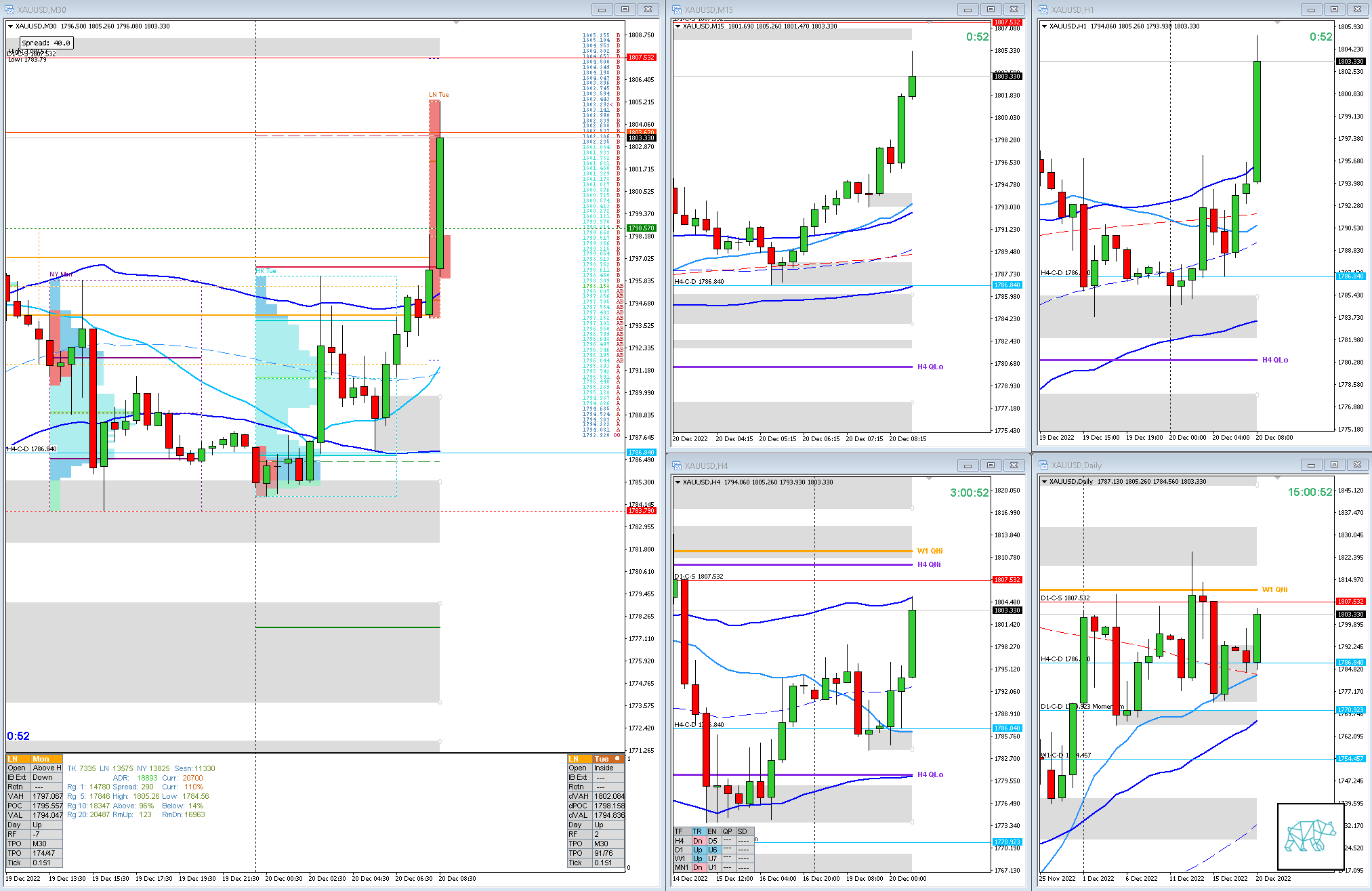

20 Dec 20221220 Premarket Prep Gold

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Larger Timeframe

- MN

- Price made a HH and is trading above body, outside range, at MN VWAP

- W1

- Price slowdown below W1 QHi, trading within body

Narrative

- D1

- D1 VWAP 200MA apex

- Possible D1 Phase 1 / 3

- H4

- H4 Bear Engulf giving H4-C‑S 1793.220 below VAL, within range

- Some demand given H4-C‑D 1786.840

- H4 QLo rejected, price trading mid swing

- Trend

- Trend is UP 2/3

- Market Profile

- Value created above the the previous

- LN Open

- Open Within Value

- Asia extended higher

- 0.83xASR Wide IBR trading higher taking out H4 Supply and exhausting ADR

Additional Notes

- N.A.

Hypos

- Hypo 1

- Short

- Reversal, possible Failed Auction

- Hypo 2

- Long

- Strength From Within IBR

- Hypo 3

- Long

- Failed Auction

- Hypo 4

- Short

- Reversal, Possible Auction Fade

Clarity / Confidence (1 — 5, low to high)

- 2

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Use SL scaling

juan l.

Posted at 16:14h, 20 DecemberGood evening Captian. I’m sure your wearing your silk pajamas by now.

I am now doing my daily plans before seeing yours to see how they match up.

as expected we seen some of the same things described differently, which is a confidence booster for me.

I also noticed i might be having what they call ” beginners luck” so i want to keep my emotions in check, limit the number of trades.I write down what i see, mark my levels, note the trends and observe Price action.

One quesiton for today :

I played a short, failed auction on GC.

later in the london session i cut it short for a -.7R ( otherwise i would’ve gotten stopped out for 1R). ultimately the trade went my way.

i based my entrance on a 5 min extended distribution followed by a bearish engulfing. pictures below:

QUESTION : Is there something i missed or did i get it completely wrong ?

T3chAddict

Posted at 04:17h, 21 DecemberYou were not completely wrong. Based on the Open Within Value and Wide IBR a Failed Auction was the more probable play. However, ADR getting exhausted during LN could be an indicator for a unidirectional day and thus a continuation. Which did transpire by the end of day. Also a Failed Auction needs to have the Price Action close within IBR. Preferably minimum a M15 candle and then even preferably on the hour / half hour mark. So not quarter past, quarter to. Seems like you jumped the gun here.

Tricky is that this could sometimes work due to the open narrative I just explained. I call this a Reversal to Failed Auction play where you monitor for a FA after entry on the reversal. Still needs a strong price action for entry though. Which came later after ASR got exhausted. M15 Bearish Inside Bar that finally transitioned into M30 closing within IBR.

Kudos to you for recognizing that you might have “beginners luck”. Having said that this is only one trade that you did not execute properly so too soon to bash yourself on the head for not performing well. Focus on getting the setups right within the right narrative. After 50+ trades you can look back and see where your strong and weak points are. Keep at it.