26 Nov Analyzing your Trading stats Month 6

#tradingforex #forex #tradingjournal #daytrading #tradinglifestyle #daytraderlife #trackyourstats #tradingstats

So you’ve been trading for a while. How do you know what to look for? How do you know what you are doing right and wrong? Which setup works best? What time of day works best? How long do I let winners and losers run? How much is my expectancy? What is my risk to reward ratio? In other words: how much money am I putting on the line to make how much? Just by looking at these stats you will get real insight into your strengths and weaknesses. Do not overlook this. Do not be one of those people that just trade and trade and trade but never review and wonder where they went wrong. You need to know what to improve upon.

Thank you for following my progress

First off. For those of you that have been following my journey I’d like to give a big thank you! Almost everyday I upload trading plans and a Daily Report Card. I sincerely hope my journey somehow adds to your own.

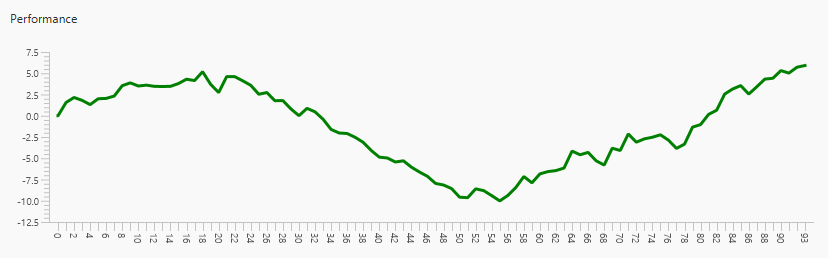

Upsloping curve continued

For those of you that have been following my trading journey know that I was in a drawdown. One month of seemingly doing everything wrong had taken away all my gains and then some. Now however I can say that I am out of the drawdown and am well on my way.

The stats that I am about to share with you help me track what I deem to be important. These mostly focus more on my process than actually making money. Process is king. Money is just a result of performing well on your process. Let’s get to some stats.

DRC Tracking Stats

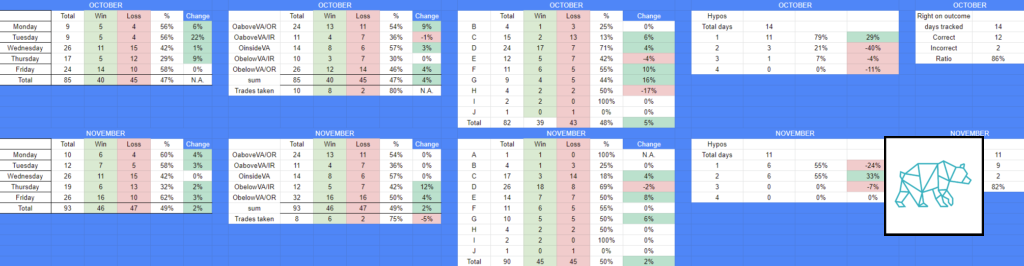

This time around I am not going to write out all the details of my DRC tracking sheet. One… it is redundant. Two… well it is redundant…. I’ll address a few details underneath. If you have any questions feel free to contact me.

Here is my DRC tracking sheet for november with the raw data:

And here it is when aggregated and compared to the previous month.

Equity curve

Started the month with +3.32% and currently I am at +5.77%. My profitable trades this month generated 2.25%.

September:

October:

November:

Trades

I took 8 trades in November of which 6 were winners and 2 losers.

I don’t like focusing on the trades that work because they will take care of themselves. So here I will dive slightly deeper into the 2 losses I had. Especially the ones that hit a full stop loss. The rest I feel are of less importance. From experience I can tell that if the trade goes against me quite quick I should not have been in the trade to begin with.

2 losses

The first loss was on November 12th and it was because my SL placement wasn’t right. It got hit right on the pip before heading my intended direction. The SL was cutting through M30 formation and this is a sign I should not have been in the trade to begin with. Instead I should have looked for a better entry. This then went on to become my weekly goal. More details you can find here:

The 2nd loss was on the 24th. I had taken the trade during C. Which is not a good Entry TPO for me. I have proven this over and over. Nonetheless… I went for it using a M15 price combination. I could have waited for a retest before getting involved which would have given me a better SL placement. I realized it was near a round number and cut my trade in half to reenter later. In the end this whole trade ended up in 0.5R. More details you can find here:

Plan

I am in the process of comparing prop firms and their challenges to get funded. Still working on this and might do a separate article on it. I had hoped for more trades this month but with the US elections it really wasn’t right to have that expectation. I will focus on concluding December with an upsloping curve before entering one of the ‘harder’ prop firms. Harder in the sense of more strict guidelines to follow. Recently came across the 5%ers and they seem interesting. Might even just start it next week as the duration to pass is 6 months instead of 1 month with a 2nd month confirming your results etc…. This would also help with any ‘dryspell’ potentially in January although GBPNZD should hold up fairly well.

Monthly goals (previous)

- Continue tracking hypos

- I enjoy tracking hypos and the potential outcome. It sets me up to be in line with the market narrative. At the same time it allows me to gather data on a particular price action or order flow event and how often (or not) it happens in a certain setting. This hopefully will allow me to find better entries in the future.

- Focus on my own progress and less on others

- I did well here. I did start kinda thinking I want to go faster. A little though… Especially with having less trades this month. Can’t force it though. It is what it is and I just have to go with what the market gives me.

- Feeling okay with NOT trading

- I did okay here. I do feel a sense of emptiness when I am not in my flow of daily routine and at my desk trading. This is probably a bad thing so I went and started new hobbies to take my mind of things.

- Following F1 racing while I (and friends) race the practice, qualifying, and race virtually of course.

- Started a book club again. I have the need to constantly pick things apart and then tell other people about it. Why their opinion sucks over mine. All that good stuff 🙂 Kidding here…. I just love exploring ideas for the exploration’s sake and then discussing them.

- I did okay here. I do feel a sense of emptiness when I am not in my flow of daily routine and at my desk trading. This is probably a bad thing so I went and started new hobbies to take my mind of things.

- Don’t trade during TPO C, unless there is a momentum trade

- Well, I took one trade during C that didn’t work out too well. So there is that. I will refrain from it next month as well. Unless there is reason for a momentum trade like price being in a trend. Please bring back trends! Just been ranging all over… Ah well… Can still make money in ranging markets.

- Have ‘quieter’ weekends

- Did well on this. Stayed in. Only went out once. Will keep this up.

- Minimum of 3 days of working out, aim for 5.

- I did well here. First week I went 5 times. 2nd week 4. 3rd week only 3 times. I am seeing a pattern here….. But still… I did well and I will keep it up. It makes me feel more grounded. More energy. All that good stuff.

Monthly goals (coming)

- Continue tracking hypos

- Focus on my own progress and less on others

- I don’t need any validation from anyone. With all the work I put in I already have a good understanding of the areas where I need work.

- Feeling okay with NOT trading

- Don’t trade during TPO C, unless there is a momentum trade

- Have ‘quieter’ weekends

- Minimum of 3 days of working out, aim for 5.

If you have made it all the way through… Here is a FREE LAMBO!!!

Sorry no Lambo. Nonetheless, I greatly appreciate your interest in my journey. I’m sure it is not an easy read as I tend to get long-winded. If you have any comments or suggestions feel free to let me know. Even though I do like writing I don’t consider myself to be much of a writer. I rather talk or play online games 🙂 Reach out to me. Let’s hang. Talk. Some Call of Duty: Modern Warfare, Sim Racing or Sim Flying perhaps? 🙂 Let’s team up. Contact me for my Discord channel details.

No Comments