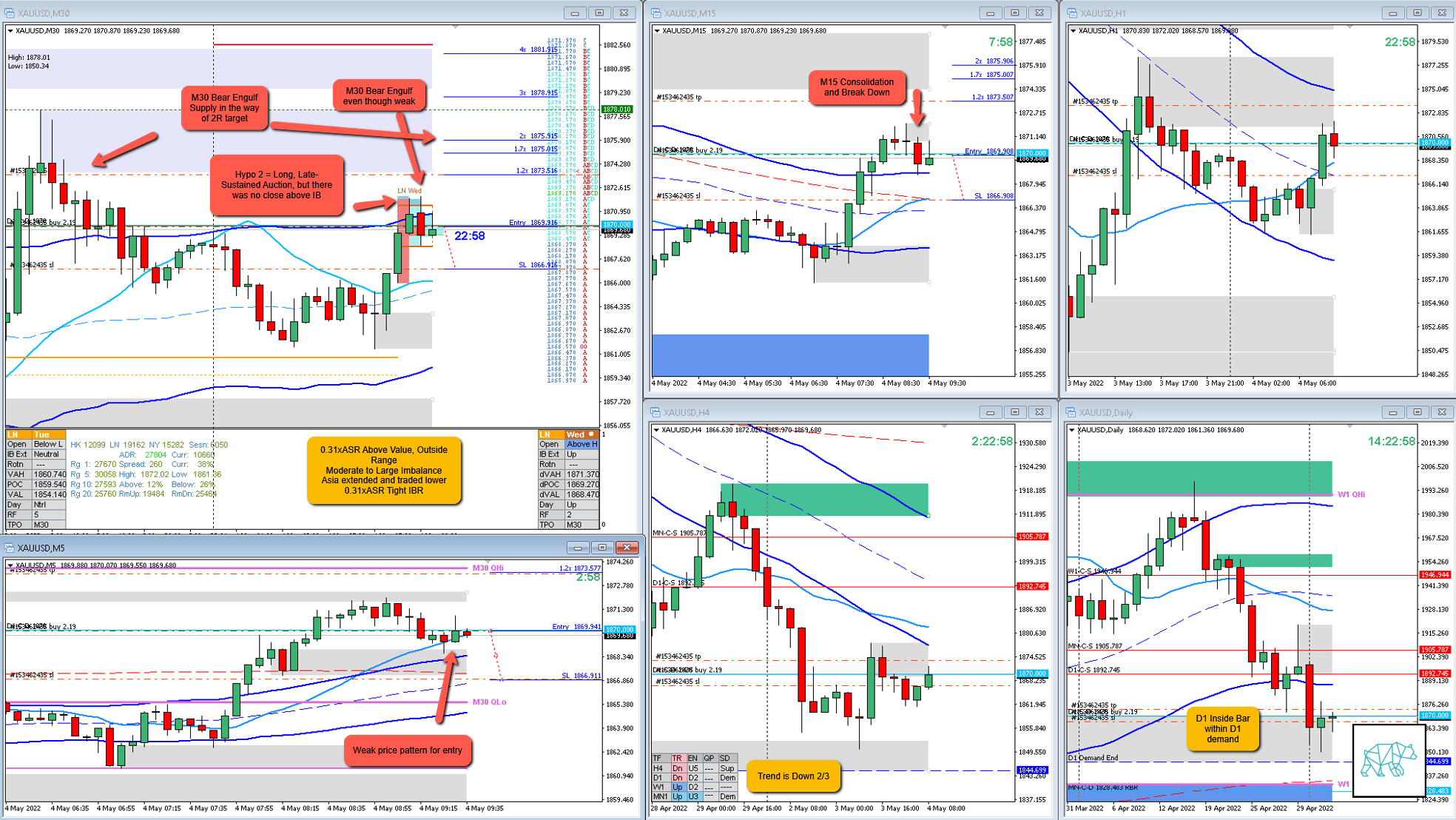

- 0.31xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia extended and traded lower

- 0.31xASR Tight IBR

- Trend

- Trend is Down 2/3

- H4: Down

- D1: Down

- W1: Up

- Hypo

- 2

- Long

- Late-Sustained Auction

- Attempted Setup

- Late-Sustained Auction

- Entry Technique

- M5 VWAP in UT TC

- SL placement

- Tight SL (300)

- TPO period for Entry

- D TPO

- Trade Duration

- 0h58m

- Long/Short

- Long

- Leading Narrative

- D1 Inside Bar within D1 demand

- H4 supply created Low in Distr. Curve being tested

Actual Development

- D closed lower within IB, E took out my SL

- F traded higher before reversing again

Good points

- Taking my stop

- Sat here observing without much emotion

- Directionally right on the day, just lousy execution and not waiting for the setup to present itself

Bad Points

- Price had not closed above IB as per Hypo 2 — Late-Sustained Auction

- M30 Bear Engulf even though weak it failed the auction

- M15 Consolidation and break down still in the way for any long thesis

- No good profit target with more congestion in the way

- SL tighter than ASR Short which is not the worst as it was based on M5 entry but if it was slightly wider I could’ve scratched the trade

- Weak M5 price pattern for entry

- I was feeling tired or as I like to call it “wearing horse blinders”. I have been sleeping well but still felt off. I then realized it was a withdrawal from the sleeping medication I was taking and quit cold turkey. The nootropics stack has been working so well that I did not have the need to take them and I just abruptly stopped taking them. Because of this I will take the rest of the week off and reevaluate Monday.

- Could I have prevented this? Yeah, I should’ve been more cognizant of the fact that I was coming off of the meds. In hindsight I feel the same way when I did the Keto diet very wrongly as well as quit smoking at the same time. Luckily we have good risk management rules in place: If I have 3–4 trades hitting full stop it is a big red flag. Something is up. I usually have good trades so whenever this happens I need to reevalute. Is there something wrong with me or has the market regime changed and do I need to reassess my approach to the markets? Lesson learned.

Next Day Analysis

- Target hit?

- Yes, ‑1R

- Time-based Exit?

- -1R

- Overlap Noise?

- -1R

- End of Day?

- -1R

- Highest R multiple?

- 0.2R

TAGS: Above Value, Outside Range, Moderate to Large Imbalance, Trend is Down 2/3,

Premarket prep on the day: