09 Dec 20221209 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

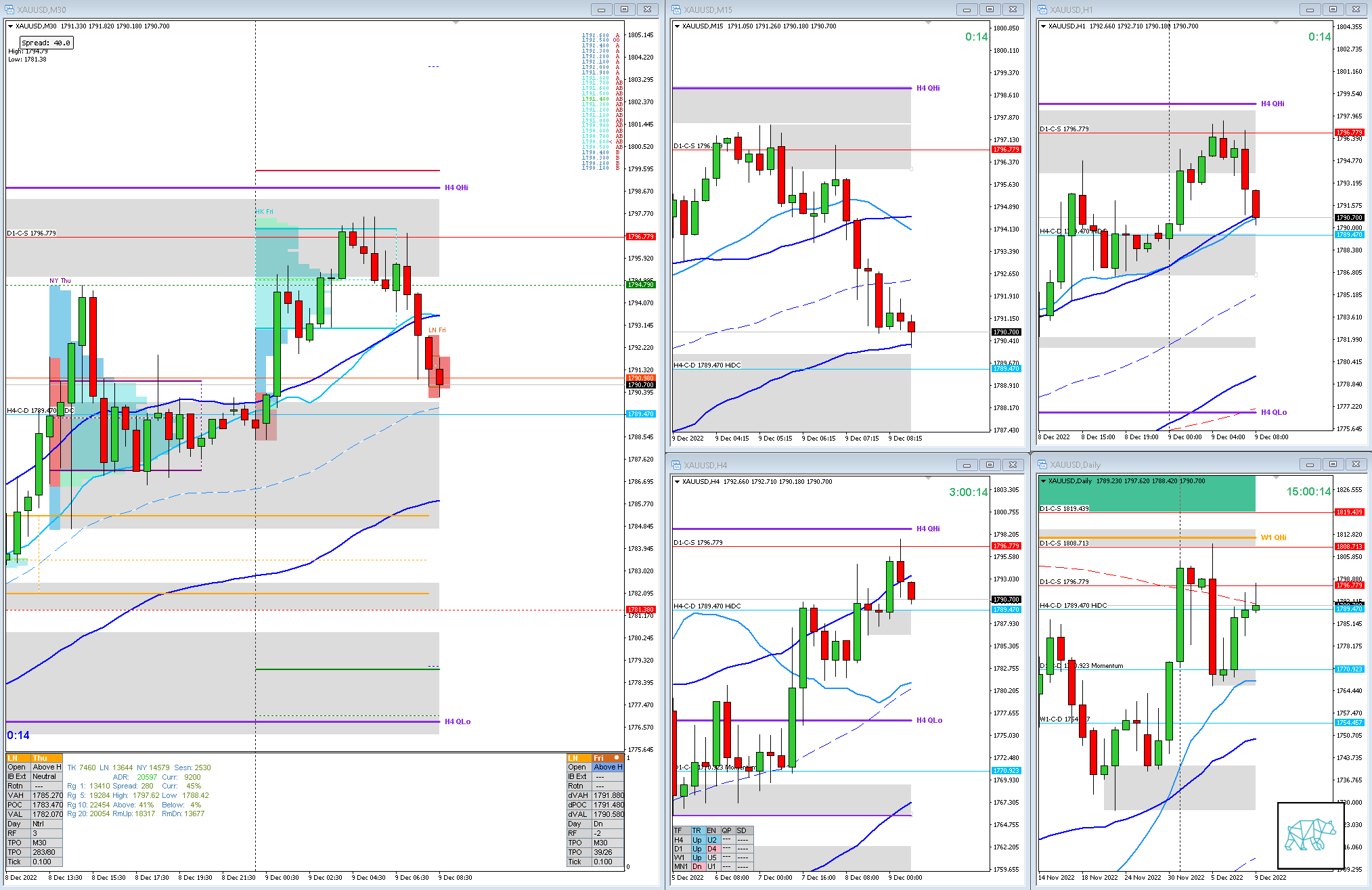

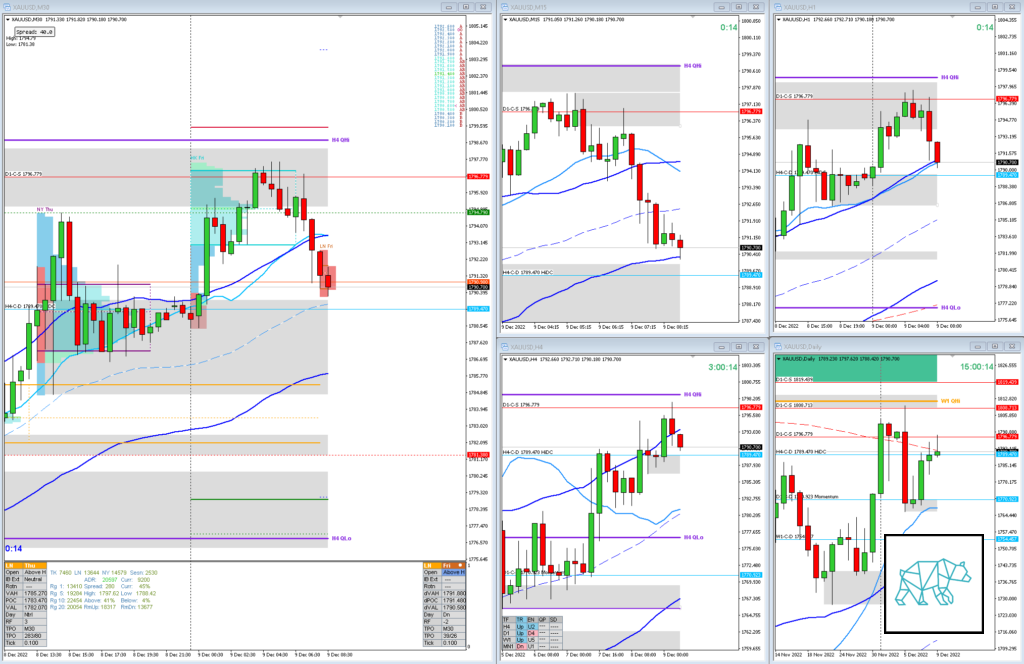

Larger Timeframe

- MN

- Price trading above body, outside range, at MN VWAP

- W1

- Price made a HH, is now trading within body, at MN 50MA in R, near Wide W1 QHi

Narrative

- D1

- Price closed higher but failed to close above D1 200MA, price tested D1-C‑S 1796.779

- H4

- H4 QLo rejected, price trading mid swing

- Price rallied giving H4-C‑D 1789.470 HiDC

- Premarket formed an Inside Bar

- Trend

- Trend is UP 3/3

- Market Profile

- Value created above the previous

- LN Open

- 0.54xASR Above Value, Outside Range

- Moderate to Large Imbalance

- Asia traded higher

- 0.18xASR Very Tight IBR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Late-Sustained Auction

- Hypo 2

- Long

- Reversal, possible Failed Auction, possible continuation

- Hypo 3

- Long

- Return to Value, possible Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 1

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 11:11h, 09 DecemberGood evening !! quick observations. website is laggy. Is it because its wordpress ? regardless content is great .

My thoughts :

Weekly is BOOLISH, but that rejection of the Qhi ( which is a W+D Qhi) leads me to believe a pull back for

this/next week, although currently seems like it will end up as an undecided candle. Time will tell.

Daily is BEARAH, starting in beginning of November their was strong Bullish momentum. girthy green candles, the subsequent moves up were less prominent, and the bearish moves were gaining strength. now we have the hanging man candle, test of the W/D Qhi which was strongly rejected. the last three days look like an attempt to move higher and the move is fizzling out. Todays candle looks to be forming a shooting star.

H4 is BEARAH, price is grinding up all week. Looks like a tired race horse. couldn’t even test the H4 Qhi and is now forming an evening star pattern.

Conclusion : Maybe a little more upside ( touches the H4 Qhi ) but Following TDA. down side is more likely today and next week.

But as you have reminded me PRICE ACTION IS KING !

