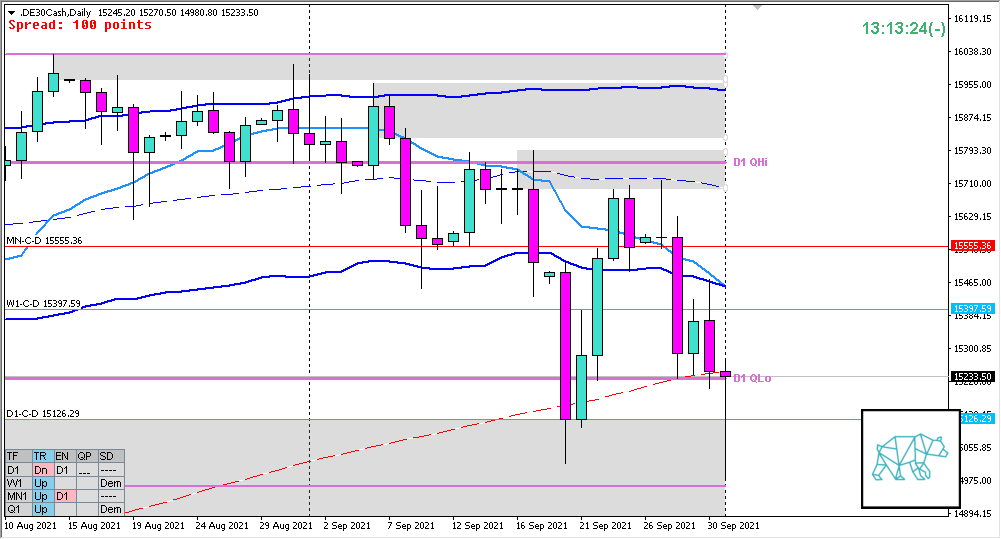

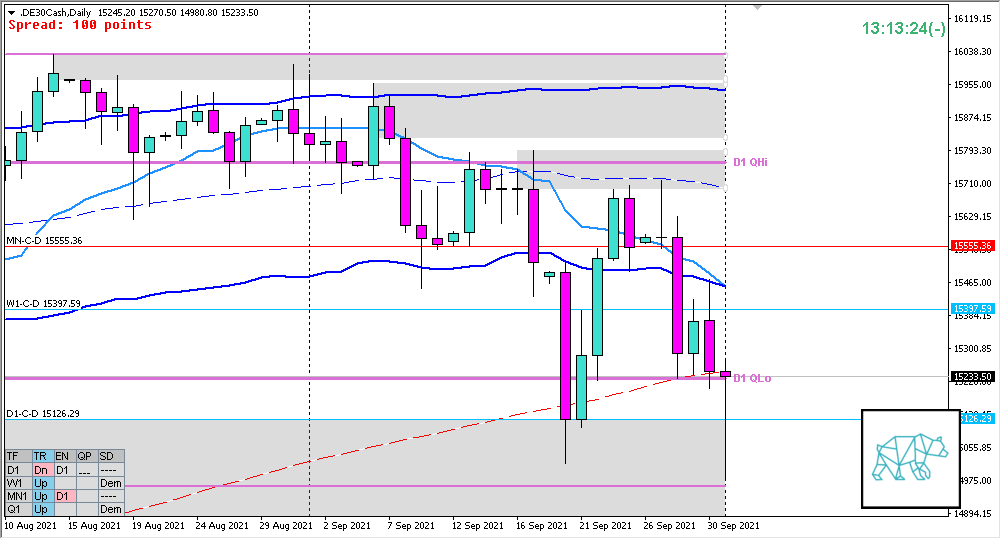

03 Oct DAX 2021 Week 40 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices #DAX #DE30Cash

This is my weekly outlook on DAX. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bearish

- MN Bearish Engulfing formed giving MN-C‑D 15555.36

Weekly — Bearish

- W1 DBD giving new supply through a bear engulf closing within W1-C‑D 15397.59

Daily — Neutral

- Price returned to D1-C‑D 15126.29 and tested it for the 4th time but failed to close within it. Instead a pinbar was formed closing at D1 200MA in UT and above D1 QLo.

Sentiment summary — Bearish

- MN confidently closed through a Bear Engulf indicating a short-biased sentiment for the time-being. Although tests of newly formed C‑sup should be considered.

- W1 closed within demand but some buyers are still around indicated by the buying wick. Demand is quite deep as well but has been tested multiple times. Nonetheless, upward bias in equities as well as W1 demand here a move higher should be considered here. A move down could have some push back.

- D1 reacted off demand and still closed bearish but above D1 QLo. Normally, a continuation could be expected but there’s a possibility for a Morning Star here so need more info first.

Additional notes

- Oct 08, 20:30, USD, Non Farm Payrolls (Sep)

ZOIs for Possible Shorts

- MN-C‑D 15555.36

ZOIs for Possible Long

- W1-C‑D 15397.59

- D1-C‑D 15126.29

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 20 trades by the end of the month, preferably 2 a day (not in the same product at the same time)

- Weekly Goal

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- ‘Bust or Target’: No early exits, either hit SL or 2R target

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments