01 Aug Analyzing Your Trading Stats Month 2

#tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! I know I haven’t been blogging much. Although almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own. Furthermore, you should know by now that I’m quite serious about this. I try not to half-ass this although I still make many mistakes. Which is perfectly fine. Try. Fail. Review. Try again and repeat till infinity! What works now, might not work later. So it’s this process that will keep you in the running. If continuous learning excites you?! You’ve found the right path in trading.

Again?! Yes, again!

Another month has passed so another review is upon us. Well.. Me. Spoiler alert. Did not do well. I will dive deeper into some stats but also my own reflection on what happened this month. For more information on what I will actually be looking at please visit my previous post on the tracking stats here. So without further adieu.

Let’s get to some stats

So one not-so-fun thing I found out about Edgewonk: It doesn’t show you previous month’s stats just the overall stats plus the current month’s. Today being 1st of August I can’t go back to see just the July stats. Which is annoying to say the least. Although I do have the basic information of the stats of course and overall stats including the month before, just not the month of July.

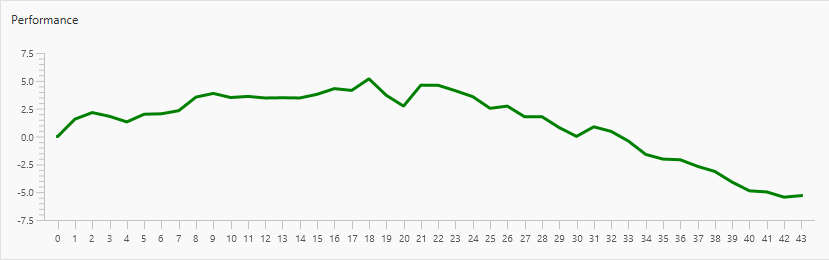

Let’s start by looking at my equity curve at the end of June:

I went from being up the month 5% to now being down the month 5%. Well, 5.27% to be exact.

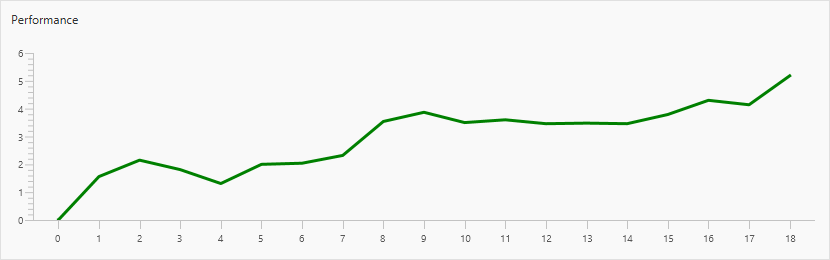

Here is a summary of all my trades June and July together:

| Trades | 43 |

| Winners | 12 |

| Losers | 20 |

| Winrate% | 37.5 |

| Profit Factor | 0.65 |

| Total Performance | -5.30% |

| Avg. Holding Time (min) | |

| Winners | 129.47 |

| Losers | 39.5 |

| Sum Holding Time (min) | |

| Winners | 2201 |

| Losers | 1027 |

What went wrong?

Let me start off by saying that all mistakes were my own and I only blame myself for my poor performance. However, it is this poor performance that is showing holes in my overall approach to trading. Knowing this I can actively deal with improving performance in a structured way. Here are the main reasons for my poor performance for the month of July.

Summer time chop!

Picked up some kung fu? Not quite… During the summer times there is less liquidity in the markets due to a lot of institutional traders being on holiday. This results in ranging markets, no follow-through on moves etc. Me being more of a momentum trader this is not something suited to my preferred strategy. Nonetheless, I should have been able to switch gears. I learned what strategy to follow in ranging markets and 1) I personally failed to put the strategy to work. However, cutting myself some slack since I am learning a new approach while trading so there is bound to be an adjustment time. 2) It’s not that the particular setup arises every single session and I can trade off it. I have set entry rules that have to come to fruition before I can take a trade. This limits me to overall exposure to a higher number of opportunities which is a fucking good thing so don’t get me wrong. 3) I am very strict on following rules and perform best when the rules are clear. I’ll contradict this later on in this very same article but hopefully you’ll understand why. Back to being a rule follower. I thought I understood the task given by my mentor to only use this particular approach during the summer time. Whereas I later found out I should have applied it whenever market conditions called for. This was not made clear to me. My rules were to apply the particular strategy and I am not allowed to do any momentum trades because I already know how to do them. Instead I should just focus on trading off a ranging strategy. In my defense I feel I followed this rule to a tee. To then only to find out that I should have changed strategies according to market conditions. Which totally fucking makes sense by the way. This brings then the more critical point of having independent thought play in. I should have independently overruled certain rules that were given to me and shown active understanding of applying the right strategy to the right market conditions. I was caught into not wanting to disobey ‘orders’ and when I felt too annoyed about it I realized what I should have done all along. Break the rules. Well some and only if applicable (I know confusing right?!). Ask for forgiveness later.

Keto-fucking-flu

Holy shit did this fuck me up. I think I did it too fast too “well”. Going cold-turkey one day to the other and not properly substituting things like electrolytes in my diet. I pride myself to have a great understanding on how my mental state works and functions. During this 2 week period time… Opposite of anything functional. So emotional like a little kid. Aggressive one time, sad the other. Lack of confidence was an understatement. Needless to say that my performance during this time was well…. Lackluster to say the least. Again, this is not an excuse even though it feels like one. — He says suddenly realizing he might have more psychological issues than previously thought — 🙂 I have this notion that I should always be able to perform. Demanding ridiculous standards and then when I fail to obtain them I go into this negative cycle. Which normally I have no issue with whatsoever. I’ll walk it off. Go for a cigarette when I still used to smoke. That actually reminds me I tried this keto thing WHILE almost the same day I had quit smoking after years and years. Talk about a double-whammy as my mentor said. That then also reminds me heyyy I quit smoking for almost a month!! 🙂 Back to the negative cycle: it went on way longer while I was chemically imbalanced. It definitely felt like that while I was trying to do keto. Since then I am back to a normal diet and feeling much better. Will see when I’ll try keto again. Only this time I’ll make sure to prepare better.

Failure to switch gears

Another reason for my poor performance is that I did not follow one particular rule: After 4 losses change going for minimum 2R trades to taking profits with 1R. See I mentioned earlier that I am good at following rules so why did I not follow this particular one. Well… I was focused on making good trades and that includes getting your exits right (another contradiction I know). So I wanted to gain experience in following exit rules using profile. Not fully understanding or blatantly disregarding, I guess, that this is yet another EXIT RULE. One that makes you switch from growing your account to preserving your capital in times when you or the market you are trading are off. So going forward this is definitely something I will focus on. Another failure to switch gears which I mentioned earlier was to apply the right strategy for the right market conditions. On top of that trading 3 assets at the same time. So needless to say I’ve been grounded (kinda) and going forward am allowed to only trade one asset. I always have a tendency to fall flat out on my face. Get back up. Make changes and continue. Which is what I will do now as well.

To sum things up

Luckily there will always be another month to get started fresh and clean. So let’s see what I learned from July and reassess how I’ll do in August. So see you next month. Hopefully with some better numbers. Can’t guarantee that but I’ll guarantee I’ll try to be as honest about my performance as I can.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂

No Comments