Questions:

1. Your confidence has been low all week, Why is that ?

2. What are your thoughts on my analysis ?

3. Your racing sim : you do Formula one ?

4. When you mention distribution curve, are you referring to the market profile or the different phases ?

My brain hurts, thanks Jehovah its Friday!!! then again weekends is for studying (┬┬﹏┬┬)

T3chAddict

Posted at 12:53h, 09 DecemberWhat do you mean the website is laggy? Loading pages? It could be because I have a bunch of images but also the distance of the server as it is located in Europe. I’ll look into it.

1. I usually perform best when my clarity/confidence is around a 2. I think it’s a psychological thing where my ego gets in the way if it’s higher than a 3. I note down a low ie. level 1 when I either lack some clarity and am really trying to look what could transpire during the session and it’s not popping out to me. Or when I am mentally not fully ‘there’ due to whatever can transpire throughout the day/week. Today I was too hyped for example. Not necessarily on caffeine, just “too happy” :). I know when I am too hyped that I don’t perform well so I take note of that and be extra cautious. I have red flags that are personal to me that I keep track of to let myself know “hey something might be up today”. This week I had a little more trouble finding the right setups to put into my preps (hence the lack of clarity/confidence) but in hindsight I still did well.

2. I think that making assumptions on price action without them having closed is a very slippery slope and you should probably stay away from it now. Actually scratch the ‘probably’. Just don’t do it. Definitely from developing candles on Low or Medium TF even I don’t do that. Once you get more experienced you can start seeing some patterns giving you more insights into a developing W1/MN candle. Price action from mid november is irrelevant to a day trader today unless price is trying to test it.

We need a possible trading location. The imbalance on the open. Assumption what could happen at that location. Backup plan if that does not happen. Sit and wait for price action and profile to show us the way. Price action confirmed the hypo? You’re good to go.

As mentioned before we are simply trying to put the market within a statistically viable context that is trackable and repeatable. Then through reading of price action and market profile we can ‘gauge’ if our assumptions are in alignment with the assumed developing market narrative. As opposed to I think price is gonna go to this level and look for clues that it possibly might ie. confirmation bias.

I often feel like I’m a politician. I say a bunch of things. Write a bunch of stuff in my plans but am not really saying much (as in oh the market is gonna go up/down for sure and this is the reason why!). This is because of that confirmation bias trap. I’m more like a detective or as I like to call it a market observer/researcher. I have my levels. Then I look at how price is behaving around them. If I’m in alignment I get involved. If not? Sit and take notes as to what I might have missed (if any). I know some of the things were redundant in my feedback but I’d really like to drive home that we are here to go WITH the market. Not trying to get the market to go with us.

3. I do love F1 but don’t really watch it. I just I love high downforce fast cars. All the offifical F1 games suck. They are made for people on a console and not for sim racers like myself. The force feedback is just terrible. I do race on Automobilista 2 with F1 cars which is pretty fun although not quite there yet either. I wish someone would fix that. Are you into F1 and/or sim racing?

4. In that case I was referring to the distribution curve of the price action through swing high/low. Basically what the Q points visually represent is that distribution curve. Hence, going long at the top of that distribution curve or QHi, or Swing High isn’t the most probable route (unless there are other factors) as it is to go long at the bottom of the distribution curve. So demands high in the DC are less strong as they are at the bottom. Hope that makes sense and I haven’t fried your brain by now.

I’m gonna help cook a dinner and get away from the screens. I wish you a great weekend and I’ll do my best to answer your questions asap.

juan l.

Posted at 16:03h, 09 December1. I’m definitely going to include tracking my emotions. thank you for that reminder

2. I now have a T3chaddict tips section in my marketstalker notebook. confirmation bias resonates with me (one of my problems). no wonder your notes are so calculated and cold.…

3. I watch race highlights and i really like the technical aspects of the cars and the rules surrounding them

4. buy low / sell high ( more to it though

So you fry my brain and now you are going to fry some eggs ? Enjoy your weekend and that Brain/egg salad !!

see you next time 😎👍

T3chAddict

Posted at 06:03h, 11 December1. Good to hear

2. Cold and calculated. I like it.

3. I like getting better at racecraft but also building stuff. I built my rig by myself. If you ever get into sim racing let me know.

4. Exactly. Buy low sell high 🙂

I think you ask good questions so keep at it. That is if what’s left of your brain can handle it 🙂 Hope you’re having a great weekend.