07 Dec 20221207 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

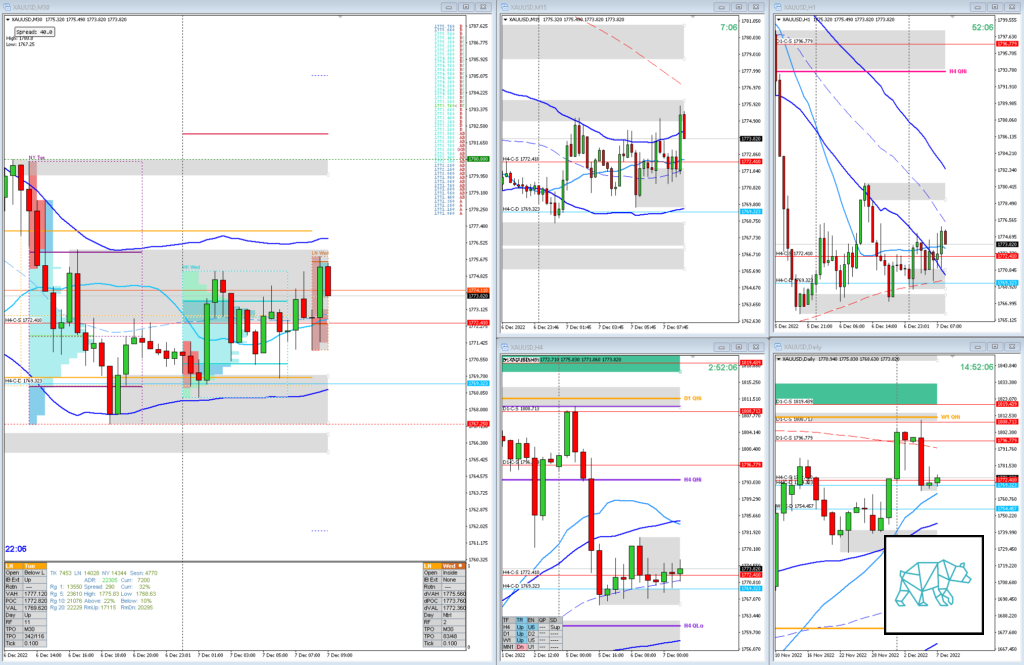

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a HH but is now trading within body, at MN VWAP

- W1

- Price retraced back within body to 50% mark of the previous week after having made a HH

Narrative

- D1

- D1 Consolidation and break down below W1/D1 QHi, Inverted Hammer formed above D1 VWAP in UT

- H4

- Some H4 Phase 1 / 3 above H4 50MA in UT

- H4 QHi rejected, price trading mid swing

- Some supply giving H4-C‑S 1772.410 within value at PPOC

- Trend

- Trend is UP 3/3

- Market Profile

- Wide value created below the previous

- LN Open

- Open Within Value

- Asia formed a Neutral Day but mostly traded higher

- 0.34xASR IBR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Reversal, possible Failed Auction

- Hypo 2

- Long

- Failed Auction

- Hypo 3

- Long

- Late-Sustained Auction

- Hypo 4

- Short

- Late-Sustained Auction

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 11:16h, 07 DecemberHey buddy good afternoon ?

Questions on Gold:

1. On the H4 TF. would you consider the last 10 candles consolidation or indecision ? or does the bullish engulfing, followed by the inside bar separate those candles into two groups ?

2. all this action is going on just below the D1 Qhi. how does that weigh on that price action ?

3. when you said wide Qhi Qlo in the email , are you refering to the profit margin multiples ?

4. I personally feel this is alot of indecision, how does that match up to your thoughts ?

5. The 1HR TF is creating alot of overlaping demands, might that indicate a possible reversal back into 1D Qhi to test the supply above ?

I hope all these questions hurt your brain 🙂

juan l.

Posted at 11:57h, 07 DecemberI just realized that I was looking at micro gold and the Q points are different. Muppet meter is ticking upwards !!

T3chAddict

Posted at 12:01h, 07 DecemberHi Juan,

Thanks for the questions. I love hard questions so keep them coming! 🙂

1. I referred to the price action as Phase 1 / 3 meaing price needs to break from this range before a more directional cue can be taken. So there is some accumulation/distribution going on but no break yet. Open within Value is not helping either.

This directional cue can be had if D1 breaks lower (as is usually more probable after a (Inverted) Hammer is formed completing a DBD formation.

Usually hammers spell continuations rather than reversals. Again trade location is important.

Since I use VWAP in my analysis as well this goes counter the possible D1 DBD narrative as D1 VWAP is right below and price is still in an uptrend. It seems the LN session does not want to make a move so this directional move could come during NY.

2. It’s actually not ‘just below the D1 QHi as price already moved lower from it last Monday. The higher/lower you go up/down into a distribution curve or swing high/low the more probable it becomes that there will be a reversal. Right now it could go either way just based on the Swing High narrative for the day. Although on a longer term a QHi rejection usually implies a move towards QLo. Although the question always remains which path it will follow. TBH I also don’t like that price just barely missed testing the W1/D1 QHi and the rejection move closing lower could just have been a short term reaction to D1 200MA. Whenever this level gets touched for the first time (relatively speaking) there is usually some reaction. Now the question is if that reaction is sustained or if price will go and test it again.

3. No a Wide QHi/QLo refers to the actual distance of the swing high/low. Not measuring the distance between but rather the top quartile a.k.a QHi from its top to where the QHi is placed. I’ve attached an image for your convenience.

4. I agree

5. Apart from doing that it is also continuously testing H1 200MA in UT and H1 50MA in DT is converging in what I like to call entering an apex. Similar to a triangle in “conventional” chart pattern readings. Usually when a test of a level happens (SD, VWAP, MA, etc) it usually means that that level gets broken. Obviously you need price action and trade location to confirm. Just as a sidenote I do not weigh in H1 analysis highly into my trading plans as you might have noticed. For me it is just there so give a slightly more nuanced confirmation or negation of a possible narrative that I might be stalking. Also, in my experience when price behaves somewhat “erratic” possibly through a tighter ASR the H1 becomes slightly more leading in my analysis.

I hope all my answers hurt your brain! 😀

juan l.

Posted at 12:05h, 07 Decemberok now im confused. my Gold contract on AMP futures is showing a different D1 Qhi

T3chAddict

Posted at 12:54h, 07 DecemberIs it a continuous contract that you are looking at?

juan l.

Posted at 13:36h, 07 DecemberGlobex Feb 2023(GCEG23) on AMP futures it was the one with the most liquidity. It looks like the Qpoint calculation might be off for some reason ?

juan l.

Posted at 16:58h, 07 DecemberIn Dee’s live stream today i also notcied she’s using the same contract im using and her D1 Qhi is lining up with mine. So i wonder how this will affect your/mine trading ?

T3chAddict

Posted at 09:18h, 08 DecemberIt’s possible the difference between Futures and me trading spot prices. I’d still like to see the difference if you can send/post a screenshot though.