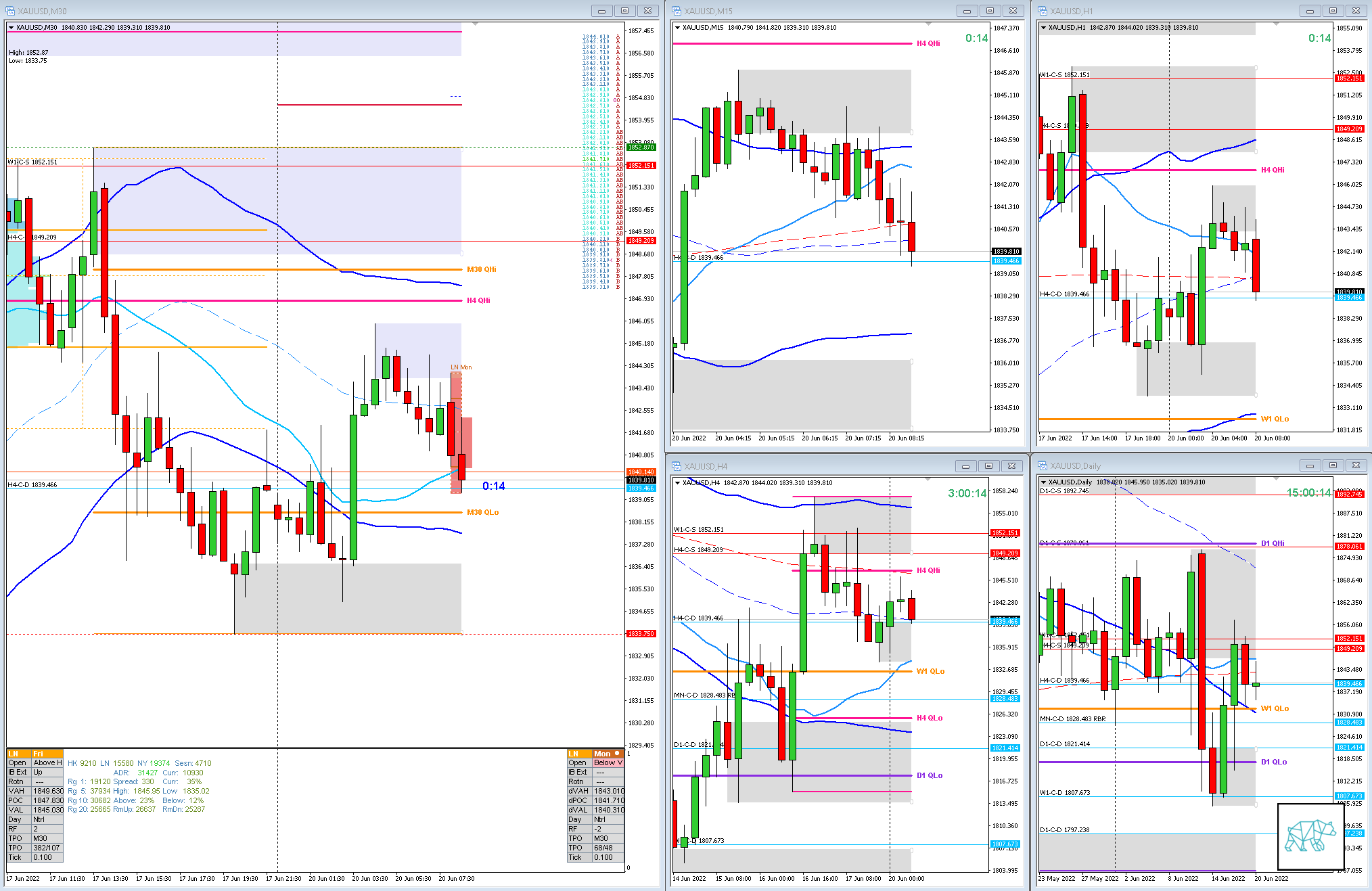

20 Jun 20220620 Premarket Prep Gold

#fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- MN Bear Engulf rejecting MN QHi with continuation although leaving longer buying wick

- Price trading within body

- W1

- W1 Bear Engulf giving W1-C‑S 1852.151 leaving a longer buying wick reacting off W1 QLo and W1 demand.

- Price trading within body

Narrative

- D1

- Possible D1 Phase 1 / 3

- D1 Bearish Inside Bar at W1/D1 Supply

- H4

- H4 DBD at W1 Supply giving H4-C‑S 1849.209 (within Value)rejecting H4 QHi

- Asia formed a Spinning Top

- Trend

- Mixed Trend, Up, Down, Up

- Market Profile

- Value created above the previous 3‑day range, still within overall range

- LN Open

- 0.14xASR Below Value, Within Range

- Moderate Imbalance

- Asia formed a Neutral Day but mostly traded higher

- 0.30xASR IBR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Return to Value, Reversal, Possible Failed Auction, possible 2nd Chance entry although perhaps already done during B TPO.

- Hypo 2

- Short

- Sustained Auction, risky due to congestion on the way to target,

- Hypo 3

- Long

- Failed Auction

- Hypo 4

- Long

- Auction Fade

Clarity

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Either hit SL or target, reassess after Trading Window Close

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments