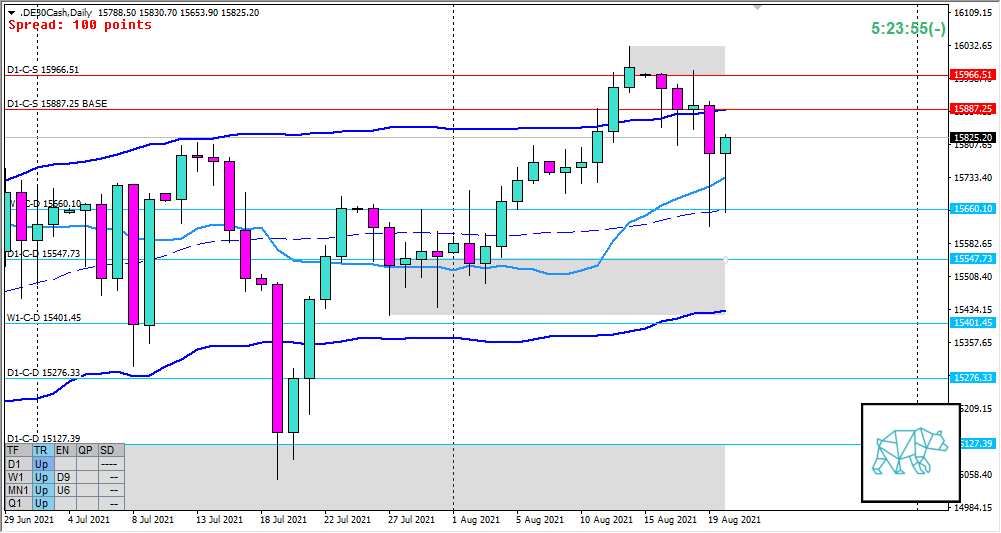

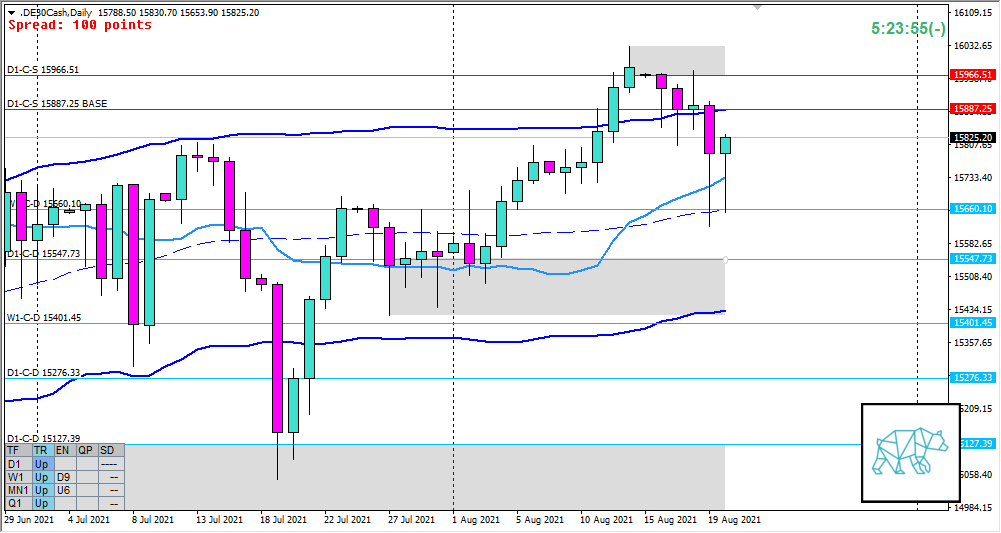

21 Aug DAX 2021 Week 34 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my weekly outlook on DAX. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bullish

- Last month ducked below the previous month’s low to then close as a near-Doji with long buying wick (Dragonfly doji). Selling wick not making a HH. Some slow-down through a potential base but need another month to confirm or reject.

- Price trading above last month’s body and outside range possibly developing a MN RBR

Weekly — Neutral

- Last week failed to make a HH and closed as a Bearish Inside Bar although weakened by the long buying wick reacting off a pullback to W1 VWAP in UT coinciding with W1-C‑D 15660.10

Daily — Neutral

- D1 DBD with long buying wick to Inside Bar with long buying wick reacting off D1 VWAP

Sentiment summary — Slightly Bullish

- All-time high made on MN and is currently trading above last month’s body and range possible forming a RBR.

- Price saw some Risk-Off trading in preparation for ECB rate decision so most likely the sentiment remains bullish. Based on price action it is not as clear-cut and thus more information is needed.

- D1 is showing long buying wicks although no complete price action formation to confirm the upward bias as of yet. The current Inside Bar could potentially turn into D1 Three Inside Up or potentially another base drop. If price reaches D1-C‑S 15887.25 Base level we’d have the bullish narrative strengthened.

Additional notes

- Aug 27, 22:00, USD, Fed’s Chair Powell speech

ZOIs for Possible Shorts

- D1-C‑S 15966.51

- D1-C‑S 15887.25 Base

ZOIs for Possible Long

- W1-C‑D 15660.10

- D1-C‑D 15547.73

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments