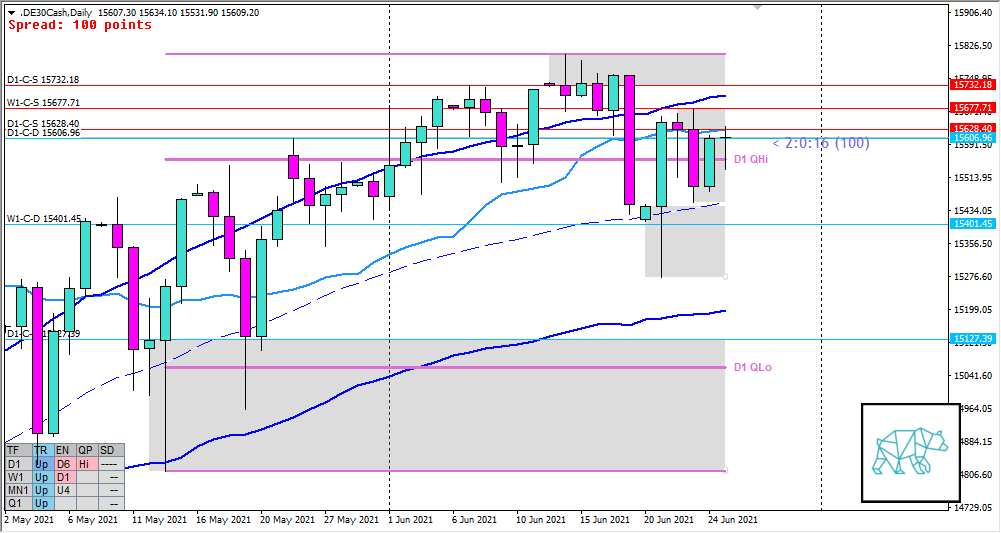

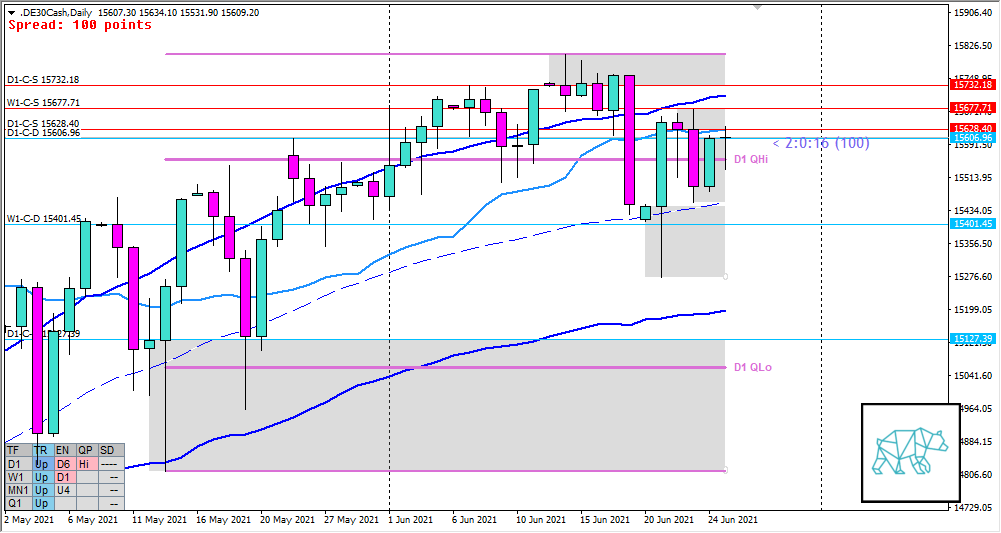

26 Jun DAX 2021 Week 26 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my weekly outlook on DAX. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Slightly Bullish

- MN Bull Engulf giving MN-C‑D 13694 and price continued higher making an all-time high

- Price currently trading above last month’s body

Weekly — Slightly Bullish

- W1 Bear Engulf giving W1-C‑S 15677.71 followed by last week forming a W1 Bullish Inside Bar with slight reaction off newly formed W1 Supply after reacting off W1-C‑D 15401.45. Price failed to close within the newly formed Supply.

Daily — Neutral

- D1 Three Inside Down at W1 Supply giving D1-C‑S 15628.40 with no continuation, instead a D1 Bullish Inside Bar (giving D1-C‑D 15606.96) with slight continuation closing above demand in the form of a Dragonfly Doji.

- No close within the newly formed supply.

- Possible D1 Phase 1 / 3

- Price rejected D1 QHi, bouncing twice off D1 50MA in UT, but is trading within QHi again.

Sentiment summary — Slightly Bullish

- Price made an all-time high and is currently trading above last month’s body at the top of the range

- W1 saw a little sell off but failed to close within W1 demand, instead continued higher through a W1 Bullish Inside Bar not closing within W1 Supply.

- D1 has some contradicting moves and has not clearly taken a direction although new demand is formed above a previous demand testing newly formed supply.

Additional notes

- Jun 28, 21:00 USD Fed’s Williams speech

- Jun 29, 01:10 USD Fed’s Quarles speech

- Jun 29, 20:00 EUR Consumer Price Index (YoY)

- Jun 30, 15:55 EUR Unemployment Change

- Jun 30, 17:00 EUR Consumer Price Index (YoY)

- Jun 30, 19:00 GBP BoE’s Haldane speech

- Jun 30, 22:30 USD EIA Crude Oil Stocks Change

- Jul 01, 16:00 EUR Markit Manufacturing PMI

- Jul 01, 17:00 EUR Unemployment Rate

- Jul 01, 20:30 USD Initial Jobless Claims

- Jul 01, 21:45 USD Markit Manufacturing PMI

- Jul 02, 03:00 GBP BoE’s Governor Bailey speech

- Jul 02, 20:30 USD Nonfarm Payrolls

ZOIs for Possible Shorts

- W1-C‑S 15677.71

- D1-C‑S 15628.40

ZOIs for Possible Long

- D1-C‑D 15606.96

- W1-C‑D 15401.45

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments